Finish all please

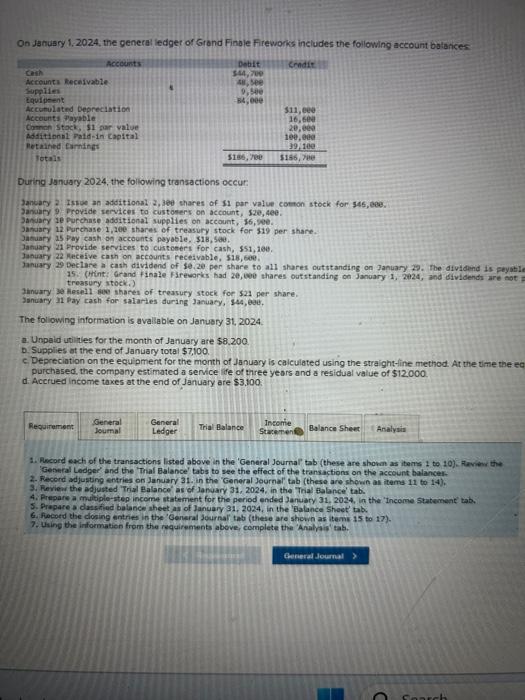

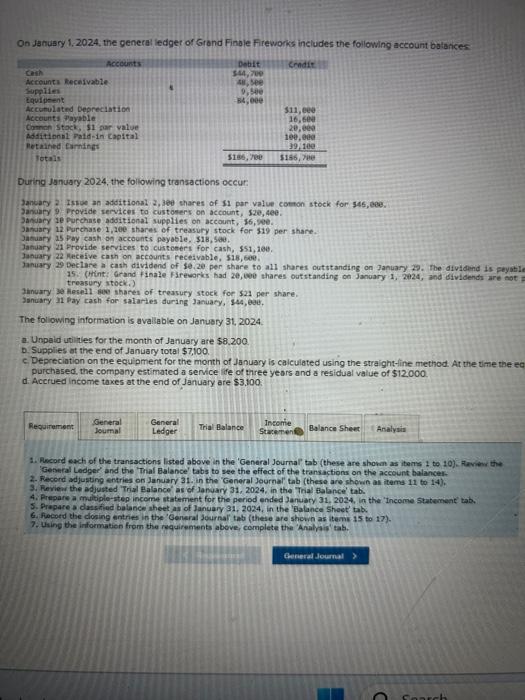

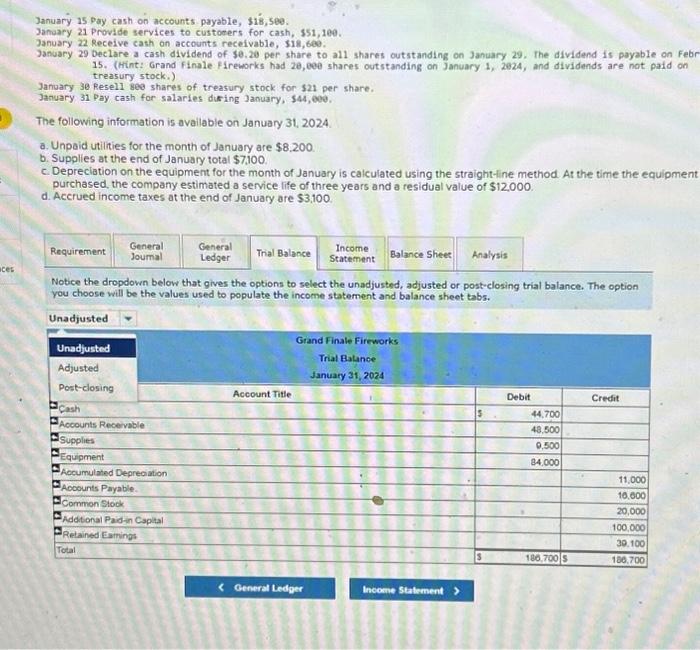

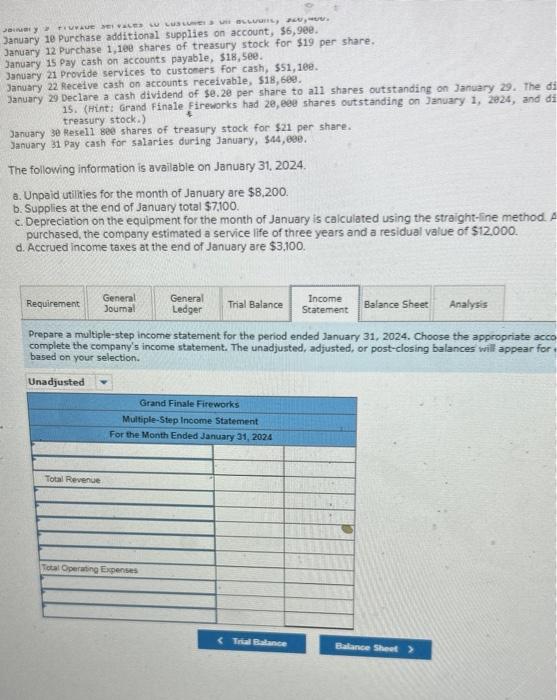

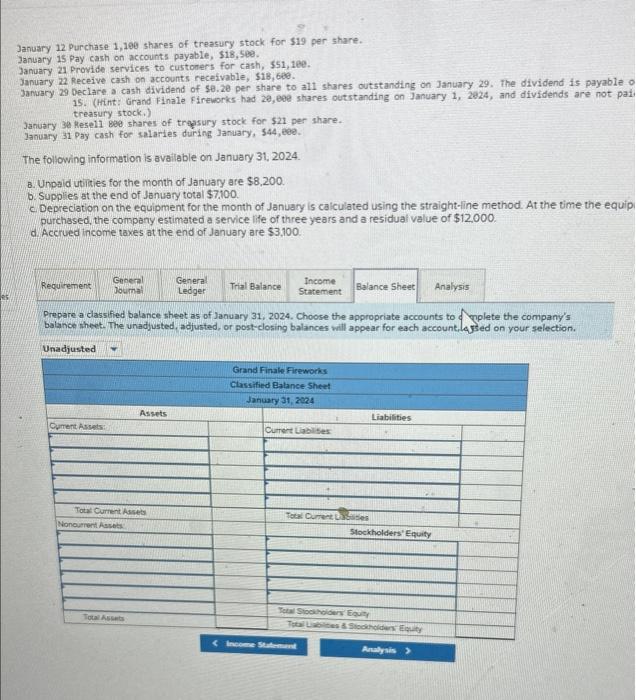

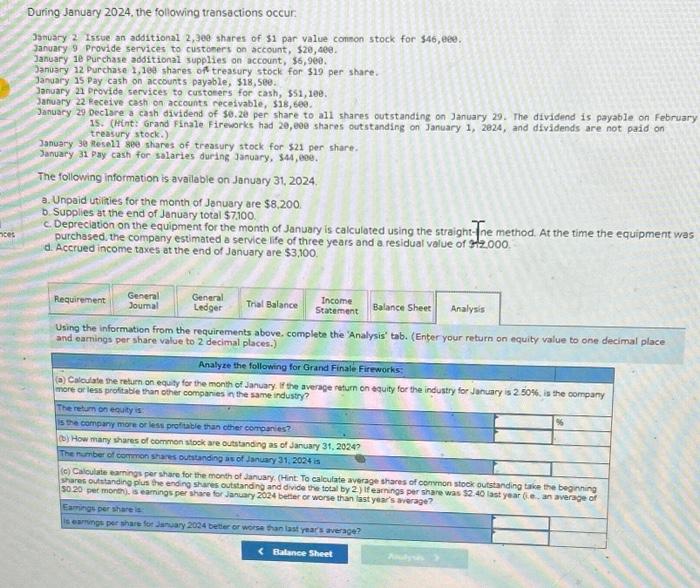

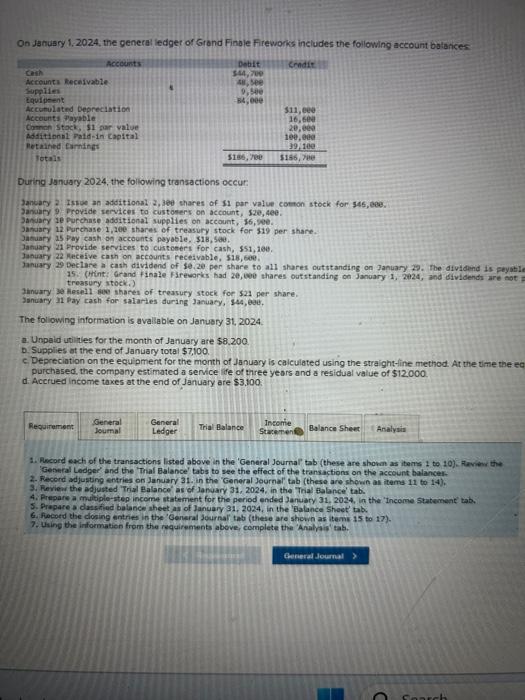

On Janusy 1,2024, the general iedger of Grand Finole Fireworks includes the following account balances: During January 2024, the following transactions occur: Javary 2 Istue an additional 2 , 3ee shares of 31 par value cotnon stock for 545 , eae, 3anary 9 irovide services to custosers on account, 520,4ee. 3 andary 1e perchase additional supplies on account, 56 ; see. Jandary 12 purchase 1,200 shares of treasury stock for $19 per share. Jabuary is pay cash on accounts peyable, 318 , Sae. Jahuary 21 Provide secvices to custoners for cash, 551,190. Janury 22 neceive cash on accounts receivable, 515,600 . anuary 29 Declare a cash dividend of 50.20 per share to al1 shares outttanding on January 29 . the dividend is peyatla 15. (Hint: Grand inale Fireworks had 2e, wee thares outstanding on January 1 , 2 at24, and dividends are aot treasury stock.) Hinuary 3e fesell dove sharet of treasury stock for $21 per share. Jonuary 11 fay cash for salarles during January, 144 , eae, The following information is avallable on Janusry 31,2024. 2. Unpaid utilies for the month of January are $8.200 b. Supplies at the end of January total $7,100. c. Deprecintion on the equ'pment for the month of January is calculated using the straight-line method. At the time the ec purchased, the company estimated a service lfe of tiree years and a residual value of $12000. d. Accrued income taxes at the end of January are $3,100 2. Record each of the transsctions listed above' in the 'General Journaf tab (these are showan as itens 1 to 10), Fiviewr the 'General Ledger and the 'Thal Balance' tabs to see the effect of the transactions on the account balancek- 2. Fecord adjusting entries on January 31 . in the "General Journal' tabl (these are shewn ar iterns 11 to 14 ). 3. Revieur the adjusted 'Trial Balance' as of lanuary 31, 2024, in the "Tral Balance' tab. 4. Prepare a mastiple-atep income wtatement for the period ended January 31, 2024, in the 'Income statement tab, 5. Prapare s dassified balance ateet as of January 31, 2024, in the 'Ealance Sheet' tab. 6. Focoed the dosing sintres in the 'General Jdurnal tab (these are shown as items 15 to 17 ). 7. Uhing the information from the requiremsents abeve, cormplete the 'Aralysis' tab. January 15 pay cash on accounts-payable, 318 , 560. January 21 Provide services to custorers for cash, 551,109. January 22 Recelve cash on accounts receivable, $18,600. January 29 beclare a cash dividend of 50.20 per share to al1 shares outstanding on January 29 . The dividend is payable on Febr 15. (Hint: Grand finale Fireworks had 20 , eee shares outstanding on January 1 , 2924, and dividends are not paid on treasury stock. ) January 36 Resel1 800 shares of treasury stock for 321 per