Answered step by step

Verified Expert Solution

Question

1 Approved Answer

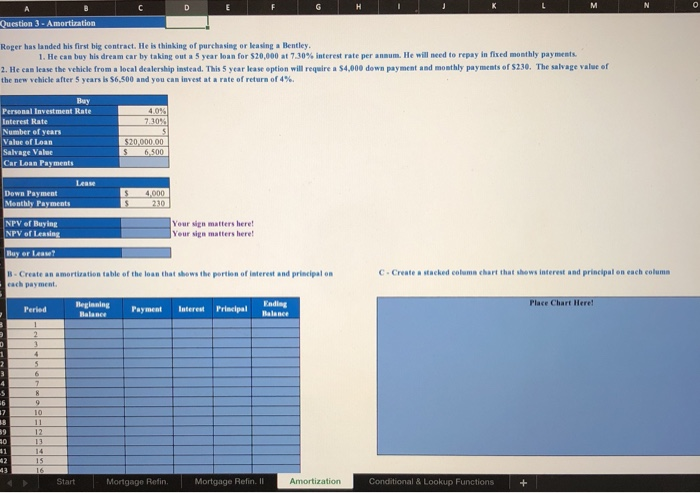

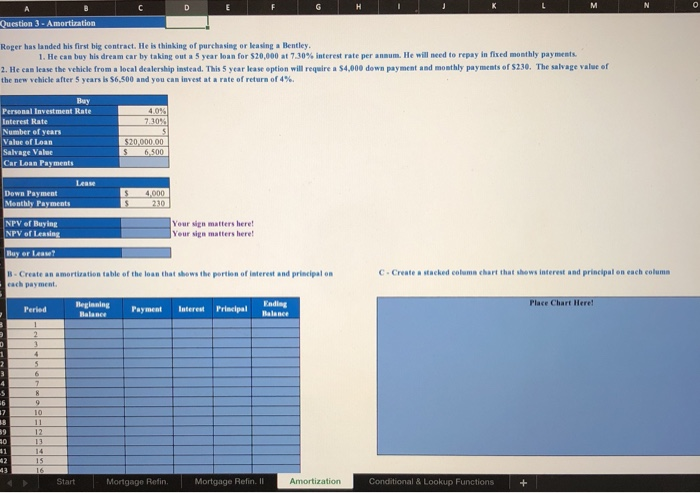

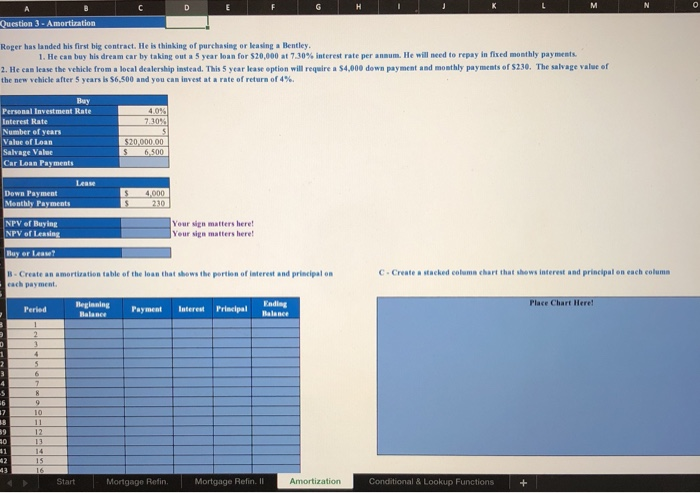

Find the values of all light blue boxes using excel formulas. M 0 Question 3 - Amortization Roger has landed his first big contract. He

Find the values of all light blue boxes using excel formulas.  M 0 Question 3 - Amortization Roger has landed his first big contract. He is thinking of purchasing or leasing a Bentley 1. He can buy his dream car by taking out a 5 year loan for $20,000 at 7.30% Interest rate per annum. He will need to repay in fixed monthly payments. 2. He can lease the vehicle from a local dealership instead. This 5 year lease option will require a $4,000 down payment and monthly payments of S230. The salvage value of the new vehicle after 5 years is 56,500 and you can invest at a rate of return of 4% Buy Personal Investment Rate Interest Rate Number of years Value of Loan Salvage Value Car Loan Payments 4.0% 7.30% 5 $20,000.00 6,500 Lease Down Payment Monthly Payments $ $ 4,000 230 NPV of Buying Your sign matters here! NPV of Leasing Your sign matters here! Buy or least - Create an amortization table of the loan that shows the portion of interest and principal on each payment Period Beginning Ending Balasee Payment Interest Principal Balance C. Create a stacked column chart that shows interest and principal on each column Place Chart Here! 1 2 3 . 1 3 4 7 8 9 10 18 12 13 10 11 42 15 Start Mortgage Refin Mortgage Refin. Il Amortization Conditional & Lookup Functions +

M 0 Question 3 - Amortization Roger has landed his first big contract. He is thinking of purchasing or leasing a Bentley 1. He can buy his dream car by taking out a 5 year loan for $20,000 at 7.30% Interest rate per annum. He will need to repay in fixed monthly payments. 2. He can lease the vehicle from a local dealership instead. This 5 year lease option will require a $4,000 down payment and monthly payments of S230. The salvage value of the new vehicle after 5 years is 56,500 and you can invest at a rate of return of 4% Buy Personal Investment Rate Interest Rate Number of years Value of Loan Salvage Value Car Loan Payments 4.0% 7.30% 5 $20,000.00 6,500 Lease Down Payment Monthly Payments $ $ 4,000 230 NPV of Buying Your sign matters here! NPV of Leasing Your sign matters here! Buy or least - Create an amortization table of the loan that shows the portion of interest and principal on each payment Period Beginning Ending Balasee Payment Interest Principal Balance C. Create a stacked column chart that shows interest and principal on each column Place Chart Here! 1 2 3 . 1 3 4 7 8 9 10 18 12 13 10 11 42 15 Start Mortgage Refin Mortgage Refin. Il Amortization Conditional & Lookup Functions +

Find the values of all light blue boxes using excel formulas.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started