Question

Finding Net Business Income Sam Skip is a self-employed businessman in Alberta. Sam's business, Skip Ltd. has been in operation for several years. The business

Finding Net Business Income

Sam Skip is a self-employed businessman in Alberta. Sam's business, Skip Ltd. has been in operation for several years. The business office is located at Sam's home. The fiscal year-end for all self-employed individuals is December 31. For the current year ended December 31, Sam provides you with the following information:

| Item | Amount | Amount |

|---|---|---|

| Revenue | $900,000 | |

| Operating expenses: | ||

| Advertising and promotion (Note 7) | $8,000 | |

| Depreciation (Note 1) | 10,000 | |

| Accounting and legal (Note 2) | 3,500 | |

| Bad debts (Note 3) | 7,500 | |

| Dues and fees (Note 4) | 5,000 | |

| Insurance (Note 5) | 2,500 | |

| Office expenses (Note 6) | 8,500 | |

| Travel (Note 9) | 7,000 | |

| Wages and benefits (Note 8) | 43,000 | |

| 95,000 | ||

| Net Income (per financial statements) | 805,000 |

Notes to financial statements:

- Note 1: Depreciation for office equipment and the business vehicles.

- Note 2: Accounting & legal includes legal fees pertaining to the purchase of the family cottage during the year in the amount of $1,500.

- Note 3: An allowance for doubtful accounts is set up each year, based on a review of the outstanding accounts and an assessment of which accounts are doubtful for collection.

- Note 4: Membership dues to the Royal Glencoe Club ($2,000) are included; Sam takes his business clients to the club regularly.

- Note 5: Life insurance premiums ($1,500) paid for Sam Skip. There is no indication that the life insurance is required for financing purposes.

- Note 6: Office expenses include the cost of a new laptop computer purchased in October this year ($1,500) and $300 for an upgrade of accounting software for payroll tax information (Hint: these amounts were expensed in accounting statements, but for tax purposes they have to be added to Class 50 and Class 12).

- Note 7: Advertising and promotion includes:

- Season hockey tickets = $3,000

- Advertisement in US magazine directed at Canadian market = $3,000

- Note 8: Wages and benefits include:

- $40,000 in wages

- $3,000 for auto allowance paid to the sole employee, Jack Jones. This allowance was calculated as $1 per km for 3,000 kms driven by the employee.

- Note 9: Travel expenses include $4,000 of travel meals.

- The office for Skip Manufacturing is located in Sam Skip's home. Sam advises you that the office space is 150 sq. ft. and the total area of his home is 1,500 sq. ft. Sam provides you with the following expenses for his home (none of which were deducted in the accounting statements):

- Property taxes = $2,000

- Insurance = $600

- Mortgage interest = $2,400

- Heat = $1,800

- Electricity = $1,500

- Snow clearing during the winter months = $400

- General repairs to the home = $300

- On January 1, 2021, company had the following UCC balances:

Class 53 $462,000

Class 50 82,000

Class 10 142,000

Class 10.1 16,500

Class 13 102,000

Class 8 96,000

Class 3 326,000

During the year, the company acquired manufacturing and processing equipment at a cost of $106,000.

Also, there were additions to Class 50 with a capital cost of $15,600.

Three passenger vehicles were acquired at a cost of $22,000 each. In addition, a delivery van with a capital cost of $43,000 was sold for $21,000.

The only asset in Class 10.1 was the CEO's $462,000 Bentley. Because of public relations concerns with such an extravagant vehicle, the car was sold during the year for $283,000.

The January 1, 2021 balance in Class 13 reflected $120,000 office improvements that were made in 2019, the year in which the lease commenced. The basic lease term is for eight years, with an option to renew for a period of two years. Additional improvements, costing $52,000, were made during 2021.

During the year, the company acquired Class 8 assets at a cost of $146,000. Class 8 assets with a capital cost of $85,000 were sold for proceeds of $56,000. None of the individual assets sold had proceeds that exceeded their individual capital cost.

