Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fine Taylors finished last year with $200,000 in revenue. The company believes that they will be able to grow revenue by 10% for the following

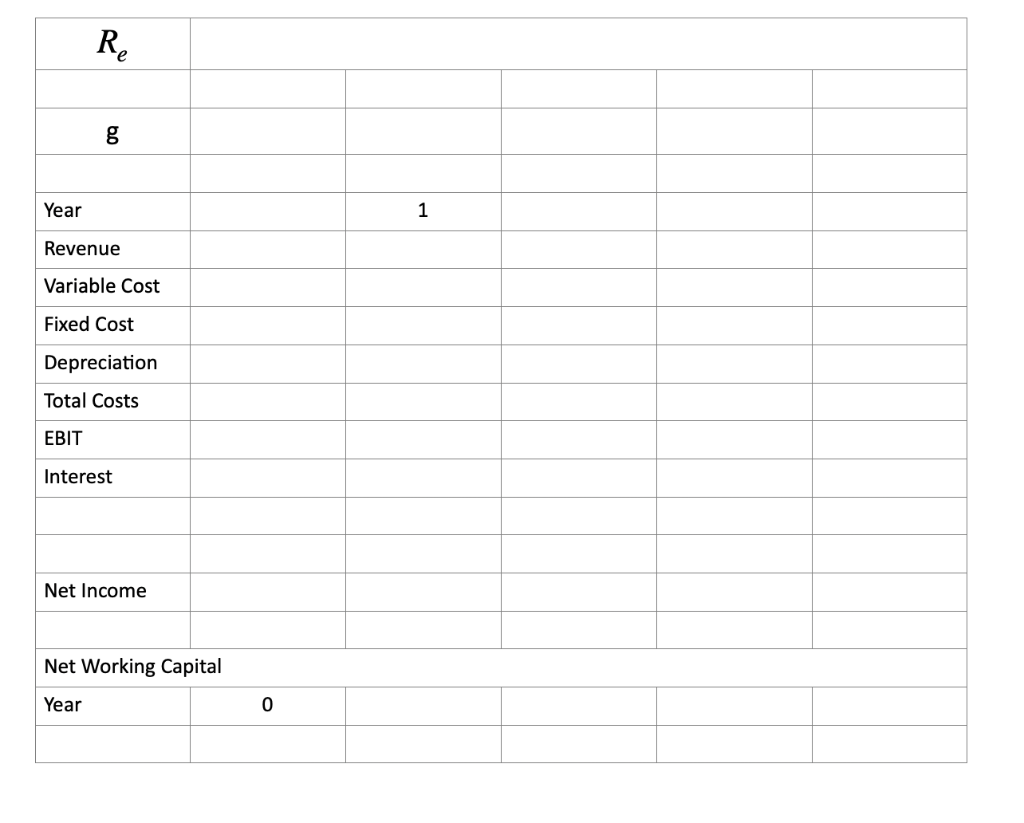

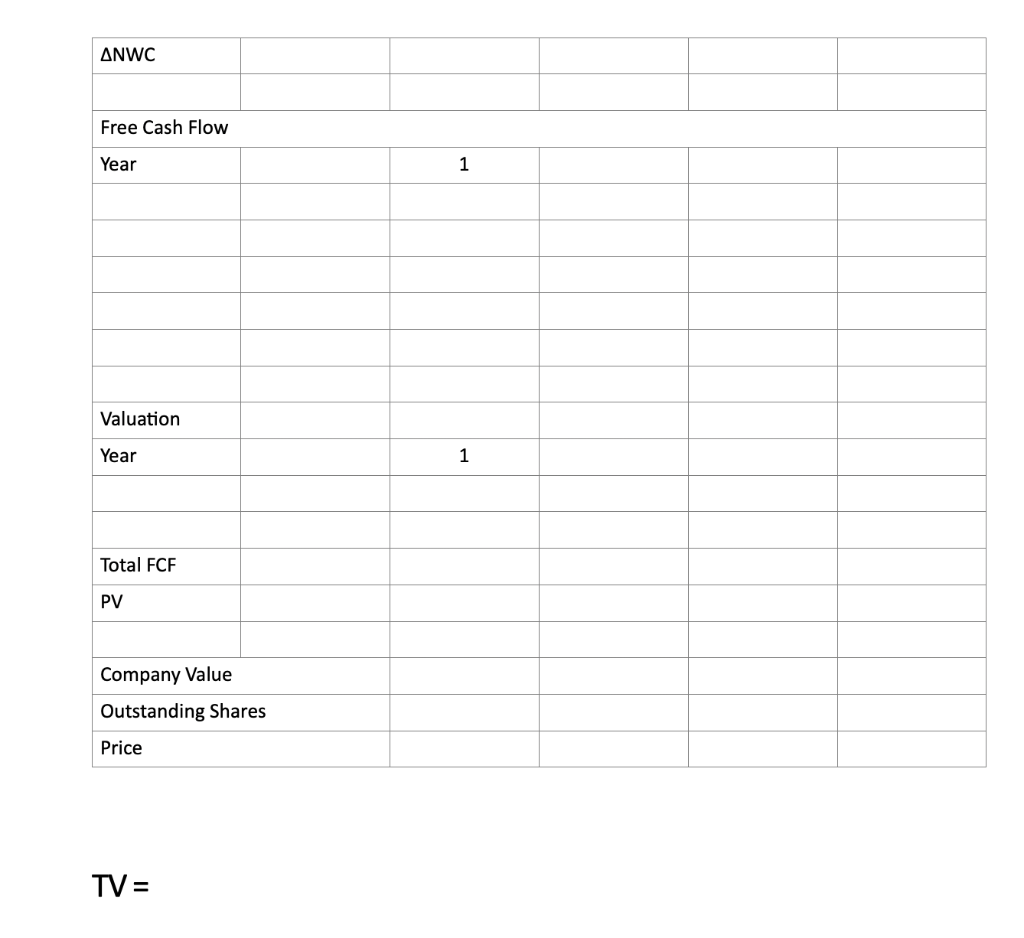

- Fine Taylors finished last year with $200,000 in revenue. The company believes that they will be able to grow revenue by 10% for the following four years. Taylors has variables costs of 25% of revenue and fixed costs of $50,000. Depreciation is estimated to be at 10% of revenue, while net working capital would be at 8% of revenue. Capital investment for the next four years would be $10,000 annually. The company has debt of 800,000 that pays 4% interest on an annual basis. There is no expectation that any new debt will be issued nor there are going to be any repayments over the next four years. The firm has 500,000 outstanding shares of common stock with a beta of 0.85, the risk free is 3.5% and the expected return on the market is 9%. Beyond the fourth year, management believes that the company is going to grow at a constant rate of 1.5%. The effective tax rate is 21%.

- What is Fine Taylors cost of equity?

- What is the pro forma financial statement for the next four years?

- What is the change in net working capital for years 1 through 4?

- What is the companys free cash flow to the equity for years 1 through 4?

- What is the stock price for Fine Taylors common stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started