share. January 31 Pay cash for salaries diring lanuary, $44,000. The following information is avallable on January 31,2024. a. Unpaid utilities for the month of January are $8,200. b. Supplies at the end of January total $7,100. c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipmen purchased, the company estimated a service life of three years and a residual value of $12,000. d. Accrued income taxes at the end of January are $3,100. Notice the dropdown below that gives the options to select the unadjusted, adjusted or post-closing trial balance. The option you choose will be the values used to populate the income statement and balance sheet tabs. January 10 Purchase additional supplies on account, $6,96e. January 12 Purchase 1,16e shares of treasury stock for $19 per share. January is pay cash on accounts payable, $18, see. January 21 provide services to customers for cash, $51,16e. January 22 Receive cash on accounts receivable, $18,669. January 29 Declare a cash dividend of $0.20 per share to a11 shares outstanding on January 29 . The di 15. (Hint: Grand Finale Fireworks had 20,eee shares outstanding on January 1, 2024, and di treasury stock.) January se Resell 800 shares of treasury stock for $21 per share. January 31 pay cash for salaries during January, s44, 69e. The following information is available on January 31, 2024. a. Unpaid utilities for the month of January are $8,200. b. Supplies at the end of January total $7,100. c. Depreciation on the equipment for the month of January is caiculated using the straight-ine method. A purchased, the company estimated a service life of three years and a residual value of $12,000. d. Accrued income taxes at the end of January are $3,100. Prepare a multiple-step income statement for the period ended January 31, 2024. Choose the appropriate acco complete the company's income statement. The unadjusted, adjusted, or post-closing balances will appear for based on your selection. January 12 Purchase 1,100 shares of treasury stock for $19 per share. January 15 Pay cash on accounts payable, 518,58e. Januery 21 Provide services to custoners for cash, 551,16e. January 22 Receive cash on accounts receivable, $18,6e. January 29 Declare a cash dividend of 50.20 per share to a11 shares outstanding on January 29 . The dividend is payable 15. (Hint: Grand Finale Fireworks had 2e, eee shares outstanding on January 1,2024 , and dividends are not pai treasury stock, January 3 a liesel1 bee shares of tragsury stock for $21 per share. January 31 Pay cash for salaries during lanuary, 544 , eee. The following information is available on January 31,2024. B. Unpaid utirities for the month of January are $8,200. b. Supplies at the end of January total $7100. c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equip purchased, the company estimated a service life of three years and a residual value of $12000. d. Accrued income taxes at the end of January are $3,100. Prepare a classified balance sheet as of January 31, 2024. Choose the appropriate accounts to ofplete