During the year, one of the buildings in Class 3 burned to the ground. It had a capital cost of $285,000. The insurance proceeds totaled $310,000.

During the year, a new factory building was acquired at a cost of $1,327,000. The estimated value of the land included in the purchase price is $270,000. The building will be used 100% for manufacturing and processing activity. It will be allocated to a separate class.

Class 12 small tools were sold for $700. None of the proceeds exceeded original cost of these tools.

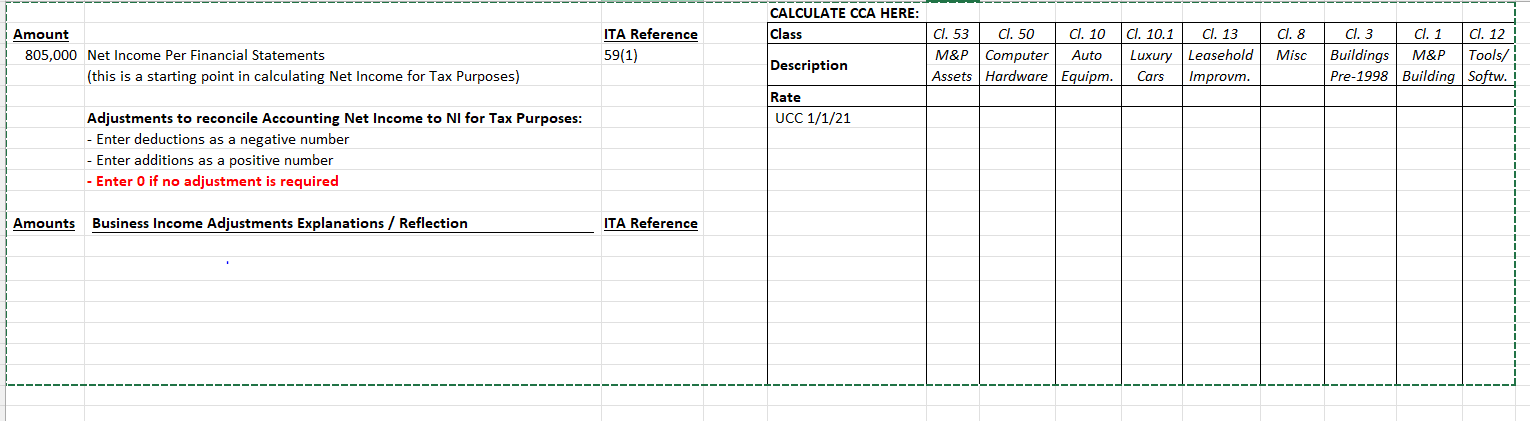

Part A:Using Excel templateprepare a Reconciliation Schedule to reconcile accounting net income to net business income for tax purposes. For each amount,give brief explanation to support your response (i.e., explain why the amount is added or subtracted in Schedule 1 or why no adjustment to accounting income is required). Provide appropriate references to the ITA.

Part B: Prepare a Capital Cost Allowance Schedule in good form.

Amount 805,000 Net Income Per Financial Statements (this is a starting point in calculating Net Income for Tax Purposes) Adjustments to reconcile Accounting Net Income to NI for Tax Purposes: Enter deductions as a negative number - Enter additions as a positive number - Enter 0 if no adjustment is required Amounts Business Income Adjustments Explanations / Reflection ITA Reference 59(1) ITA Reference CALCULATE CCA HERE: Class Description Rate UCC 1/1/21 Cl. 53 Cl. 50 Cl. 10 M&P Computer Auto Assets Hardware Equipm. Cl. 10.1 Cl. 13 Luxury Leasehold Cars Improvm. Cl. 8 Misc Cl. 3 Cl. 1 Cl. 12 Buildings M&P Tools/ Pre-1998 Building Softw. + I 1 1 + I + I 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Part A Reconciliation Schedule Item Amount Explanation Net Income per financial statements 805000 This is the net income as reported in the fin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started