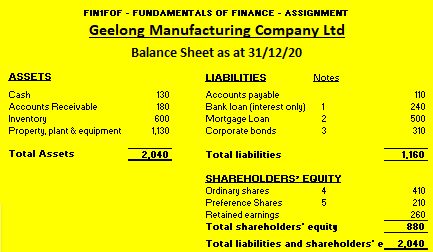

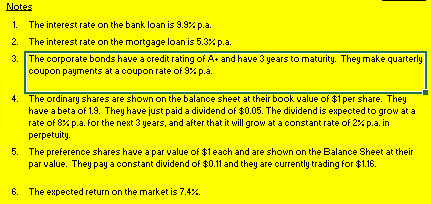

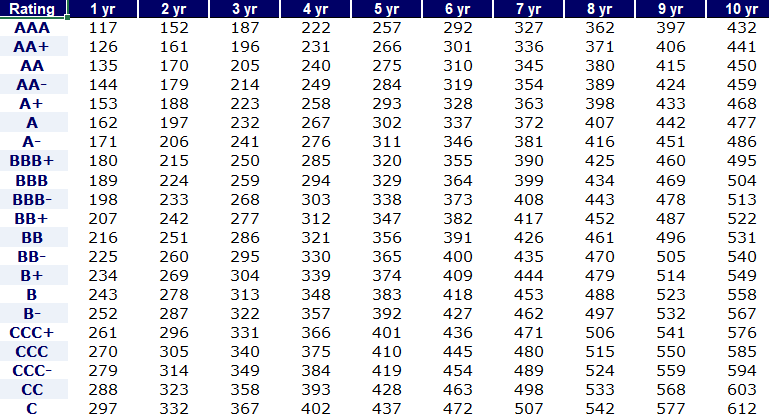

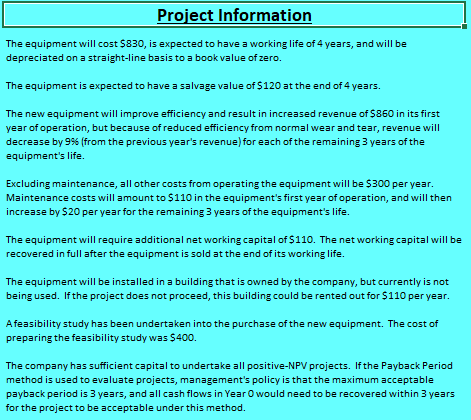

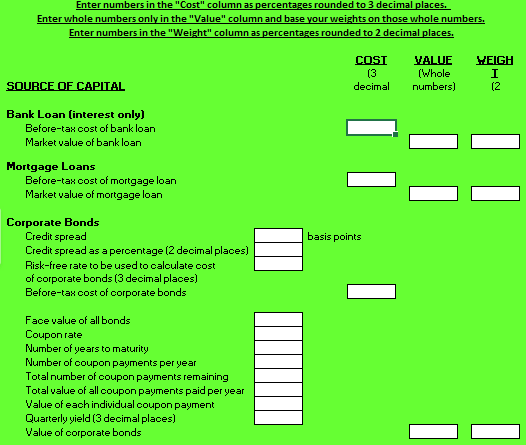

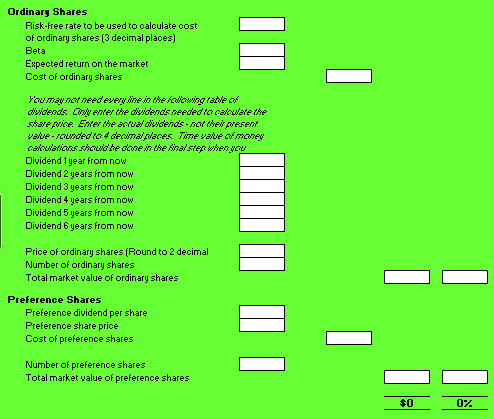

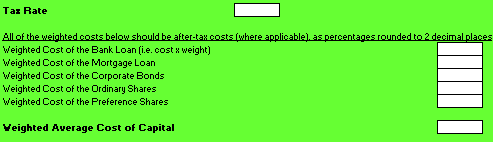

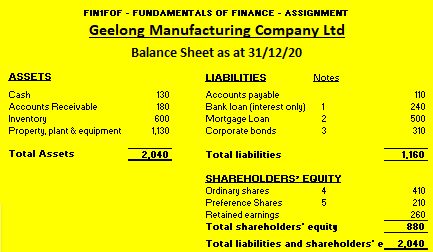

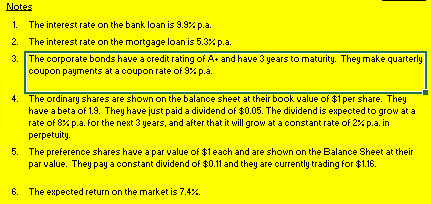

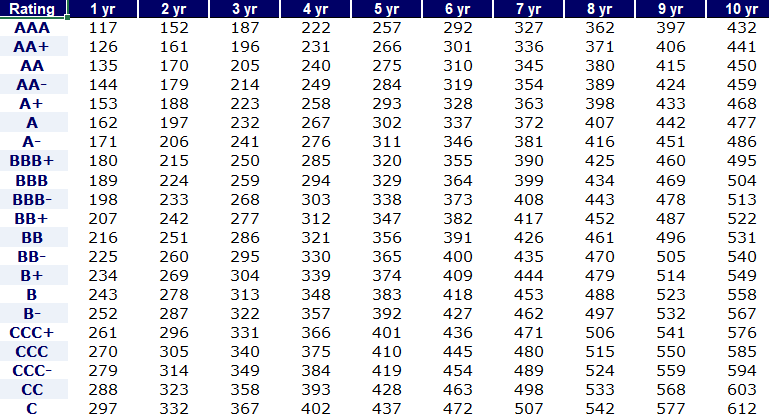

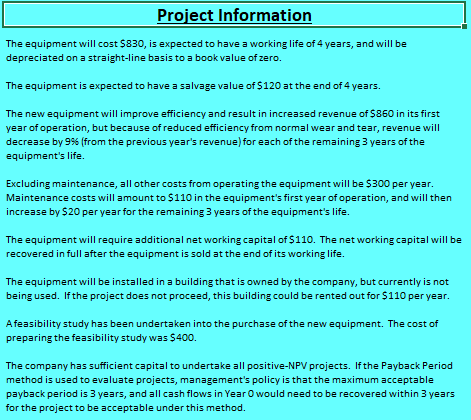

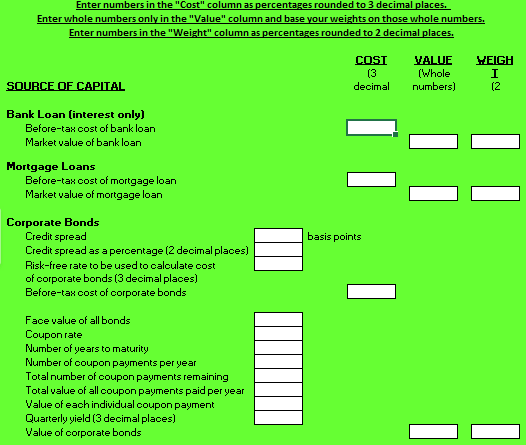

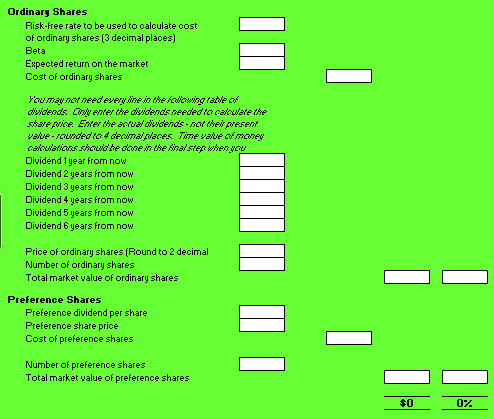

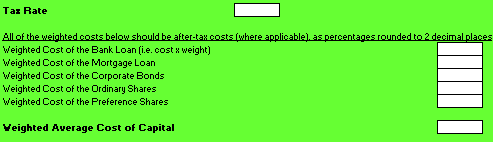

FINIFOF - FUNDAMENTALS OF FINANCE - ASSIGNMENT Geelong Manufacturing Company Ltd Balance Sheet as at 31/12/20 ASSETS Notes 110 Cash Accounts Receivable Inventory Property, plant & equipment 130 180 600 1,130 LIABILITIES Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds 1 2 3 240 500 310 Total Assets 2,040 1,160 Total liabilities SHAREHOLDERS' EQUITY Ordinary shares 4 Preference Shares 5 Retained earnings Total shareholders' equity Total liabilities and shareholders' e. 410 210 260 880 2,040 Notes 1. The interest rate on the bank loan is 9.9% p.a. 2. The interest rate on the mortgage loan is 5.3% p.a. 3. The corporate bonds have a credit rating of A+ and have 3 years to maturity. They make quarterly coupon payments at a coupon rate of 9p.a. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.9. They have just paid a dividend of $0.05. The dividend is expected to grow at a rate of 8% p.a. for the next 3 years, and after that it will grow at a constant rate of 2% p.a. in perpetuity. 5. The preference shares have a par value of $1each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.11 and they are currently trading for $1.16. 6. The expected return on the market is 7.4%. 1 yr 4 6 yr 7 yr 8 10 yr Rating AA+ AA- A+ A - BBB+ BBB- BB+ BB- + B - CCC+ CCC- 117 126 135 144 153 162 171 180 189 198 207 216 225 234 243 252 261 270 279 288 297 2 yr 152 161 170 179 188 197 206 215 224 233 242 251 260 269 278 287 296 305 314 323 332 187 196 205 214 223 232 241 250 259 268 277 286 295 304 313 322 331 340 349 358 367 222 231 240 249 258 267 276 285 294 303 312 321 330 339 348 357 366 375 384 393 402 5 yr 257 266 275 284 293 302 311 320 329 338 347 356 365 374 383 392 401 410 419 428 437 292 301 310 319 328 337 346 355 364 373 382 391 400 409 418 427 436 445 454 463 472 327 336 345 354 363 372 381 390 399 408 417 426 435 444 453 462 471 480 489 498 507 362 371 380 389 398 407 416 425 434 443 452 461 470 479 488 497 506 515 524 533 542 9 yr 397 406 415 424 433 442 451 460 469 478 487 496 505 514 523 532 541 550 559 568 577 432 441 450 459 468 477 486 495 504 513 522 531 540 549 558 567 576 585 594 603 612 