Answered step by step

Verified Expert Solution

Question

1 Approved Answer

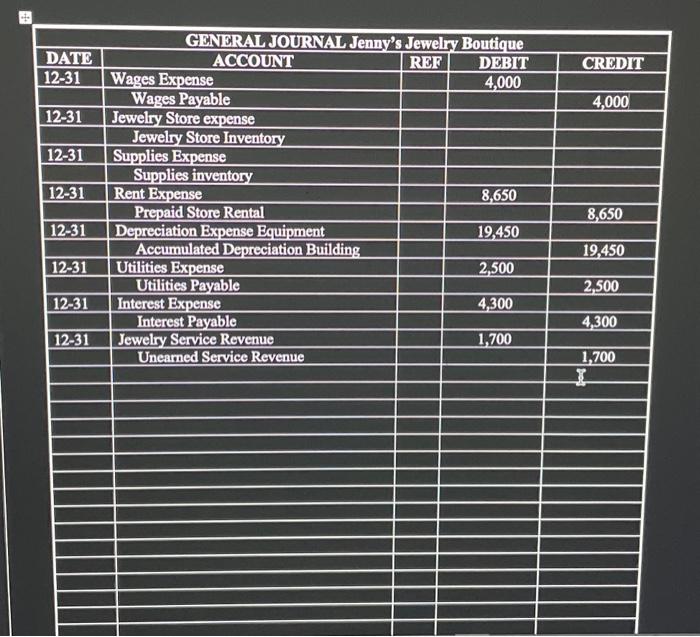

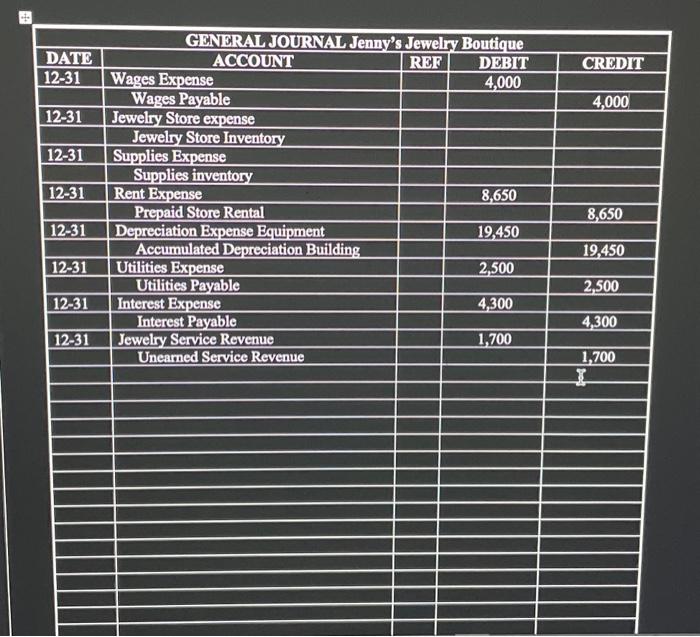

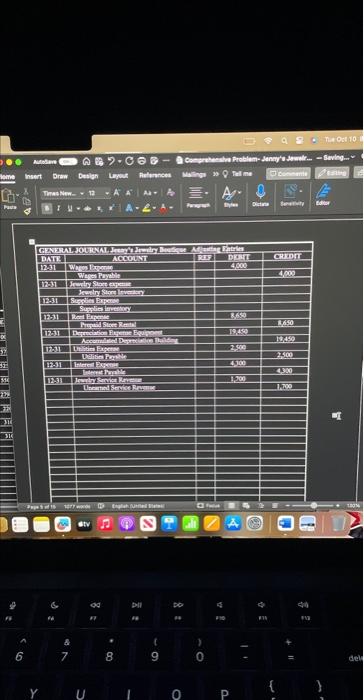

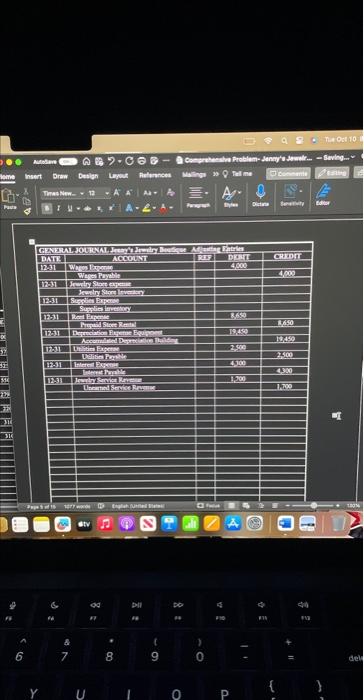

finish the general journal with the information provided in the picuters the adjusted balance is (adjusted entries in what i have) begin{tabular}{|c|c|c|c|c|} hline multicolumn{5}{|c|}{ GBNORAL

finish the general journal with the information provided in the picuters

the adjusted balance is (adjusted entries in what i have)

