Answered step by step

Verified Expert Solution

Question

1 Approved Answer

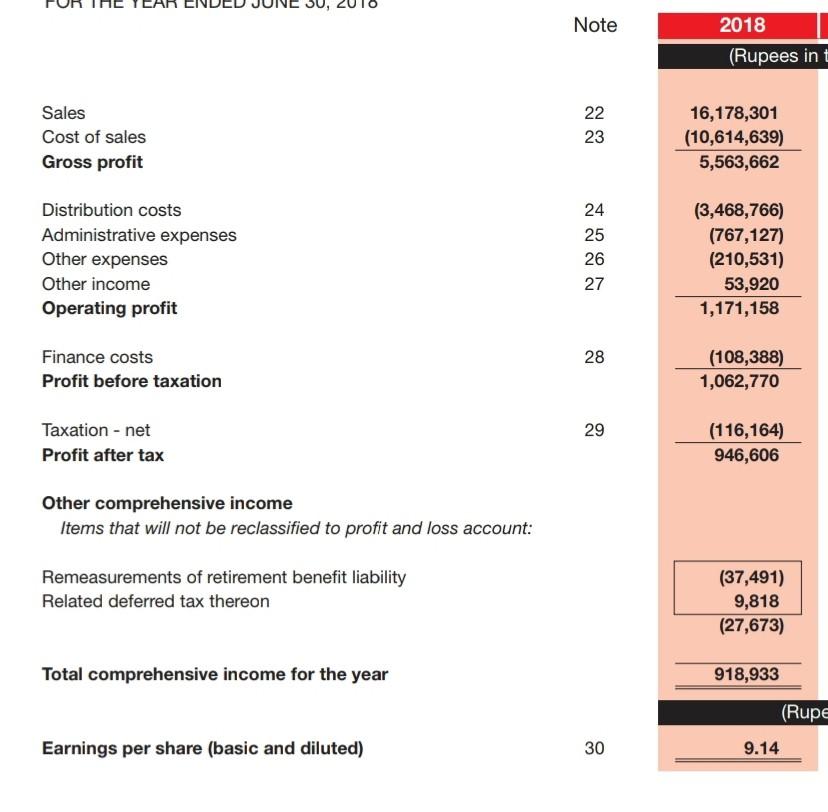

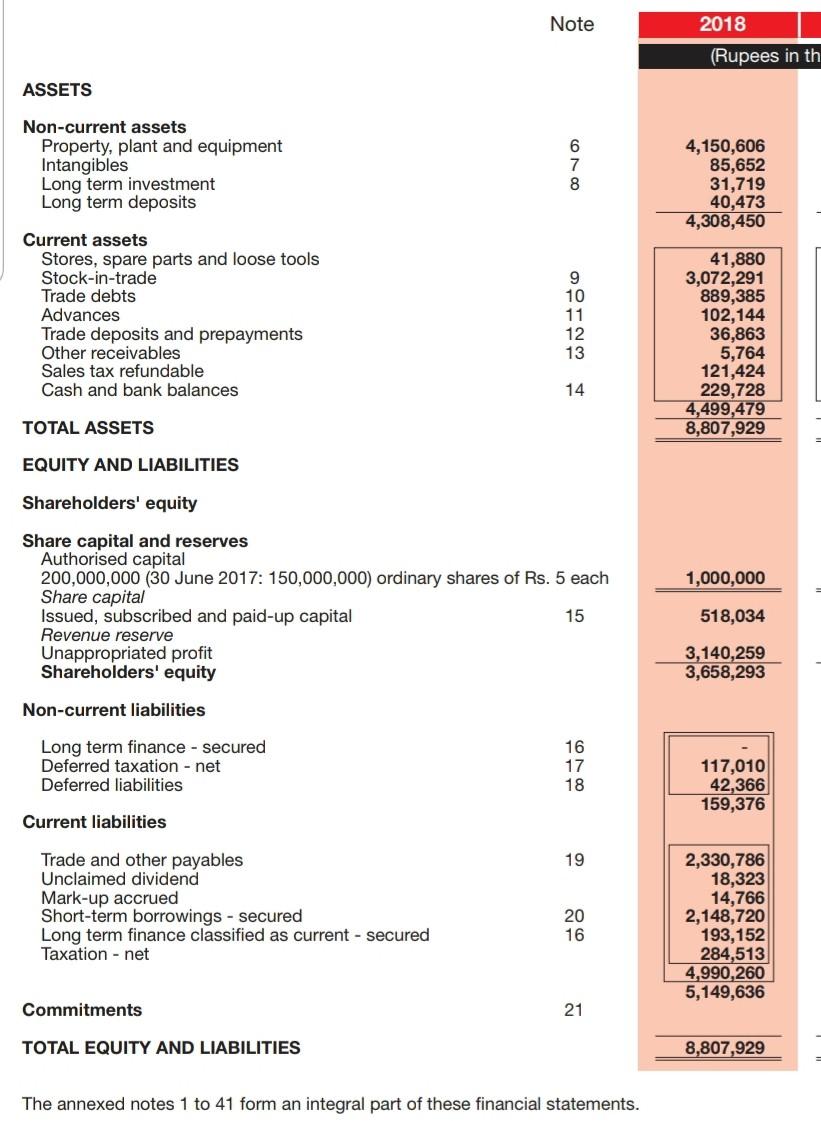

find these ratios of the above given data 1. Current Ratio= current assets/current liabilites 2. Quick Ratio=quick assets/current liabilites 3. Net working capital=current assets-current liabilities

find these ratios of the above given data 1. Current Ratio= current assets/current liabilites 2. Quick Ratio=quick assets/current liabilites 3. Net working capital=current assets-current liabilities 4.Cash Ratio=cash+marketable securities/current liabilites

Note 2018 (Rupees in t Sales Cost of sales Gross profit 22 23 16,178,301 (10,614,639) 5,563,662 Distribution costs Administrative expenses Other expenses Other income Operating profit 24 25 26 27 (3,468,766) (767,127) (210,531) 53,920 1,171,158 28 Finance costs Profit before taxation (108,388) 1,062,770 29 Taxation - net Profit after tax (116,164) 946,606 Other comprehensive income Items that will not be reclassified to profit and loss account: Remeasurements of retirement benefit liability Related deferred tax thereon (37,491) 9,818 (27,673) Total comprehensive income for the year 918,933 (Rupe Earnings per share (basic and diluted) 30 9.14 Note 2018 (Rupees in th ASSETS Non-current