Answered step by step

Verified Expert Solution

Question

1 Approved Answer

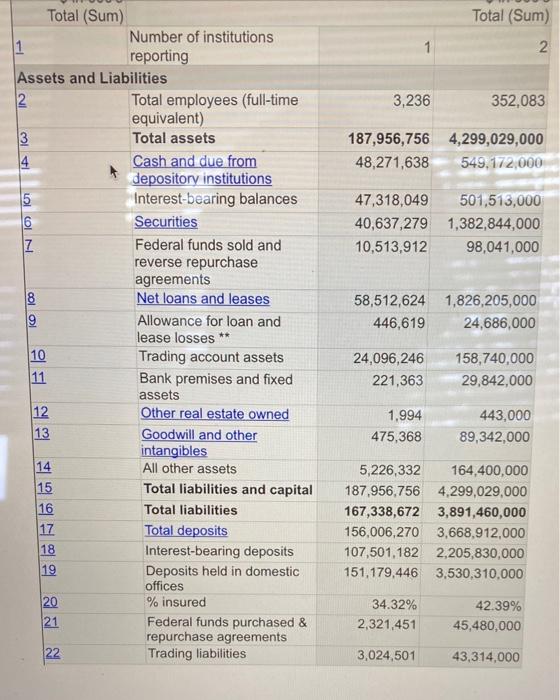

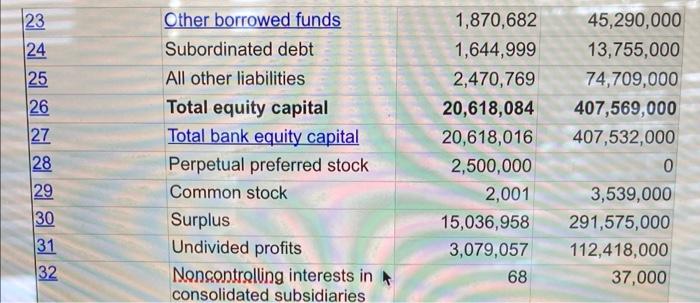

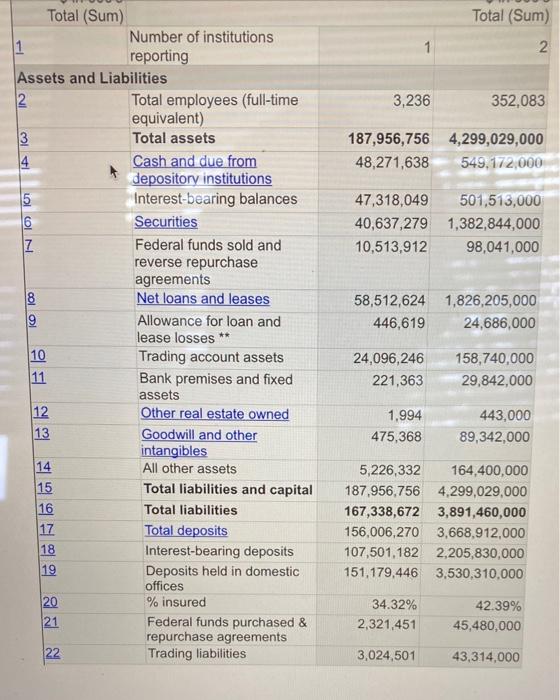

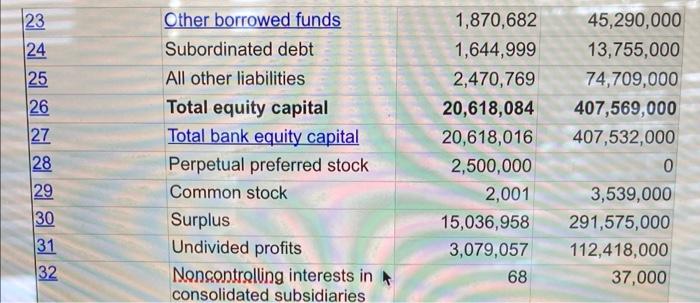

find total rate sensitive assets and total rate sensitive liabilities from the assets vs liabilities statement for HSBC bank Total (Sum) 1 2 IN 3,236

find total rate sensitive assets and total rate sensitive liabilities from the assets vs liabilities statement for HSBC bank

