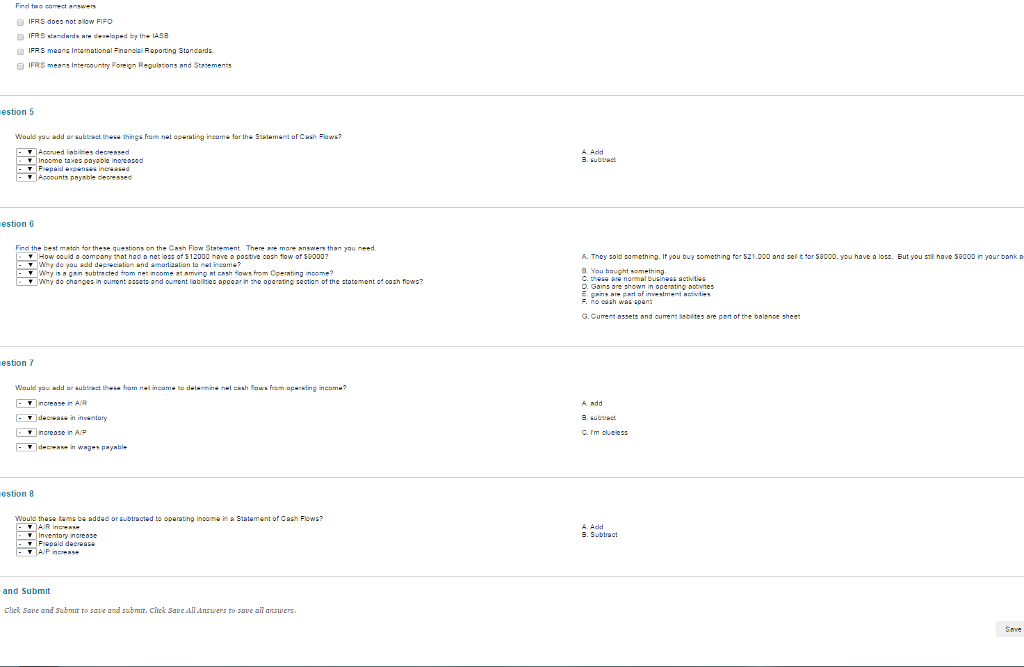

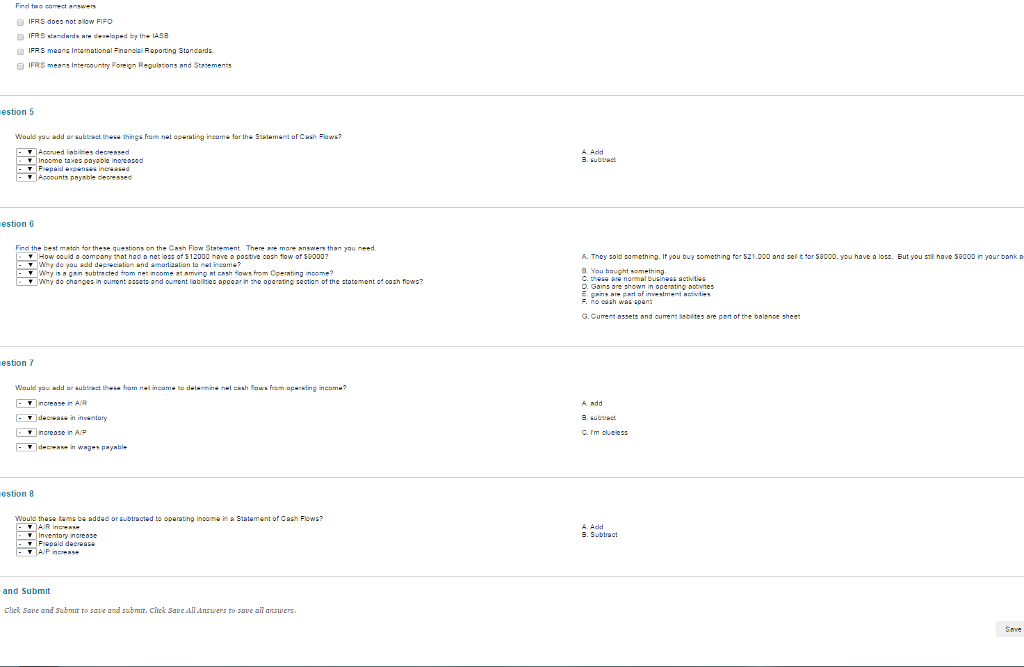

Find two correct answers. IFRS does not allow FlFO IFRS standards are developed by the IASB IFRS means international Financial Reporting Statements. IFRS means intercountry foreign Regulations and Statements. Would you add or subtract these things from net operating income for the Statement of Cash Flows? Accrued liabilities decreased Income payable increased Prepaid expenses increased Accounts payable decreased Find the best match for the these question on the Cash Flow Statement. There are more answer than you need. How could a company that had a net loss or $12000 have a positive each flow of why do you add depreciation and amortization to net income? Why do changes in current assets and current liabilities appear in operating section of the statement of cash flows? A. Add B. subtract They sold something. If you buy something for $21,000 and sell it for $8000, you have a loss. But you still have in your bank B/You bought something C. these are normal business activities D. Gains are shown in operating activates E. are part of investment activates F. no cash was spent G Current assets and current are part of the balance sheet A. add B. C. lm clueless A. Add B. Subtract Find two correct answers. IFRS does not allow FlFO IFRS standards are developed by the IASB IFRS means international Financial Reporting Statements. IFRS means intercountry foreign Regulations and Statements. Would you add or subtract these things from net operating income for the Statement of Cash Flows? Accrued liabilities decreased Income payable increased Prepaid expenses increased Accounts payable decreased Find the best match for the these question on the Cash Flow Statement. There are more answer than you need. How could a company that had a net loss or $12000 have a positive each flow of why do you add depreciation and amortization to net income? Why do changes in current assets and current liabilities appear in operating section of the statement of cash flows? A. Add B. subtract They sold something. If you buy something for $21,000 and sell it for $8000, you have a loss. But you still have in your bank B/You bought something C. these are normal business activities D. Gains are shown in operating activates E. are part of investment activates F. no cash was spent G Current assets and current are part of the balance sheet A. add B. C. lm clueless A. Add B. Subtract