assets Property, plant and equipment Intangibles Long term investment Long term deposits 6 7 8 4,150,606 85,652 31,719 40,473 4,308,450 Current assets Stores, spare parts and loose tools Stock-in-trade Trade debts Advances Trade deposits and prepayments Other receivables Sales tax refundable Cash and bank balances 9 10 11 12 13 41,880 3,072,291 889,385 102,144 36,863 5,764 121,424 229,728 4,499,479 8,807,929 14 TOTAL ASSETS EQUITY AND LIABILITIES Shareholders' equity 1,000,000 Share capital and reserves Authorised capital 200,000,000 (30 June 2017: 150,000,000) ordinary shares of Rs. 5 each Share capital Issued, subscribed and paid-up capital 15 Revenue reserve Unappropriated profit Shareholders' equity 518,034 3,140,259 3,658,293 Non-current liabilities Long term finance - secured Deferred taxation - net Deferred liabilities 16 17 18 117,010 42,366 159,376 Current liabilities 19 Trade and other payables Unclaimed dividend Mark-up accrued Short-term borrowings - secured Long term finance classified as current - secured Taxation - net 20 16 2,330,786 18,323 14,766 2,148,720 193,152 284,513 4,990,260 5,149,636 Commitments 21 TOTAL EQUITY AND LIABILITIES 8,807,929 The annexed notes 1 to 41 form an integral part of these financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started