Project Information The equipment will cost $830, is expected to have a working life of 4 years, and will be depreciated on a straight-line basis to a book value of zero. The equipment is expected to have a salvage value of $120 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $860 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 9% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $300 per year. Maintenance costs will amount to $110 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional networking capital of $110. The networking capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $110 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $400. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year Owould need to be recovered within 3 years for the project to be acceptable under this method. Enter numbers in the "Cost" column as percentages rounded to 3 decimal places. Enter whole numbers only in the "Value" column and base your weights on those whole numbers. Enter numbers in the "Weight" column as percentages rounded to 2 decimal places. COST (3 decimal VALUE (Whole numbers) WEIGH I (2 SOURCE OF CAPITAL Bank Loan (interest only) Before-tax cost of bank loan Market value of bank loan Mortgage Loans Before-tax cost of mortgage loan Market value of mortgage loan basis points Corporate Bonds Credit spread Credit spread as a percentage (2 decimal places) Risk-free rate to be used to calculate cost of corporate bonds (3 decimal places) Before-tax cost of corporate bonds Face value of all bonds Coupon rate Number of years to maturity Number of coupon payments per year Total number of coupon payments remaining Total value of all coupon payments paid per year Value of each individual coupon payment Quarterly yield (3 decimal places) Value of corporate bonds Ordinary Shares Risk-free rate to be used to calculate cost of ordinary shares (3 decimal places) Beta Expected return on the market Cost of ordinary shares You may not feed every time in the following father duidends Cowy enter the dividends needed to cause the staregoice. Enter the avaldwidend's-Dar the wesen mate - reaunced tea a decoratoes Time Paste TTEN caravarticussherawi the done in the final ster of the NCTLY Dividend 1 year from now Dividend 2 years from now Dividend 3 years from now Dividend 4 years from now Dividend 5 years from now Dividend 6 years from now Price of ordinary shares (Round to 2 decimal Number of ordinary shares Total market value of ordinary shares Preference Shares Preference dividend per share Preference share price Cost of preference shares Number of preference shares Total market value of preference shares $0 07 Tax Rate All of the weighted costs below should be after-tax costs (where applicable) as percentages founded to 2 decimal places Weighted Cost of the Bank Loan (i.e.cost x weight) Weighted Cost of the Mortgage Loan Weighted Cost of the Corporate Bonds Weighted Cost of the Ordinary Shares Weighted Cost of the Preference Shares Veighted Average Cost of Capital O FINIFOF - FUNDAMENTALS OF FINANCE - ASSIGNMENT Geelong Manufacturing Company Ltd Balance Sheet as at 31/12/20 ASSETS Notes 110 Cash Accounts Receivable Inventory Property, plant & equipment 130 180 600 1,130 LIABILITIES Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds 1 2 3 240 500 310 Total Assets 2,040 1,160 Total liabilities SHAREHOLDERS' EQUITY Ordinary shares 4 Preference Shares 5 Retained earnings Total shareholders' equity Total liabilities and shareholders' e. 410 210 260 880 2,040 Notes 1. The interest rate on the bank loan is 9.9% p.a. 2. The interest rate on the mortgage loan is 5.3% p.a. 3. The corporate bonds have a credit rating of A+ and have 3 years to maturity. They make quarterly coupon payments at a coupon rate of 9p.a. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.9. They have just paid a dividend of $0.05. The dividend is expected to grow at a rate of 8% p.a. for the next 3 years, and after that it will grow at a constant rate of 2% p.a. in perpetuity. 5. The preference shares have a par value of $1each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.11 and they are currently trading for $1.16. 6. The expected return on the market is 7.4%. 1 yr 4 6 yr 7 yr 8 10 yr Rating AA+ AA- A+ A - BBB+ BBB- BB+ BB- + B - CCC+ CCC- 117 126 135 144 153 162 171 180 189 198 207 216 225 234 243 252 261 270 279 288 297 2 yr 152 161 170 179 188 197 206 215 224 233 242 251 260 269 278 287 296 305 314 323 332 187 196 205 214 223 232 241 250 259 268 277 286 295 304 313 322 331 340 349 358 367 222 231 240 249 258 267 276 285 294 303 312 321 330 339 348 357 366 375 384 393 402 5 yr 257 266 275 284 293 302 311 320 329 338 347 356 365 374 383 392 401 410 419 428 437 292 301 310 319 328 337 346 355 364 373 382 391 400 409 418 427 436 445 454 463 472 327 336 345 354 363 372 381 390 399 408 417 426 435 444 453 462 471 480 489 498 507 362 371 380 389 398 407 416 425 434 443 452 461 470 479 488 497 506 515 524 533 542 9 yr 397 406 415 424 433 442 451 460 469 478 487 496 505 514 523 532 541 550 559 568 577 432 441 450 459 468 477 486 495 504 513 522 531 540 549 558 567 576 585 594 603 612 Project Information The equipment will cost $830, is expected to have a working life of 4 years, and will be depreciated on a straight-line basis to a book value of zero. The equipment is expected to have a salvage value of $120 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $860 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 9% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $300 per year. Maintenance costs will amount to $110 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional networking capital of $110. The networking capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $110 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $400. