Question

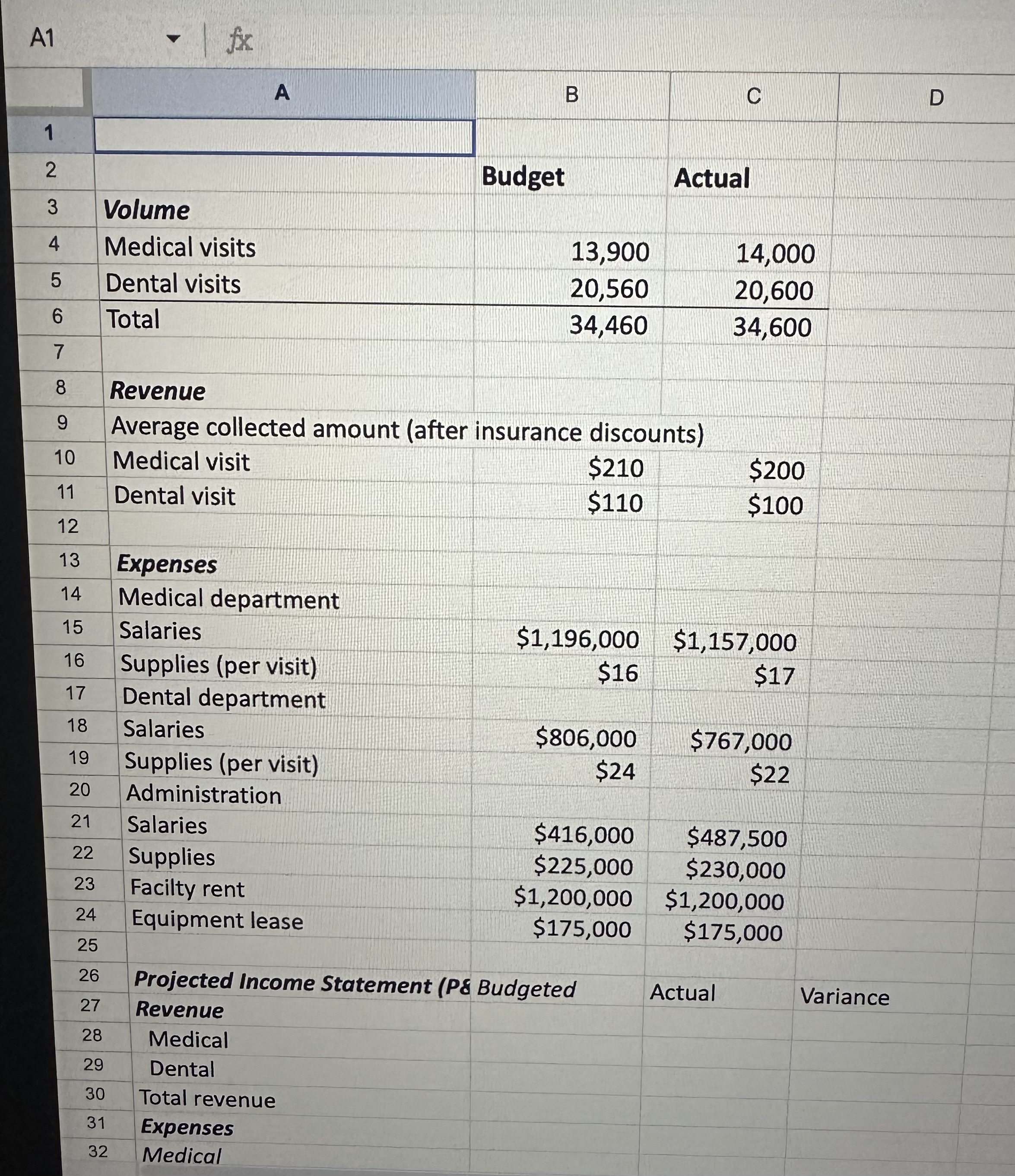

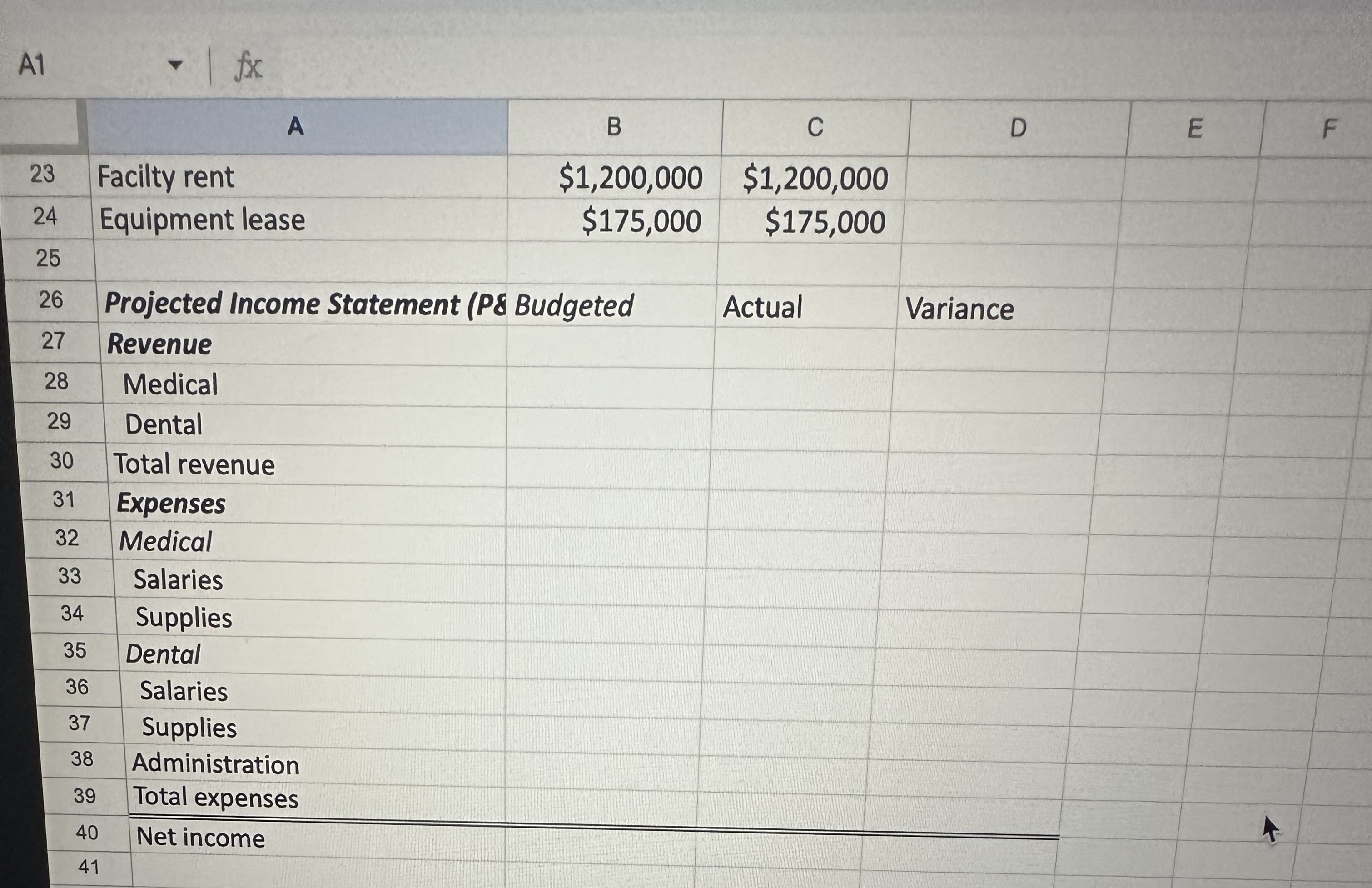

Find variances for each of the accounts listed in the projected income statement (i.e. for medical revenue, dental revenue, medical salaries, medical supplies, dental salaries,

- Find variances for each of the accounts listed in the projected income statement (i.e. for medical revenue, dental revenue, medical salaries, medical supplies, dental salaries, dental supplies, and administration).

