Question

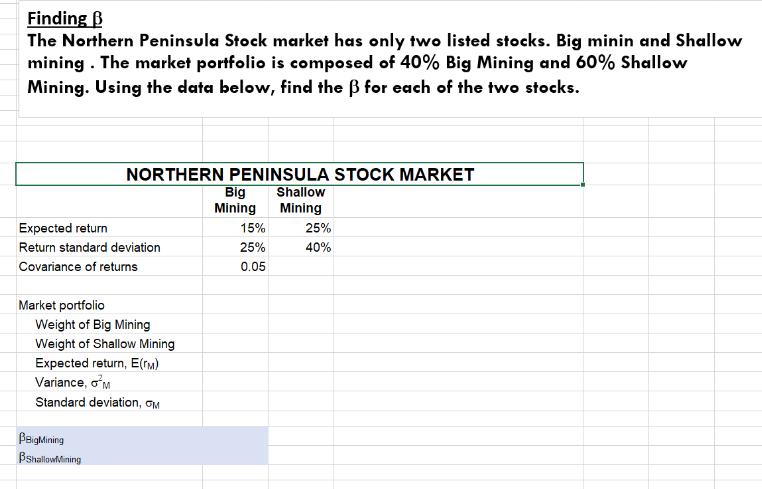

Finding B The Northern Peninsula Stock market has only two listed stocks. Big minin and Shallow mining. The market portfolio is composed of 40%

Finding B The Northern Peninsula Stock market has only two listed stocks. Big minin and Shallow mining. The market portfolio is composed of 40% Big Mining and 60% Shallow Mining. Using the data below, find the for each of the two stocks. Expected return Return standard deviation Covariance of returns Market portfolio NORTHERN PENINSULA STOCK MARKET Shallow Mining Weight of Big Mining Weight of Shallow Mining Expected return, E(M) Variance, M Standard deviation, GM BeigMining BshallowMining Big Mining 15% 25% 0.05 25% 40%

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To find the beta for each of the two stocks Big Mining and Shallow Mining we can use the following f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance Core Principles And Applications

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

6th Edition

1260571122, 978-1260571127

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App