Answered step by step

Verified Expert Solution

Question

1 Approved Answer

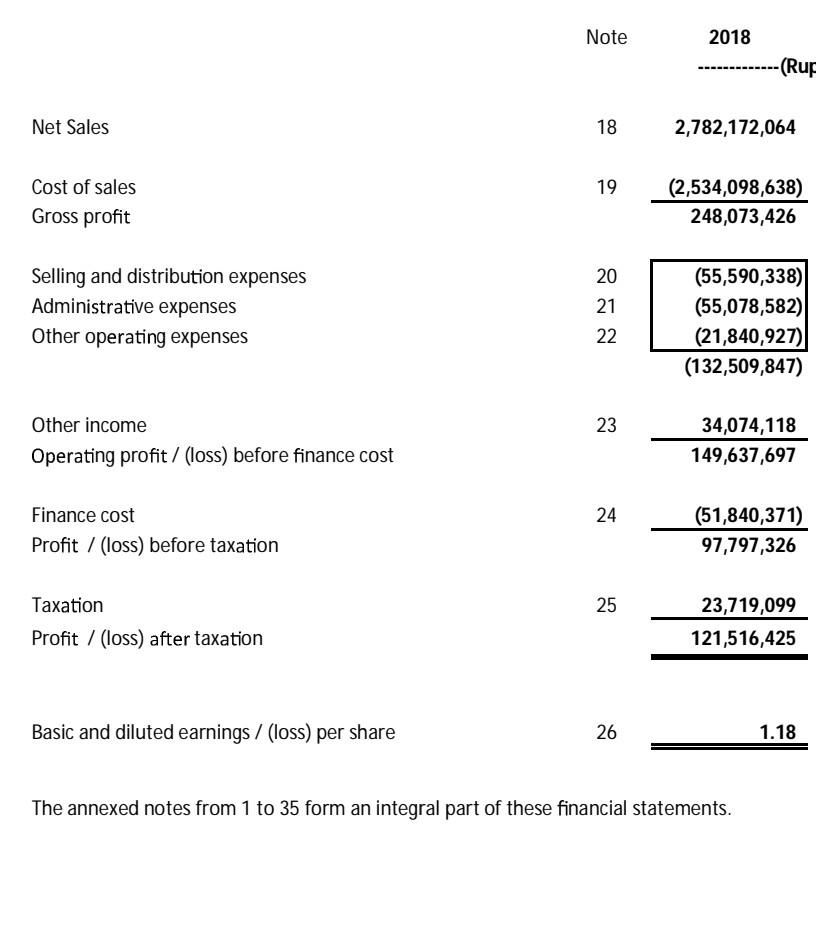

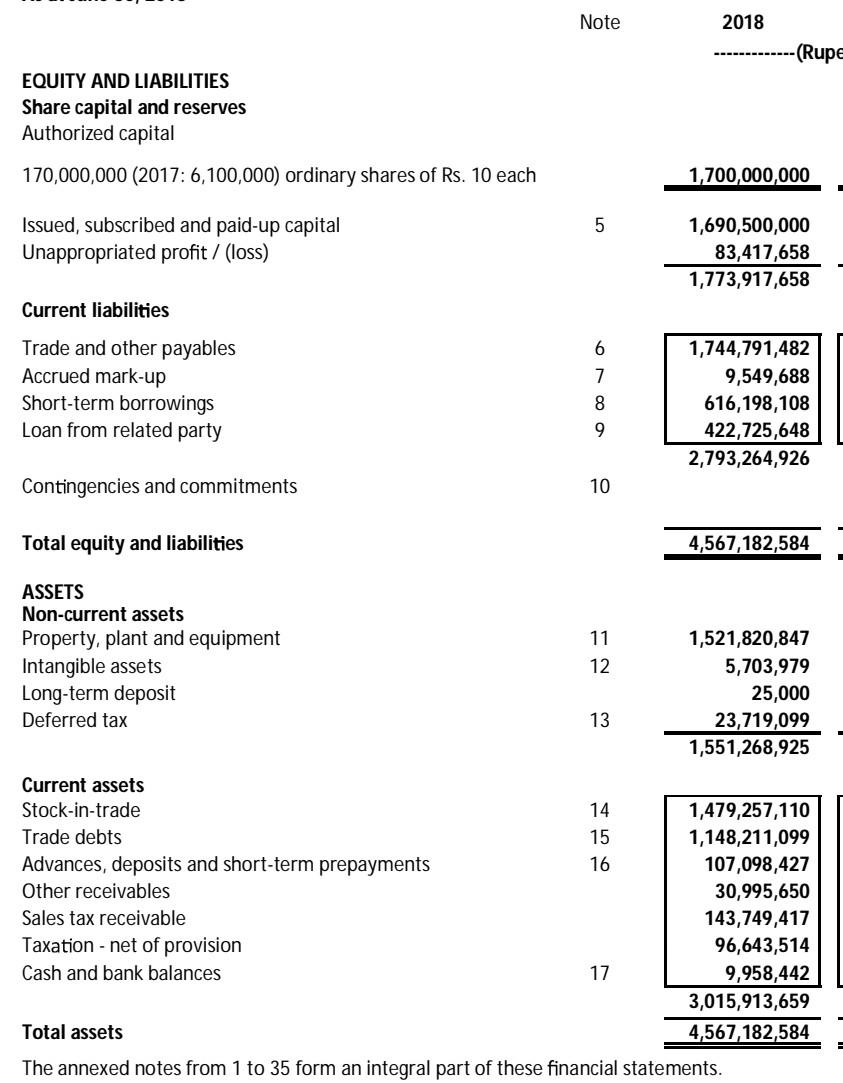

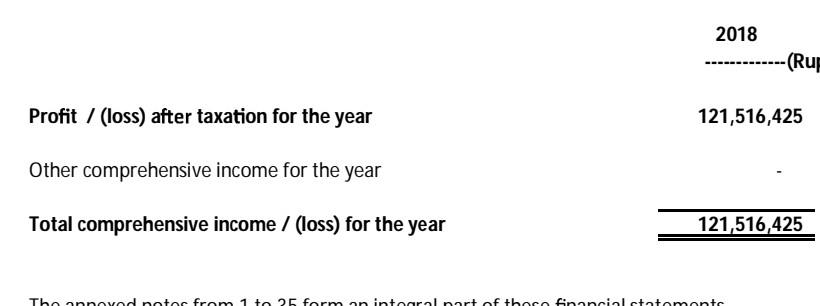

find these ratios of the above given data 1. Price Earning ratio=Market price per share / earning per share 2. Dividend payout ratio=Dividend per share/

find these ratios of the above given data 1. Price Earning ratio=Market price per share / earning per share 2. Dividend payout ratio=Dividend per share/ earning per share 3. Dividend yield ratio=Dividend per share/ market price per share 4. Book value per share=Common equity/average common shares outs.

Note 2018 -(Rup Net Sales 18 2,782,172,064 19 Cost of sales Gross profit (2,534,098,638) 248,073,426 20 Selling and distribution expenses Administrative expenses Other operating expenses 21 22 (55,590,338) (55,078,582) (21,840,927) (132,509,847) 23 Other income Operating profit / (loss) before finance cost 34,074,118 149,637,697 24 Finance cost Profit / (loss) before taxation (51,840,371) 97,797,326 25 Taxation Profit / (loss) after taxation 23,719,099 121,516,425 Basic and diluted earnings / (loss) per share 26 1.18 The annexed notes from 1 to 35 form an integral part of these financial statements. Note 2018 -(Rupe EQUITY AND LIABILITIES Share capital and reserves Authorized capital 170,000,000 (2017: 6,100,000) ordinary shares of Rs. 10 each 1,700,000,000 5 Issued, subscribed and paid-up capital Unappropriated profit / (loss) 1,690,500,000 83,417,658 1,773,917,658 Current liabilities 6 Trade and other payables Accrued mark-up Short-term borrowings Loan from related party 7 8 9 1,744,791,482 9,549,688 616,198,108 422,725,648 2,793,264,926 Contingencies and commitments 10 Total equity and liabilities 4,567,182,584 ASSETS Non-current assets Property, plant and equipment Intangible assets Long-term deposit Deferred tax 11 12 1,521,820,847 5,703,979 25,000 23,719,099 1,551,268,925 13 Current assets Stock-in-trade 14 1,479,257,110 Trade debts 15 1,148,211,099 Advances, deposits and short-term prepayments 16 107,098,427 Other receivables 30,995,650 Sales tax receivable 143,749,417 Taxation - net of provision 96,643,514 Cash and bank balances 17 9,958,442 3,015,913,659 Total assets 4,567,182,584 The annexed notes from 1 to 35 form an integral part of these financial statements. 