the company's balance theet. The unadjusted, adjusted, or post-closing balances will appear for each account, lajsed on your selection. During January 2024, the following transactions occur: January 2 Issue an additional 2,309 shares of $1 par value connon stock for 346,009. January 9 Provide services to customers on account, $26,409. January 1e Purchase additional supplies on account, $6,960. January 12 Purchase 1,10 shares of treasury stock for $19 per share. Jandary 15 pay cash on accounts payable, $18,580. January 21 Provide services to custoeers for cash, $51,10e. Jaruary 22 keceive cash on accounts recelvable, $18,609. January 29 Declare a cash dividend of $0.23 per share to all shares outstanding on Janiary 29 . The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 20 , eve shares outstanding on January 1 , 2e24, and dividends are not paid on treasury stock.) January 30 Resell 800 shanes of treasury stock for $21 per share. January 31 pay cash for salaries during January, $44, , 00 . The following information is available on January 31, 2024. a. Unpaid utilities for the month of January are $8,200. b. Supplies at the end of January total $7,100 c. Depreciation on the equipment for the month of January is calculated using the straight- ne method. At the time the equipment was purchased. the company estimated a service life of three years and a residual value of $72000. d. Accrued income taxes at the end of January are $3,100. Using the information from the requirements above. complete the 'Analysis' tab. (Enter your return on equity value to one decimal place and eamings per share value to 2 decimal places.) On Janusy 1,2024, the general iedger of Grand Finole Fireworks includes the following account balances: During January 2024, the following transactions occur: Javary 2 Istue an additional 2 , 3ee shares of 31 par value cotnon stock for 545 , eae, 3anary 9 irovide services to custosers on account, 520,4ee. 3 andary 1e perchase additional supplies on account, 56 ; see. Jandary 12 purchase 1,200 shares of treasury stock for $19 per share. Jabuary is pay cash on accounts peyable, 318 , Sae. Jahuary 21 Provide secvices to custoners for cash, 551,190. Janury 22 neceive cash on accounts receivable, 515,600 . anuary 29 Declare a cash dividend of 50.20 per share to al1 shares outttanding on January 29 . the dividend is peyatla 15. (Hint: Grand inale Fireworks had 2e, wee thares outstanding on January 1 , 2 at24, and dividends are aot treasury stock.) Hinuary 3e fesell dove sharet of treasury stock for $21 per share. Jonuary 11 fay cash for salarles during January, 144 , eae, The following information is avallable on Janusry 31,2024. 