Find

- Which depreciation method does Target use _______________________________

- What was the amount of depreciation for year ending February 2020 __________________

Go to Statement of Cash Flows

Under heading Investing Activities

3 How much did Target add to property plant & equipment during the year? Look at expenditures in the Investing Section on the Statement of Cash Flows. Spending money to add property plant & equipment is a negative number.

____________________________________________________________________________

4 Did Target record any proceeds from disposal of property plant & equipment?

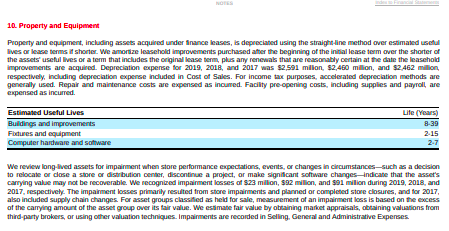

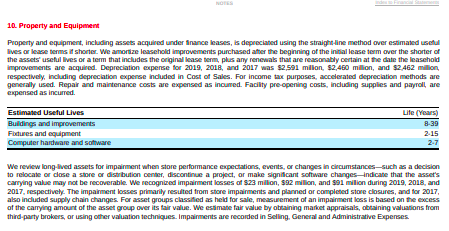

10. Property and Equipment Property and equipment, including assets acquired under finance leases, is depreciated using the straight-line method over estimated us lives or lease terms it shorter. We amortize leasehold improvements purchased after the beginning of the initial lease term over the shorter of the assets useful lives or a term that includes the original lease term, plus any renewals that are reasonably certain at the date the leasehold improvements are acquired. Depreciation expense for 2019, 2018, and 2017 was $2,591 million, 52,460 milion, and $2.462 million, respectively, including depreciation expense included in Cost of Sales. For income tax purposes, accelerated depreciation methods are generally used. Repair and maintenance costs are expensed as incured. Facility pre opening costs, including supplies and payroll, are expensed as incurred Estimated Useful Lives Life (Years Buildings and improvements 8-39 Fidures and equipment 2.15 Computer hardware and software 2-7 We review long-lived assets for impairment when store performance expectations, events, or changes in circumstances such as a decision to relocate or dose a store or distrbution center, discontinue a project, or make significant software changes indicate that the asset's carrying value may not be recoverable. We recognized impairment losses of S23 milion, 592 milion, and 591 milion during 2019, 2018, and 2017, respectively. The impairment losses primarily resulted from store impairments and planned or completed store closures, and for 2017, also included supply chain changes. For asset groups classified as held for sale, measurement of an impairment loss is based on the excess of the carrying amount of the asset group over its fair value. We estimate fair value by obtaining market appraisals, obtaining valuations from third-party brokers, or using other valuation techniques. Impairments are recorded in Selling. General and Administrative Expenses 10. Property and Equipment Property and equipment, including assets acquired under finance leases, is depreciated using the straight-line method over estimated us lives or lease terms it shorter. We amortize leasehold improvements purchased after the beginning of the initial lease term over the shorter of the assets useful lives or a term that includes the original lease term, plus any renewals that are reasonably certain at the date the leasehold improvements are acquired. Depreciation expense for 2019, 2018, and 2017 was $2,591 million, 52,460 milion, and $2.462 million, respectively, including depreciation expense included in Cost of Sales. For income tax purposes, accelerated depreciation methods are generally used. Repair and maintenance costs are expensed as incured. Facility pre opening costs, including supplies and payroll, are expensed as incurred Estimated Useful Lives Life (Years Buildings and improvements 8-39 Fidures and equipment 2.15 Computer hardware and software 2-7 We review long-lived assets for impairment when store performance expectations, events, or changes in circumstances such as a decision to relocate or dose a store or distrbution center, discontinue a project, or make significant software changes indicate that the asset's carrying value may not be recoverable. We recognized impairment losses of S23 milion, 592 milion, and 591 milion during 2019, 2018, and 2017, respectively. The impairment losses primarily resulted from store impairments and planned or completed store closures, and for 2017, also included supply chain changes. For asset groups classified as held for sale, measurement of an impairment loss is based on the excess of the carrying amount of the asset group over its fair value. We estimate fair value by obtaining market appraisals, obtaining valuations from third-party brokers, or using other valuation techniques. Impairments are recorded in Selling. General and Administrative Expenses