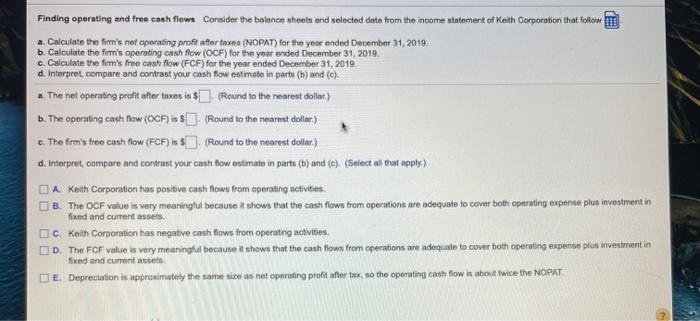

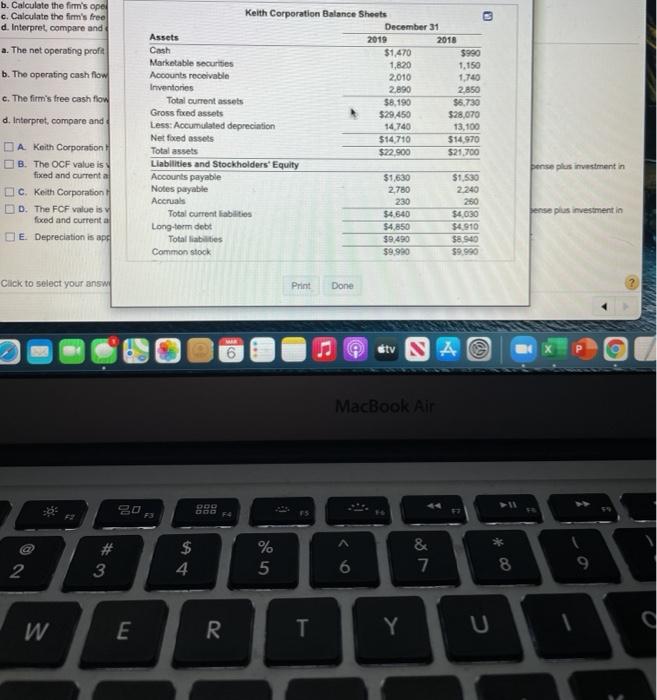

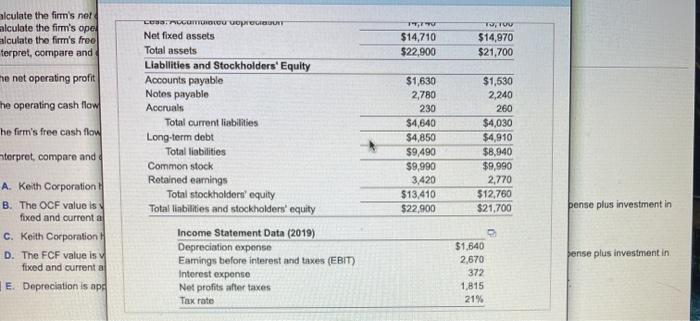

Finding operating and free cash flows Connider the balance sheets and selected data from the income statement of Keith Corporation that follow a Calculate the firm's not operating profit afer taxes (NOPAT) for the year ended December 31, 2019 b. Calculate the firm's operating cash flow (OCF) for the year ended December 31, 2019. c. Calculate the firm's free cash flow (FCF) for the year ended December 31, 2019 d. Interpret compare and contrast your cash flow estimato in parts (b) and (c). 2. The net operating profit after tnxen is $(Round to the nearest dollar.) b. The operating cash flow (OCF) in (Round to the nearest dollar) c. The femis free cash flow (FCF) is $. (Round to the nearest dollar) d. Interprot, compare and contrast your cash flow estimato in parts (b) and (c) (Select all that apply) A. Keith Corporation has positive cash flows from operating activities 8. The OCF value is very meaningful because it shows that the cash flows from operations are adequate to cover both operating expense plus investment in fixed and current assets Keith Corporation hos negative cash flows from operating activities D. The FCF value is very meaningful because it shows that the cash flows from operations are adequate to cover both operating expense plus investment in fixed and current assets DE Depreciation is approximately the same size as net operating profit after tax, so the operating cash flow is about twice the NOPAT 3 b. Calculate the firm's opel c. Calculate the firm's free d. Interpret compare and a. The net operating profit b. The operating cash flow c. The firm's free cash flow d. Interpret, compare and Keith Corporation Balance Sheets December 31 Assets 2018 Cash $1.470 $990 Marketable securities 1,820 1.150 Accounts receivable 2010 1,740 Inventories 2.890 2.850 Total current assets $8,190 $6.730 Gross foxed assets $29.450 $28,070 Less: Accumulated depreciation 14,740 13.100 Net foed assets $14.710 $14.970 Total assets $22.900 $21,700 Liabilities and Stockholders' Equity Accounts payable $1,630 $1.530 Notes payable 2.780 2.240 Accruals 230 250 Total current liabilities $4.640 $4.030 Long-term debt $4,850 $4910 Total liabilities $9.490 $8940 Common stock $9.990 $9.990 pense plus investment in DA Keith Corporation B. The OCF value is fixed and current al c. Keith Corporation D. The FCF value is foxed and current a D E. Depreciation is apg Sense plus investment in Click to select your answ Print Done tv CO MacBook Air 20 DOO 4 DBF & # 3 $ 4 % 5 2 6 9 8 W R. E U c T Y alculate the firm's net alculate the firm's opel alculate the firm's free terpret, compare and TU $14,710 $22.900 TOT $14,970 $21,700 me net operating profit the operating cash flow he firm's free cash flow terpret, compare and Net fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Income Statement Data (2019) Depreciation expense Earnings before interest and taxes (EBIT) Interest expense Net profits after taxes Tax rate $1,630 2,780 230 $4,640 $4,850 $9.490 $9.990 3,420 $13,410 $22.900 $1,530 2,240 260 $4,030 $4,910 $8,940 $9,990 2,770 $12,760 $21,700 pense plus investment in A. Keith Corporation B. The OCF value is fixed and current a c. Keith Corporation D. The FCF value is fixed and current a E. Depreciation is apg pense plus investment in $1.640 2,670 372 1,815 21%