Answered step by step

Verified Expert Solution

Question

1 Approved Answer

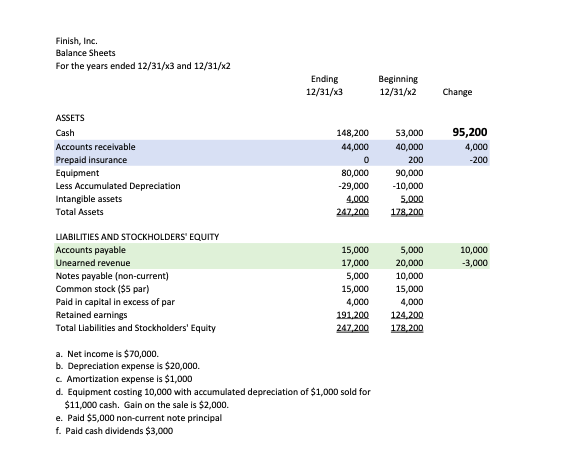

Finish, Inc. Balance Sheets For the years ended 12/31/x3 and 12/31/x2 Ending Beginning 12/31/x3 12/31/x2 Change ASSETS Cash 148,200 53,000 95,200 Accounts receivable 44,000

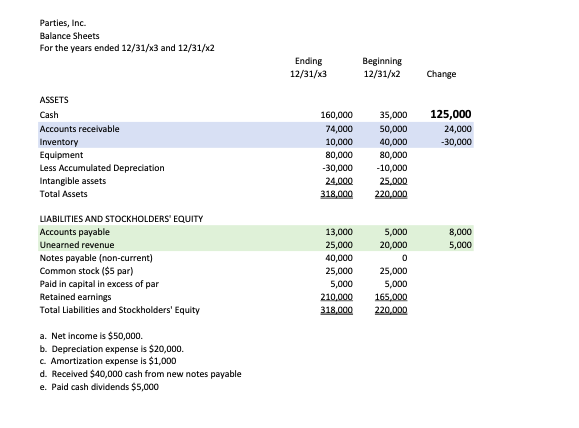

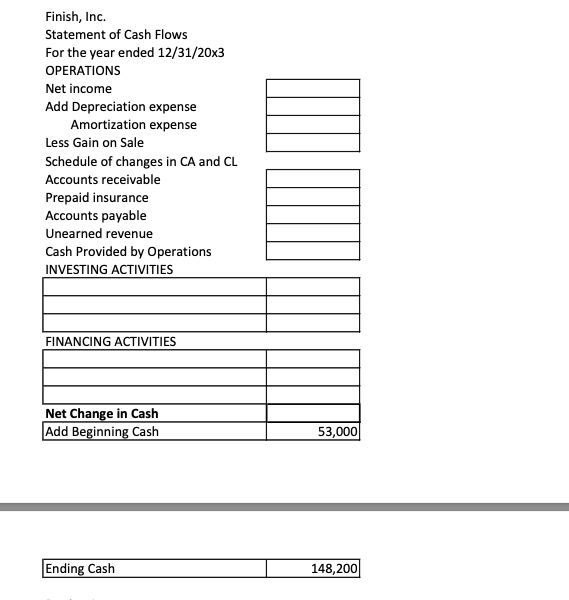

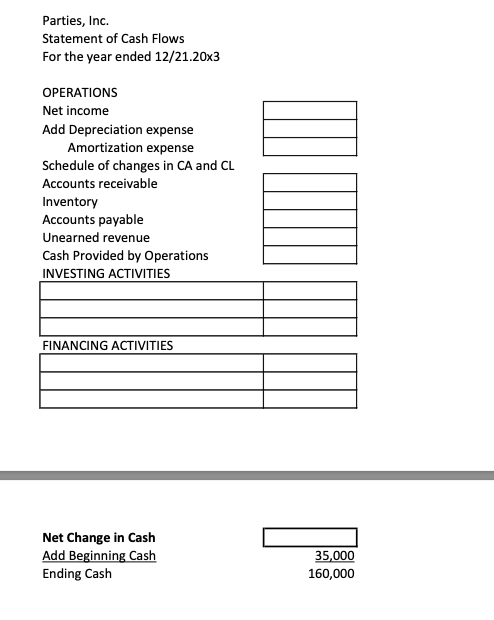

Finish, Inc. Balance Sheets For the years ended 12/31/x3 and 12/31/x2 Ending Beginning 12/31/x3 12/31/x2 Change ASSETS Cash 148,200 53,000 95,200 Accounts receivable 44,000 40,000 4,000 Prepaid insurance 0 200 -200 Equipment 80,000 90,000 Less Accumulated Depreciation -29,000 -10,000 Intangible assets 4,000 5,000 Total Assets 247,200 178,200 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable 15,000 5,000 10,000 Unearned revenue 17,000 20,000 -3,000 Notes payable (non-current) 5,000 10,000 Common stock ($5 par) 15,000 15,000 Paid in capital in excess of par 4,000 4,000 Retained earnings 191,200 124,200 Total Liabilities and Stockholders' Equity 247,200 178,200 a. Net income is $70,000. b. Depreciation expense is $20,000. c. Amortization expense is $1,000 d. Equipment costing 10,000 with accumulated depreciation of $1,000 sold for $11,000 cash. Gain on the sale is $2,000. e. Paid $5,000 non-current note principal f. Paid cash dividends $3,000 Parties, Inc. Balance Sheets For the years ended 12/31/x3 and 12/31/x2 Ending 12/31/x3 Beginning 12/31/x2 Change ASSETS Cash Accounts receivable Inventory Equipment Less Accumulated Depreciation Intangible assets Total Assets 160,000 35,000 125,000 74,000 50,000 24,000 10,000 40,000 -30,000 80,000 80,000 -30,000 -10,000 24,000 25,000 318,000 220,000 LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable 13,000 5,000 8,000 Unearned revenue 25,000 20,000 5,000 Notes payable (non-current) 40,000 0 Common stock ($5 par) 25,000 25,000 Paid in capital in excess of par Retained earnings Total Liabilities and Stockholders' Equity a. Net income is $50,000. 5,000 5,000 210,000 165,000 318,000 220,000 b. Depreciation expense is $20,000. c. Amortization expense is $1,000 d. Received $40,000 cash from new notes payable e. Paid cash dividends $5,000 Finish, Inc. Statement of Cash Flows For the year ended 12/31/20x3 OPERATIONS Net income Add Depreciation expense Amortization expense Less Gain on Sale Schedule of changes in CA and CL Accounts receivable Prepaid insurance Accounts payable Unearned revenue Cash Provided by Operations INVESTING ACTIVITIES FINANCING ACTIVITIES Net Change in Cash Add Beginning Cash 53,000 Ending Cash 148,200 Parties, Inc. Statement of Cash Flows For the year ended 12/21.20x3 OPERATIONS Net income Add Depreciation expense Amortization expense Schedule of changes in CA and CL Accounts receivable Inventory Accounts payable Unearned revenue Cash Provided by Operations INVESTING ACTIVITIES FINANCING ACTIVITIES Net Change in Cash Add Beginning Cash Ending Cash 35,000 160,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started