Total (Sum) 1 2 IN 3,236 352,083 187,956,756 48,271,638 4,299,029,000 549,172,000 LOL COIN 47,318,049 40,637,279 10,513,912 501,513,000 1,382,844,000 98,041,000 IO 100 58,512,624 1,826,205,000 446,619 24,686,000 Total (Sum) Number of institutions reporting Assets and Liabilities Total employees (full-time equivalent) Total assets Cash and due from depository institutions Interest-bearing balances 6 Securities Z Federal funds sold and reverse repurchase agreements Net loans and leases 9 Allowance for loan and lease losses ** 10 Trading account assets 11 Bank premises and fixed assets 12 Other real estate owned 13 Goodwill and other intangibles 14 All other assets 15 Total liabilities and capital 16 Total liabilities 17 Total deposits 18 Interest-bearing deposits 19 Deposits held in domestic offices 20 % insured 21 Federal funds purchased & repurchase agreements 22 Trading liabilities 24,096,246 221,363 158,740,000 29,842,000 1,994 475,368 443,000 89,342,000 5,226,332 164,400,000 187,956,756 4.299,029,000 167,338,672 3,891,460,000 156,006,270 3,668,912,000 107,501,182 2,205,830,000 151,179,446 3,530,310,000 34.32% 2,321,451 42.39% 45,480,000 3,024,501 43,314,000 23 24 25 26 27 28 Other borrowed funds Subordinated debt All other liabilities Total equity capital Total bank equity capital Perpetual preferred stock Common stock Surplus Undivided profits Noncontrolling interests in consolidated subsidiaries 1,870,682 1,644,999 2,470,769 20,618,084 20,618,016 2,500,000 2,001 15,036,958 3,079,057 68 45,290,000 13,755,000 74,709,000 407,569,000 407,532,000 0 3,539,000 291,575,000 112,418,000 37,000 29 30 31 32 Total (Sum) 1 2 IN 3,236 352,083 187,956,756 48,271,638 4,299,029,000 549,172,000 LOL COIN 47,318,049 40,637,279 10,513,912 501,513,000 1,382,844,000 98,041,000 IO 100 58,512,624 1,826,205,000 446,619 24,686,000 Total (Sum) Number of institutions reporting Assets and Liabilities Total employees (full-time equivalent) Total assets Cash and due from depository institutions Interest-bearing balances 6 Securities Z Federal funds sold and reverse repurchase agreements Net loans and leases 9 Allowance for loan and lease losses ** 10 Trading account assets 11 Bank premises and fixed assets 12 Other real estate owned 13 Goodwill and other intangibles 14 All other assets 15 Total liabilities and capital 16 Total liabilities 17 Total deposits 18 Interest-bearing deposits 19 Deposits held in domestic offices 20 % insured 21 Federal funds purchased & repurchase agreements 22 Trading liabilities 24,096,246 221,363 158,740,000 29,842,000 1,994 475,368 443,000 89,342,000 5,226,332 164,400,000 187,956,756 4.299,029,000 167,338,672 3,891,460,000 156,006,270 3,668,912,000 107,501,182 2,205,830,000 151,179,446 3,530,310,000 34.32% 2,321,451 42.39% 45,480,000 3,024,501 43,314,000 23 24 25 26 27 28 Other borrowed funds Subordinated debt All other liabilities Total equity capital Total bank equity capital Perpetual preferred stock Common stock Surplus Undivided profits Noncontrolling interests in consolidated subsidiaries 1,870,682 1,644,999 2,470,769 20,618,084 20,618,016 2,500,000 2,001 15,036,958 3,079,057 68 45,290,000 13,755,000 74,709,000 407,569,000 407,532,000 0 3,539,000 291,575,000 112,418,000 37,000 29 30 31 32

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started