2018 -(Rup Profit / (loss) after taxation for the year 121,516,425 Other comprehensive income for the year Total comprehensive income / (loss) for the year 121,516,425 Theannavodnotoc from 1 to 25 forma integral part of theco financial statemente Note 2018 -(Rup Net Sales 18 2,782,172,064 19 Cost of sales Gross profit (2,534,098,638) 248,073,426 20 Selling and distribution expenses Administrative expenses Other operating expenses 21 22 (55,590,338) (55,078,582) (21,840,927) (132,509,847) 23 Other income Operating profit / (loss) before finance cost 34,074,118 149,637,697 24 Finance cost Profit / (loss) before taxation (51,840,371) 97,797,326 25 Taxation Profit / (loss) after taxation 23,719,099 121,516,425 Basic and diluted earnings / (loss) per share 26 1.18 The annexed notes from 1 to 35 form an integral part of these financial statements. Note 2018 -(Rupe EQUITY AND LIABILITIES Share capital and reserves Authorized capital 170,000,000 (2017: 6,100,000) ordinary shares of Rs. 10 each 1,700,000,000 5 Issued, subscribed and paid-up capital Unappropriated profit / (loss) 1,690,500,000 83,417,658 1,773,917,658 Current liabilities 6 Trade and other payables Accrued mark-up Short-term borrowings Loan from related party 7 8 9 1,744,791,482 9,549,688 616,198,108 422,725,648 2,793,264,926 Contingencies and commitments 10 Total equity and liabilities 4,567,182,584 ASSETS Non-current assets Property, plant and equipment Intangible assets Long-term deposit Deferred tax 11 12 1,521,820,847 5,703,979 25,000 23,719,099 1,551,268,925 13 Current assets Stock-in-trade 14 1,479,257,110 Trade debts 15 1,148,211,099 Advances, deposits and short-term prepayments 16 107,098,427 Other receivables 30,995,650 Sales tax receivable 143,749,417 Taxation - net of provision 96,643,514 Cash and bank balances 17 9,958,442 3,015,913,659 Total assets 4,567,182,584 The annexed notes from 1 to 35 form an integral part of these financial statements. 2018 -(Rup Profit / (loss) after taxation for the year 121,516,425 Other comprehensive income for the year Total comprehensive income / (loss) for the year 121,516,425 Theannavodnotoc from 1 to 25 forma integral part of theco financial statementeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started