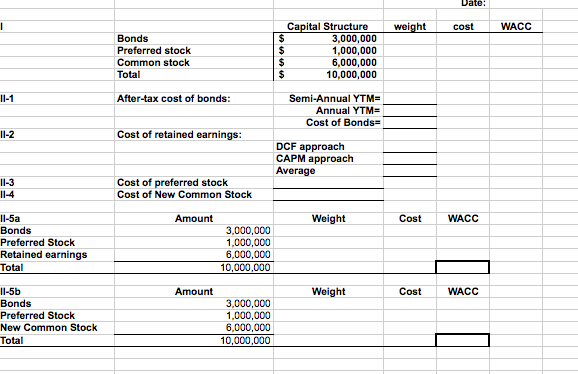

find the weight, cost and WACC

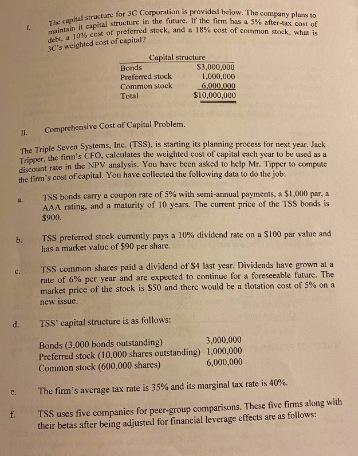

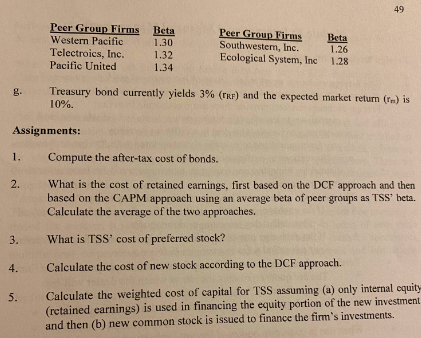

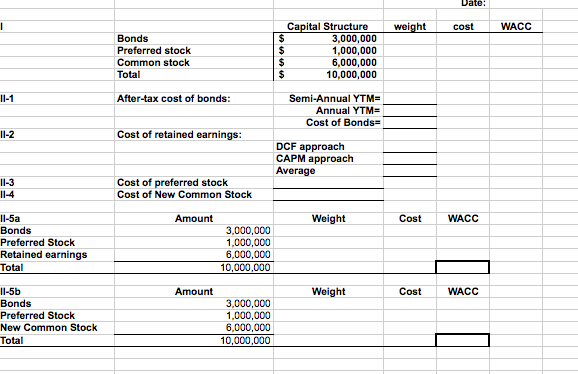

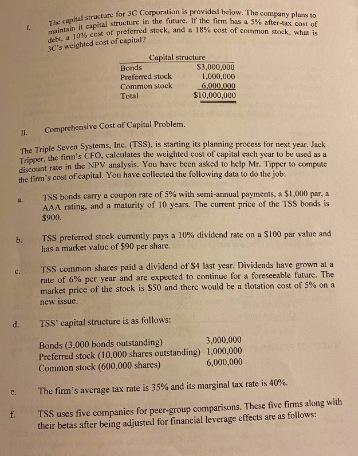

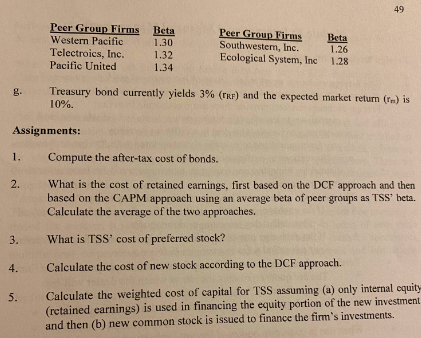

The capital for 3C Corporation is provided below. The company plum 10 litcp structure in the future. If the firm has a 5% after-X Clu debe a 10% cost of preferred stock, and 1 18% cost of common stock, what is C's weighted cost of capital? Capital structure Bonds $3,000,000 Preferred stock 1,000,000 Common stock 6.000.000 Total $10,000,000 IL Comprehensive Cost of Capital Problem. The Triple Seven Systems, Inc. (TSS), is starting its planning process for next year. Jack discount rate in the NPV analysis. You have been asked to help Mr. Tipper to compare Tripper, the finn's CFO, calculates the weighted cost of capital each year to be used as a the firm's cost of capital. You have collected the following data to do the job: TSS bonds carry a coupon rate of 5% with semi-annual paymeets, * $1,000 par, a AAA rating, and a maturity of 10 years. The current price of the TSS bonds is $900. b. TSS preferred stock currently pays a 10% dividend rate on a $100 par value and has a market value of $90 per share. c. TSS common shares paid a dividend of S4 last year. Dividends have grown at a rate of 6% per year and are expected to continue for a foreseeable future. The market price of the stock is SSO and there would be a flotation cost of 5% on a new issue d. TSS capital structure is as follows: Bonds (3.000 bonds outstanding) 3,000,000 Preferred stock (10,000 shares outstanding) 1,000,000 Common stock (600,000 shares) 6,000,000 c. The firm's average tax rate is 35% and its marginal tax rate is 40%. TSS uses five companies for peer-group comparisons. These five firms along with their betas after being adjusted for financial leverage effects are as follows: 49 Peer Group Firms Western Pacific Telectroics, Inc. Pacific United Beta 1.30 1.32 1.34 Peer Group Firms Southwestem, Inc. Ecological System, Inc Beta 1.26 1.28 Treasury bond currently yields 3% (TRF) and the expected market return (r.) is 10% Assignments: 1. Compute the after-tax cost of bonds. 2. What is the cost of retained earnings, first based on the DCF approach and then based on the CAPM approach using an average beta of peer groups as TSS beta. Calculate the average of the two approaches. 3. What is TSS' cost of preferred stock? 4. . Calculate the cost of new stock according to the DCF approach. 5. Calculate the weighted cost of capital for TSS assuming (a) only internal equity (retained earnings) is used in financing the equity portion of the new investment and then (b) new common stock is issued to finance the firm's investments. Date: 1 weight cost WACC Bonds Preferred stock Common stock Total en een Capital Structure 3,000,000 $ 1,000,000 $ 6,000,000 $ 10,000,000 11-1 After-tax cost of bonds: Semi-Annual YTM Annual YTM= Cost of Bonds= 11-2 Cost of retained earnings: DCF approach CAPM approach Average 11-3 11-4 Cost of preferred stock Cost of New Common Stock Weight Cost WACC 11-5a Bonds Preferred Stock Retained earnings Total Amount 3,000,000 1,000,000 6,000,000 10,000,000 Amount Weight Cost WACC 11-5b Bonds Preferred Stock New Common Stock Total 3,000,000 1,000,000 6,000,000 10,000,000