2. Unpaid utilies for the month of January are $8.200 b. Supplies at the end of January total $7,100. c. Deprecintion on the equ'pment for the month of January is calculated using the straight-line method. At the time the ec purchased, the company estimated a service lfe of tiree years and a residual value of $12000. d. Accrued income taxes at the end of January are $3,100 2. Record each of the transsctions listed above' in the 'General Journaf tab (these are showan as itens 1 to 10), Fiviewr the 'General Ledger and the 'Thal Balance' tabs to see the effect of the transactions on the account balancek- 2. Fecord adjusting entries on January 31 . in the "General Journal' tabl (these are shewn ar iterns 11 to 14 ). 3. Revieur the adjusted 'Trial Balance' as of lanuary 31, 2024, in the "Tral Balance' tab. 4. Prepare a mastiple-atep income wtatement for the period ended January 31, 2024, in the 'Income statement tab, 5. Prapare s dassified balance ateet as of January 31, 2024, in the 'Ealance Sheet' tab. 6. Focoed the dosing sintres in the 'General Jdurnal tab (these are shown as items 15 to 17 ). 7. Uhing the information from the requiremsents abeve, cormplete the 'Aralysis' tab. January 15 pay cash on accounts-payable, 318 , 560. January 21 Provide services to custorers for cash, 551,109. January 22 Recelve cash on accounts receivable, $18,600. January 29 beclare a cash dividend of 50.20 per share to al1 shares outstanding on January 29 . The dividend is payable on Febr 15. (Hint: Grand finale Fireworks had 20 , eee shares outstanding on January 1 , 2924, and dividends are not paid on treasury stock. ) January 36 Resel1 800 shares of treasury stock for 321 per share. January 31 Pay cash for salaries diring lanuary, $44,000. The following information is avallable on January 31,2024. a. Unpaid utilities for the month of January are $8,200. b. Supplies at the end of January total $7,100. c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equipmen purchased, the company estimated a service life of three years and a residual value of $12,000. d. Accrued income taxes at the end of January are $3,100. Notice the dropdown below that gives the options to select the unadjusted, adjusted or post-closing trial balance. The option you choose will be the values used to populate the income statement and balance sheet tabs. January 10 Purchase additional supplies on account, $6,96e. January 12 Purchase 1,16e shares of treasury stock for $19 per share. January is pay cash on accounts payable, $18, see. January 21 provide services to customers for cash, $51,16e. January 22 Receive cash on accounts receivable, $18,669. January 29 Declare a cash dividend of $0.20 per share to a11 shares outstanding on January 29 . The di 15. (Hint: Grand Finale Fireworks had 20,eee shares outstanding on January 1, 2024, and di treasury stock.) January se Resell 800 shares of treasury stock for $21 per share. January 31 pay cash for salaries during January, s44, 69e. The following information is available on January 31, 2024. a. Unpaid utilities for the month of January are $8,200. b. Supplies at the end of January total $7,100. c. Depreciation on the equipment for the month of January is caiculated using the straight-ine method. A purchased, the company estimated a service life of three years and a residual value of $12,000. d. Accrued income taxes at the end of January are $3,100. Prepare a multiple-step income statement for the period ended January 31, 2024. Choose the appropriate acco complete the company's income statement. The unadjusted, adjusted, or post-closing balances will appear for based on your selection. January 12 Purchase 1,100 shares of treasury stock for $19 per share. January 15 Pay cash on accounts payable, 518,58e. Januery 21 Provide services to custoners for cash, 551,16e. January 22 Receive cash on accounts receivable, $18,6e. January 29 Declare a cash dividend of 50.20 per share to a11 shares outstanding on January 29 . The dividend is payable 15. (Hint: Grand Finale Fireworks had 2e, eee shares outstanding on January 1,2024 , and dividends are not pai treasury stock, January 3 a liesel1 bee shares of tragsury stock for $21 per share. January 31 Pay cash for salaries during lanuary, 544 , eee. The following information is available on January 31,2024. B. Unpaid utirities for the month of January are $8,200. b. Supplies at the end of January total $7100. c. Depreciation on the equipment for the month of January is calculated using the straight-line method. At the time the equip purchased, the company estimated a service life of three years and a residual value of $12000. d. Accrued income taxes at the end of January are $3,100. Prepare a classified balance sheet as of January 31, 2024. Choose the appropriate accounts to ofplete the company's balance theet. The unadjusted, adjusted, or post-closing balances will appear for each account, lajsed on your selection. During January 2024, the following transactions occur: January 2 Issue an additional 2,309 shares of $1 par value connon stock for 346,009. January 9 Provide services to customers on account, $26,409. January 1e Purchase additional supplies on account, $6,960. January 12 Purchase 1,10 shares of treasury stock for $19 per share. Jandary 15 pay cash on accounts payable, $18,580. January 21 Provide services to custoeers for cash, $51,10e. Jaruary 22 keceive cash on accounts recelvable, $18,609. January 29 Declare a cash dividend of $0.23 per share to all shares outstanding on Janiary 29 . The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 20 , eve shares outstanding on January 1 , 2e24, and dividends are not paid on treasury stock.) January 30 Resell 800 shanes of treasury stock for $21 per share. January 31 pay cash for salaries during January, $44, , 00 . The following information is available on January 31, 2024. a. Unpaid utilities for the month of January are $8,200. b. Supplies at the end of January total $7,100 c. Depreciation on the equipment for the month of January is calculated using the straight- ne method. At the time the equipment was purchased. the company estimated a service life of three years and a residual value of $72000. d. Accrued income taxes at the end of January are $3,100. Using the information from the requirements above. complete the 'Analysis' tab. (Enter your return on equity value to one decimal place and eamings per share value to 2 decimal places.)