Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Find the project's unlevered Firm Free Cash Flow (FFCF, or Cash Flow From Assets CFFA) at time t = 0. You do not need to

Find the project's unlevered Firm Free Cash Flow (FFCF, or Cash Flow From Assets CFFA) at time t = 0. You do not need to find the NPV.

Find the project's unlevered FFCF or CFFA at time t = 1. You do not need to find the NPV

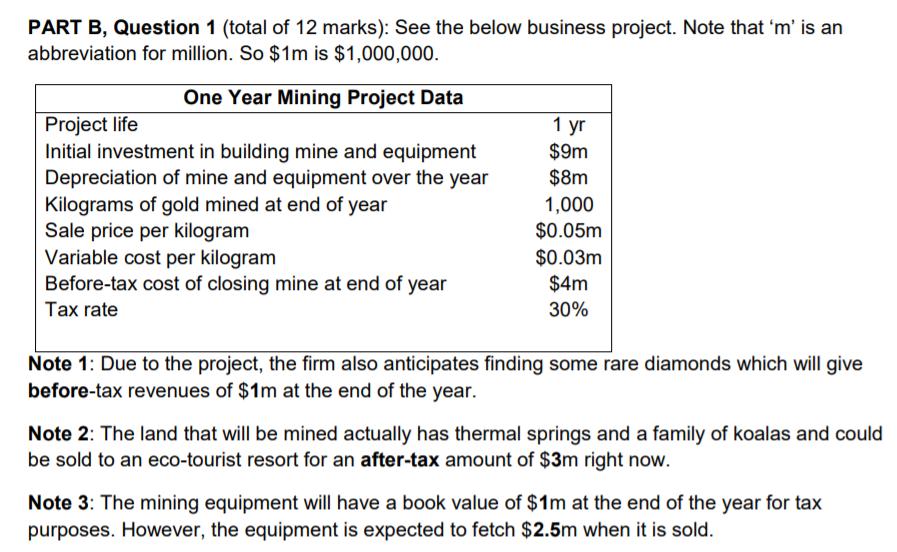

PART B, Question 1 (total of 12 marks): See the below business project. Note that 'm' is an abbreviation for million. So $1m is $1,000,000. One Year Mining Project Data Project life Initial investment in building mine and equipment Depreciation of mine and equipment over the year Kilograms of gold mined at end of year Sale price per kilogram Variable cost per kilogram Before-tax cost of closing mine at end of year Tax rate 1 yr $9m $8m 1,000 $0.05m $0.03m $4m 30% Note 1: Due to the project, the firm also anticipates finding some rare diamonds which will give before-tax revenues of $1m at the end of the year. Note 2: The land that will be mined actually has thermal springs and a family of koalas and could be sold to an eco-tourist resort for an after-tax amount of $3m right now. Note 3: The mining equipment will have a book value of $1m at the end of the year for tax purposes. However, the equipment is expected to fetch $2.5m when it is sold.

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To find the unlevered Firm Free Cash Flow FFCF or Cash Flow From Assets CFFA at time t 0 and t 1 for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started