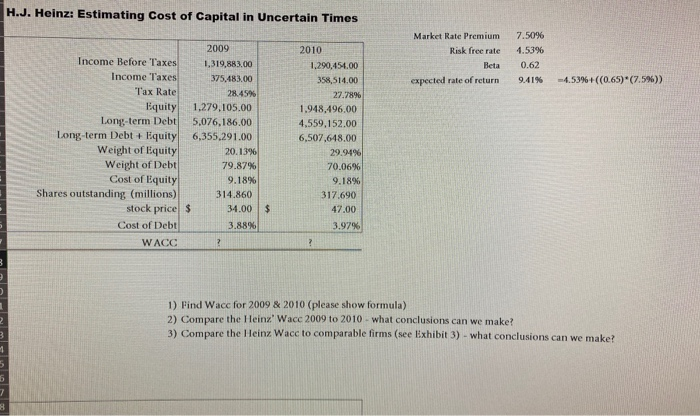

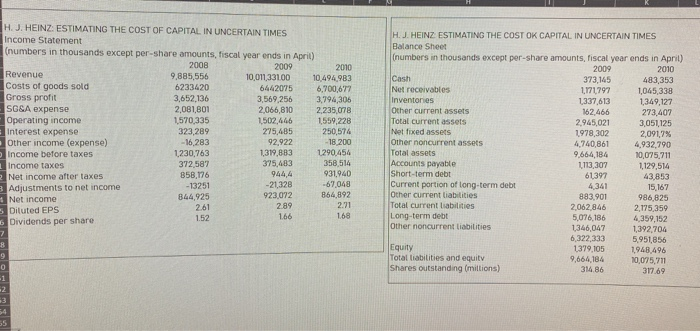

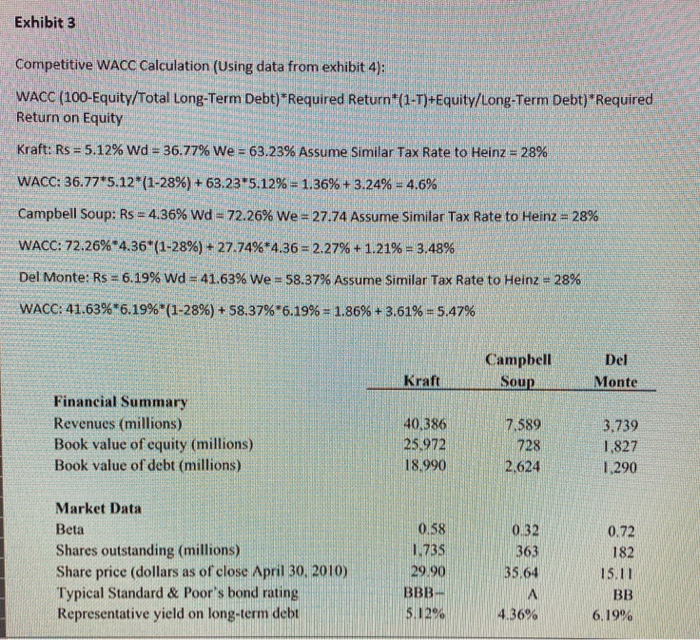

H.J. Heinz: Estimating Cost of Capital in Uncertain Times Market Rate Premium Risk free rate Beta expected rate of return 7.50% 4.53% 0.62 9.41% 4,59%+((0.65) (7.5%)) 2009 Income Before Taxes 1,319,883.00 Income Taxes 375483.00 Tax Rate 28.45% Equity 1,279,105.00 Long-term Debt 5.076,186.00 Long-term Debt + Equity 6,355.291.00 Weight of Equity 20.13% Weight of Debt 79.87% Cost of Equity 9.18% Shares outstanding (millions) 314.860 stock price $ 34.00 Cost of Debt 3.88% WACC 2010 1.290,454.00 358,514,00 27.78% 1.948.496.00 4,559,152.00 6,507.648.00 29.94% 70.06% 9.18% 317.690 47.00 3.97% 1) Find Wacc for 2009 & 2010 (please show formula) 2) Compare the Heinz' Wace 2009 to 2010 - what conclusions can we make? 3) Compare the Heinz Wace to comparable firms (see Exhibit 3) - what conclusions can we make! HJ. HEINZ: ESTIMATING THE COST OF CAPITAL IN UNCERTAIN TIMES Income Statement (numbers in thousands except per-share amounts, fiscal year ends in April) 2009 2009 2010 Revenue 9885556 10,07 33100 10494 983 Costs of goods sold 6233420 6442075 6,700 677 Gross profit 3.652 126 3,569,256 3,794 306 SGSA expense 2,081,801 2066,810 2.235078 Operating income 1570335 1502 446 1559,228 Interest expense 323,289 275,485 250,574 Other income (expense) - 16.283 92.922 -18 200 income before taxes 1230,763 1319,883 1290.454 372587 Income taxes 358 514 375,483 B58.126 944,4 931.940 Net income after taxes - 2112B -13251 -67048 Adjustments to net income 844.925 923072 164,892 Net income Diluted EPS 1.52 Dividends per share HJ HEINZ ESTIMATING THE COST OK CAPITAL IN UNCERTAIN TIMES Balance Sheet (numbers in thousands except per-share amounts, fiscal year ends in April) 2009 2010 Cash 372145 483 353 Netreceivables 17797 1045.338 Inventores 1,337,613 1,349,127 Other current assets 162466 273 407 Total current assets 2,945,021 3.051125 Nel fixed assets 1978,302 2091,7% other noncurrent assets 4,740,861 4,932,790 Total assets 9.664,184 10.075,711 Accounts payable 1113,307 1129,514 Short-term debt 61397 43853 Current portion of long-term debt 15,167 Other current liabilities 882901 986 825 Total current liabilities 2062846 2 175 359 Long-term debt 5.076186 4359,152 Other noncurrent liabilities 1346 047 392704 6322333 5951856 Equity 1379 105 1948 496 Total liabilities and equity 9664 186 10.075,711 Shares outstanding millions) 314 86 31769 4341 261 2.89 2.71 166 168 FEL Exhibit 3 Competitive WACC Calculation (Using data from exhibit 4); WACC (100-Equity/Total Long-Term Debt)*Required Return (1-T)+Equity/Long-Term Debt)*Required Return on Equity Kraft: Rs = 5.12% Wd = 36.77% We = 63.23% Assume Similar Tax Rate to Heinz = 28% WACC: 36.77*5.12*(1-28%) + 63.23*5.12% = 1.36% + 3.24% = 4.6% Campbell Soup: Rs = 4.36% Wd = 72.26% We = 27.74 Assume Similar Tax Rate to Heinz = 28% WACC: 72.26%*4.36*(1-28%) + 27.74%*4.36 = 2.27% +1.21% = 3.48% Del Monte: Rs = 6.19% Wd - 41.63% We = 58.37% Assume Similar Tax Rate to Heinz = 28% WACC: 41.63%*6.19%*(1-28%) + 58.37%*6.19% = 1.86% +3.61% = 5.47% Campbell Del Monte Kraft Soup Financial Summary Revenues (millions) Book value of equity (millions) Book value of debt (millions) 40,386 25.972 18.990 7,589 728 3.739 1,827 1.290 2,624 0.72 Market Data Beta Shares outstanding (millions) Share price (dollars as of close April 30, 2010) Typical Standard & Poor's bond rating Representative yield on long-term debt 0.58 735 29.90 BBB- 0.32 363 35.64 182 15.11 BB 6.19% 4.36%