find WACC

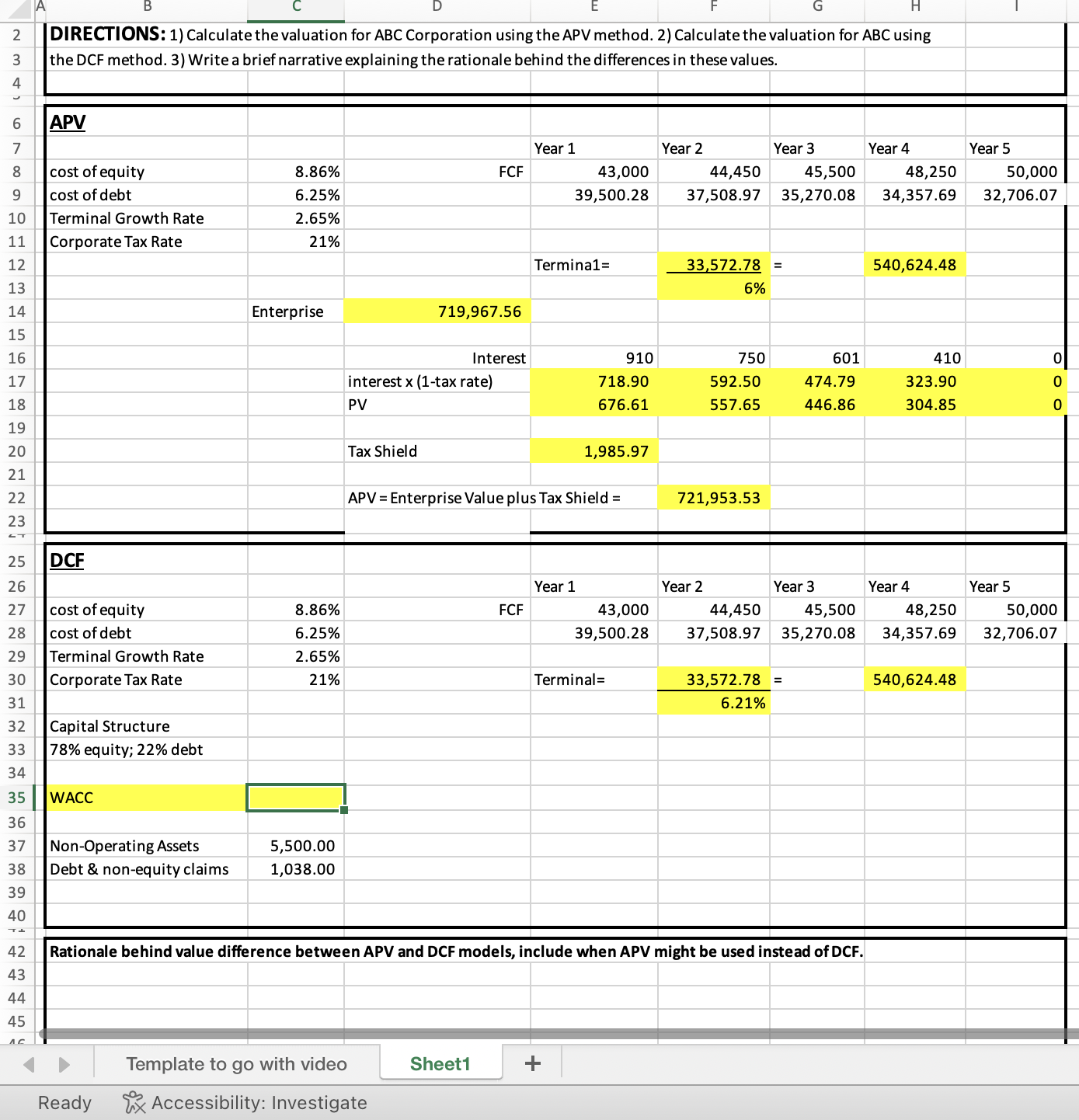

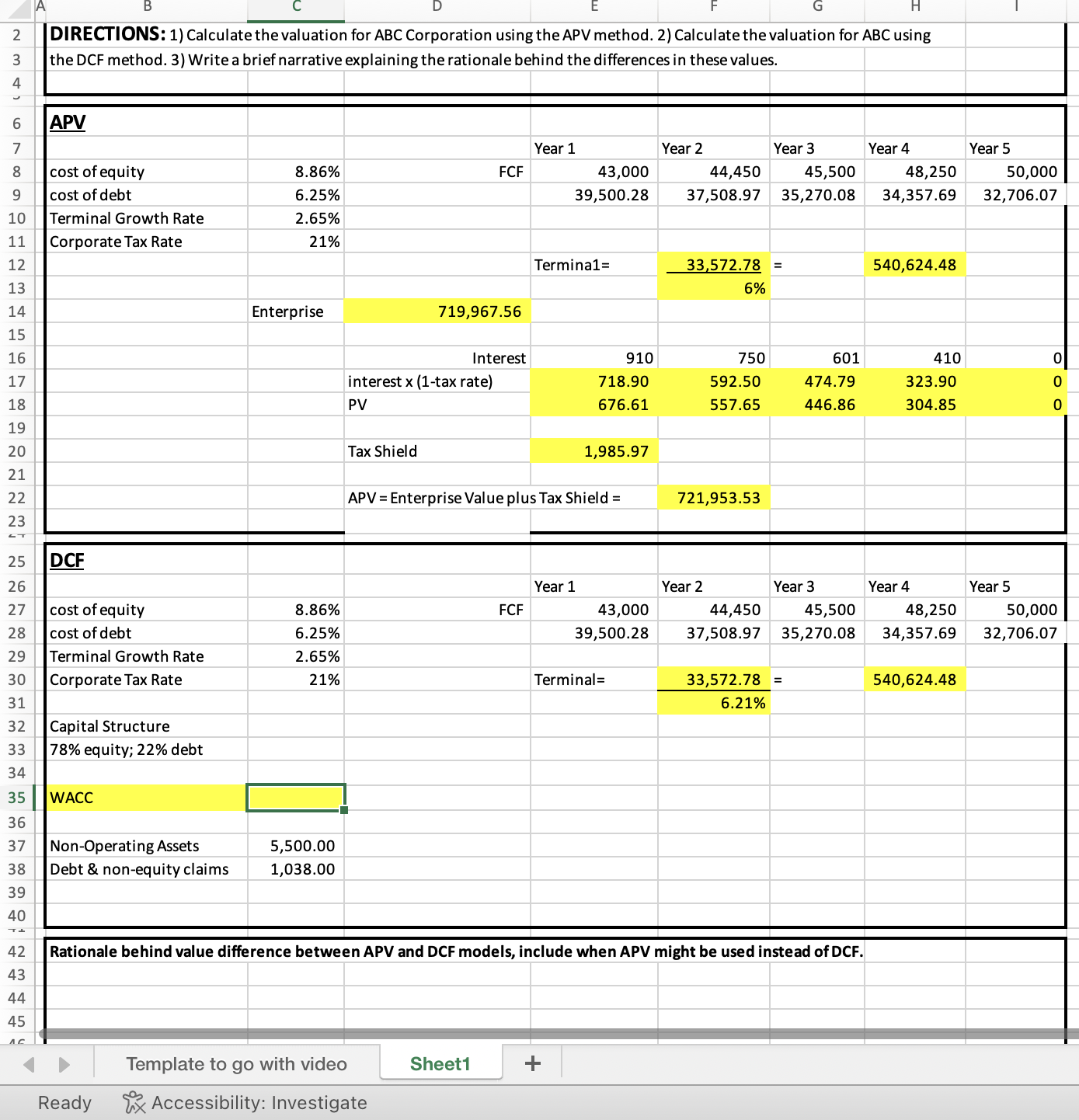

\begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline & & C & D & E & F & G & H & 1 \\ \hline 2 & \multicolumn{8}{|c|}{ DIRECTIONS: 1) Calculate the valuation for ABC Corporation using the APV method. 2) Calculate the valuation for ABC using } \\ \hline 3 & \multicolumn{6}{|c|}{ the DCF method. 3) Write a brief narrative explaining the rationale behind the differences in these values. } & & \\ \hline 4 & & & & & & & & \\ \hline 6 & APV & & & & & & & \\ \hline 7 & & & & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 \\ \hline 8 & cost of equity & 8.86% & FCF & 43,000 & 44,450 & 45,500 & 48,250 & 50,000 \\ \hline 9 & cost of debt & 6.25% & & 39,500.28 & 37,508.97 & 35,270.08 & 34,357.69 & 32,706.07 \\ \hline 10 & Terminal Growth Rate & 2.65% & & & & & & \\ \hline 11 & Corporate Tax Rate & 21% & & & & & & \\ \hline 12 & & & & Termina1= & 33,572.78 & = & 540,624.48 & \\ \hline 13 & & & & & 6% & & & \\ \hline 14 & & Enterprise & 719,967.56 & & & & & \\ \hline 15 & & & & & & & & \\ \hline 16 & & & Interest & 910 & 750 & 601 & 410 & 0 \\ \hline 17 & & & interest x (1-tax rate) & 718.90 & 592.50 & 474.79 & 323.90 & 0 \\ \hline 18 & & & PV & 676.61 & 557.65 & 446.86 & 304.85 & 0 \\ \hline 19 & & & & & & & & \\ \hline 20 & & & Tax Shield & 1,985.97 & & & & \\ \hline 21 & & & & & & & & \\ \hline 22 & & & APV = Enterprise Value plu & s Tax Shield = & 721,953.53 & & & \\ \hline 23 & & & & & & & & \\ \hline 25 & DCF & & & & & & & \\ \hline 26 & & & & Year 1 & Year 2 & Year 3 & Year 4 & Year 5 \\ \hline 27 & cost of equity & 8.86% & FCF & 43,000 & 44,450 & 45,500 & 48,250 & 50,000 \\ \hline 28 & cost of debt & 6.25% & & 39,500.28 & 37,508.97 & 35,270.08 & 34,357.69 & 32,706.07 \\ \hline 29 & Terminal Growth Rate & 2.65% & & & & & & \\ \hline 30 & Corporate Tax Rate & 21% & & Terminal= & 33,572.78 & = & 540,624.48 & \\ \hline 31 & & & & & 6.21% & & & \\ \hline 32 & Capital Structure & & & & & & & \\ \hline 33 & 78% equity; 22% debt & & & & & & & \\ \hline 34 & & & & & & & & \\ \hline 35 & WACC & & & & & & & \\ \hline 36 & & & & & & & & \\ \hline 37 & Non-Operating Assets & 5,500.00 & & & & & & \\ \hline 38 & Debt \& non-equity claims & 1,038.00 & & & & & & \\ \hline 39 & & & & & & & & \\ \hline 40 & & & & & & & & \\ \hline \end{tabular} 42 Rationale behind value difference between APV and DCF models, include when APV might be used instead of DCF. 43 44 45 ic Template to go with video Sheet1 Accessibility: Investigate