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year Owould need to be recovered within 3 years for the project to be acceptable under this method. Enter numbers in the "Cost" column as percentages rounded to 3 decimal places. Enter whole numbers only in the "Value" column and base your weights on those whole numbers. Enter numbers in the "Weight" column as percentages rounded to 2 decimal places. COST (3 decimal VALUE (Whole numbers) WEIGH I (2 SOURCE OF CAPITAL Bank Loan (interest only) Before-tax cost of bank loan Market value of bank loan Mortgage Loans Before-tax cost of mortgage loan Market value of mortgage loan basis points Corporate Bonds Credit spread Credit spread as a percentage (2 decimal places) Risk-free rate to be used to calculate cost of corporate bonds (3 decimal places) Before-tax cost of corporate bonds Face value of all bonds Coupon rate Number of years to maturity Number of coupon payments per year Total number of coupon payments remaining Total value of all coupon payments paid per year Value of each individual coupon payment Quarterly yield (3 decimal places) Value of corporate bonds Ordinary Shares Risk-free rate to be used to calculate cost of ordinary shares (3 decimal places) Beta Expected return on the market Cost of ordinary shares You may not feed every time in the following father duidends Cowy enter the dividends needed to cause the staregoice. Enter the avaldwidend's-Dar the wesen mate - reaunced tea a decoratoes Time Paste TTEN caravarticussherawi the done in the final ster of the NCTLY Dividend 1 year from now Dividend 2 years from now Dividend 3 years from now Dividend 4 years from now Dividend 5 years from now Dividend 6 years from now Price of ordinary shares (Round to 2 decimal Number of ordinary shares Total market value of ordinary shares Preference Shares Preference dividend per share Preference share price Cost of preference shares Number of preference shares Total market value of preference shares $0 07 Tax Rate All of the weighted costs below should be after-tax costs (where applicable) as percentages founded to 2 decimal places Weighted Cost of the Bank Loan (i.e.cost x weight) Weighted Cost of the Mortgage Loan Weighted Cost of the Corporate Bonds Weighted Cost of the Ordinary Shares Weighted Cost of the Preference Shares Veighted Average Cost of Capital O