2. Continuing with the worksheet for the question above, what is the profit variance for the clinic for the year?

3. Which effect is more important in driving this profit variance? The variance in expenses or the variance in revenue? Explain your answer.

4. The COO sees that the clinic had lower profits than expected and immediately exclaims I knew it! We need to do a much better job controlling our expenses. I knew we were paying too much for supplies and paying our employees too much! If we fix these things, Im sure well get back to our budgeted profit levels! Based on your analysis and answer to the previous question, what would you tell the COO?

5. The COO is impressed at the work youve done so far and wants to get you involved in a new project the clinic is considering. The clinic board has noticed the community has an acute need for behavioral health services and they have requested that the clinic management team do an analysis of whether offering these services would be feasible. The COO is particularly interested in getting your understanding of how the clinics costs would change if it began offering behavioral health services. You collect the following information about how the COO proposes to provide behavioral health:

The strategy to provide behavioral health services would involve:

- Hiring a licensed clinical social worker and a community outreach worker. The expense for adding both these positions would be $110,000

- Services would be provided in two rooms in the existing clinic building. These rooms were originally in an unfinished part of the clinic but they were framed out and HVAC was added 3 years ago at a cost of $45,000. The rooms are currently rented to United Way, who uses them for community outreach. United Way is currently paying the clinic $50 per month in rent for the privilege of using the rooms. If the clinic were to offer behavioral health services, the arrangement with United Way would be discontinued.

- The clinical social worker would need a computer for charting. The clinic has a spare computer purchased two years ago for $750. This computer would be suitable but the clinic would need to invest $400 to purchase a behavioral-health add-on to their current medical record system.

Review the costs listed about. Which ones should you consider as you are determining whether or not to offer behavioral health services?

6. Continuing off of the scenario presented in question 4, which of the costs listed in the question are sunk costs? Will these affect your decision about whether or not to offer behavioral health?

7. Again, continuing with the scenario from question 4 and 5, which of the costs listed in the question are opportunity costs? Will these affect your decision about whether or not to offer behavioral health?

A1 fx \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & \\ \hline \multicolumn{5}{|l|}{1} \\ \hline 2 & & Budget & Actual & \\ \hline 3 & Volume & & & \\ \hline 4 & Medical visits & 13,900 & 14,000 & \\ \hline 5 & Dental visits & 20,560 & 20,600 & \\ \hline 6 & Total & 34,460 & 34,600 & \\ \hline \multicolumn{5}{|l|}{7} \\ \hline 8 & Revenue & & & \\ \hline 9 & \multicolumn{3}{|c|}{ Average collected amount (after insurance discounts) } & \\ \hline 10 & Medical visit & $210 & $200 & \\ \hline 11 & Dental visit & $110 & $100 & \\ \hline \multicolumn{5}{|l|}{\begin{tabular}{l} 12 \\ 13 \end{tabular}} \\ \hline 13 & Expenses & & & \\ \hline 14 & Medical department & & & \\ \hline 15 & Salaries & $1,196,000 & $1,157,000 & \\ \hline 16 & Supplies (per visit) & $16 & $17 & \\ \hline 17 & Dental department & & & \\ \hline 18 & Salaries & $806,000 & $767,000 & \\ \hline 19 & Supplies (per visit) & $24 & $22 & \\ \hline 20 & Administration & & & \\ \hline 21 & Salaries & $416,000 & $487,500 & \\ \hline 22 & Supplies & $225,000 & $230,000 & \\ \hline 23 & 3 Facilty rent & $1,200,000 & $1,200,000 & \\ \hline 24 & Equipment lease & $175,000 & $175,000 & \\ \hline \\ \hline 26 & \multicolumn{2}{|c|}{ Projected Income Statement (P\& Budgeted } & Actual & Variance \\ \hline 27 & 7 Revenue & & & \\ \hline & \begin{tabular}{l} Medical \\ Dental \end{tabular} & & & \\ \hline & \begin{tabular}{l} Dental \\ Total revenue \end{tabular} & & & \\ \hline & 31 Expenses & & & \\ \hline & 32 Medical & & & \\ \hline \end{tabular} A1 \begin{tabular}{|c|c|c|c|c|} \hline- & A & B & c & D \\ \hline 23 & Facilty rent & $1,200,000 & $1,200,000 & \\ \hline 24 & Equipment lease & $175,000 & $175,000 & \\ \hline 25 & & & & \\ \hline 26 & \multicolumn{2}{|c|}{ Projected Income Statement (P\& Budgeted } & Actual & Variance \\ \hline 27 & Revenue & & & \\ \hline 28 & Medical & & & \\ \hline 29 & Dental & & & \\ \hline 30 & Total revenue & & & \\ \hline 31 & Expenses & & & \\ \hline 32 & Medical & & & \\ \hline 33 & Salaries & & & \\ \hline 34 & Supplies & & & \\ \hline 35 & Dental & & & \\ \hline 36 & Salaries & & & \\ \hline 37 & Supplies & & & \\ \hline 38 & Administration & & & \\ \hline & 39 Total expenses & & & \\ \hline & 40 Net income & & & \\ \hline \end{tabular}

A1 fx \begin{tabular}{|c|c|c|c|c|} \hline & A & B & C & \\ \hline \multicolumn{5}{|l|}{1} \\ \hline 2 & & Budget & Actual & \\ \hline 3 & Volume & & & \\ \hline 4 & Medical visits & 13,900 & 14,000 & \\ \hline 5 & Dental visits & 20,560 & 20,600 & \\ \hline 6 & Total & 34,460 & 34,600 & \\ \hline \multicolumn{5}{|l|}{7} \\ \hline 8 & Revenue & & & \\ \hline 9 & \multicolumn{3}{|c|}{ Average collected amount (after insurance discounts) } & \\ \hline 10 & Medical visit & $210 & $200 & \\ \hline 11 & Dental visit & $110 & $100 & \\ \hline \multicolumn{5}{|l|}{\begin{tabular}{l} 12 \\ 13 \end{tabular}} \\ \hline 13 & Expenses & & & \\ \hline 14 & Medical department & & & \\ \hline 15 & Salaries & $1,196,000 & $1,157,000 & \\ \hline 16 & Supplies (per visit) & $16 & $17 & \\ \hline 17 & Dental department & & & \\ \hline 18 & Salaries & $806,000 & $767,000 & \\ \hline 19 & Supplies (per visit) & $24 & $22 & \\ \hline 20 & Administration & & & \\ \hline 21 & Salaries & $416,000 & $487,500 & \\ \hline 22 & Supplies & $225,000 & $230,000 & \\ \hline 23 & 3 Facilty rent & $1,200,000 & $1,200,000 & \\ \hline 24 & Equipment lease & $175,000 & $175,000 & \\ \hline \\ \hline 26 & \multicolumn{2}{|c|}{ Projected Income Statement (P\& Budgeted } & Actual & Variance \\ \hline 27 & 7 Revenue & & & \\ \hline & \begin{tabular}{l} Medical \\ Dental \end{tabular} & & & \\ \hline & \begin{tabular}{l} Dental \\ Total revenue \end{tabular} & & & \\ \hline & 31 Expenses & & & \\ \hline & 32 Medical & & & \\ \hline \end{tabular} A1 \begin{tabular}{|c|c|c|c|c|} \hline- & A & B & c & D \\ \hline 23 & Facilty rent & $1,200,000 & $1,200,000 & \\ \hline 24 & Equipment lease & $175,000 & $175,000 & \\ \hline 25 & & & & \\ \hline 26 & \multicolumn{2}{|c|}{ Projected Income Statement (P\& Budgeted } & Actual & Variance \\ \hline 27 & Revenue & & & \\ \hline 28 & Medical & & & \\ \hline 29 & Dental & & & \\ \hline 30 & Total revenue & & & \\ \hline 31 & Expenses & & & \\ \hline 32 & Medical & & & \\ \hline 33 & Salaries & & & \\ \hline 34 & Supplies & & & \\ \hline 35 & Dental & & & \\ \hline 36 & Salaries & & & \\ \hline 37 & Supplies & & & \\ \hline 38 & Administration & & & \\ \hline & 39 Total expenses & & & \\ \hline & 40 Net income & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started