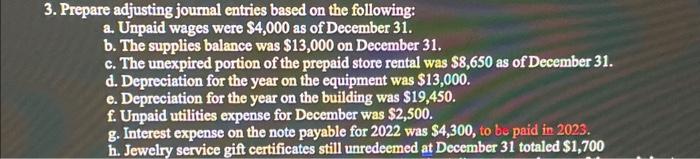

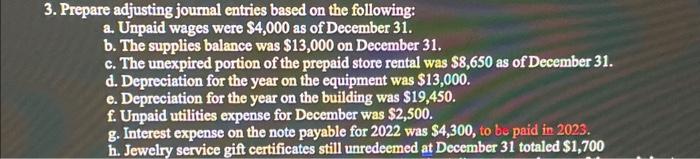

\begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ GBNORAL JOURNAL Jenny's Jewelry Boutique } \\ \hline DATE & ACCOUNT & REF & DMBT & CRDDT \\ \hline \multirow[t]{2}{*}{1231} & Wages Expense & & 4,000 & \\ \hline & Wages Payable & & & 4,000 \\ \hline \multirow[t]{2}{*}{1231} & Jeweliny Store expense & & & \\ \hline & Jewelry Store Inventory & & & \\ \hline \multirow[t]{2}{*}{1231} & Supplies Expense & & & \\ \hline & Supplies inventory & & & \\ \hline \multirow[t]{2}{*}{1231} & Rent Expense & & 8,650 & \\ \hline & Prepaid Store Rental & & & 8,650 \\ \hline \multirow[t]{2}{*}{1231} & Depreciation Expense Equipment & & 19,450 & \\ \hline & Accumulated Depreciation Building & & & 19,450 \\ \hline \multirow[t]{2}{*}{1231} & Utilities Expense & & 2,500 & \\ \hline & Utilities Payable & & & 2,500 \\ \hline \multirow[t]{2}{*}{ 12-31 } & Interest Expense & & 4,300 & \\ \hline & Interest Payable & & & 4,300 \\ \hline \multirow[t]{3}{*}{1231} & Jewelry Service Revenue & & 1,700 & \\ \hline & Uneamed Service Revenue & & & 1,700 \\ \hline & & & & 7 \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ GBNORAL JOURNAL Jenny's Jewelry Boutique } \\ \hline DATE & ACCOUNT & REF & DMBT & CRDDT \\ \hline \multirow[t]{2}{*}{1231} & Wages Expense & & 4,000 & \\ \hline & Wages Payable & & & 4,000 \\ \hline \multirow[t]{2}{*}{1231} & Jeweliny Store expense & & & \\ \hline & Jewelry Store Inventory & & & \\ \hline \multirow[t]{2}{*}{1231} & Supplies Expense & & & \\ \hline & Supplies inventory & & & \\ \hline \multirow[t]{2}{*}{1231} & Rent Expense & & 8,650 & \\ \hline & Prepaid Store Rental & & & 8,650 \\ \hline \multirow[t]{2}{*}{1231} & Depreciation Expense Equipment & & 19,450 & \\ \hline & Accumulated Depreciation Building & & & 19,450 \\ \hline \multirow[t]{2}{*}{1231} & Utilities Expense & & 2,500 & \\ \hline & Utilities Payable & & & 2,500 \\ \hline \multirow[t]{2}{*}{ 12-31 } & Interest Expense & & 4,300 & \\ \hline & Interest Payable & & & 4,300 \\ \hline \multirow[t]{3}{*}{1231} & Jewelry Service Revenue & & 1,700 & \\ \hline & Uneamed Service Revenue & & & 1,700 \\ \hline & & & & 7 \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} 3. Prepare adjusting joumal entries based on the following: a. Unpaid wages were $4,000 as of December 31 . b. The supplies balance was $13,000 on December 31 . c. The unexpired portion of the prepaid store rental was $8,650 as of December 31 . d. Depreciation for the year on the equipment was $13,000. e. Depreciation for the year on the building was $19,450. f. Unpaid utilities expense for December was $2,500. g. Interest expense on the note payable for 2022 was $4,300, to be paid in 202S. h. Jewelry service gift certificates still unredeemed at December 31 totaled $1,700 \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ GBNORAL JOURNAL Jenny's Jewelry Boutique } \\ \hline DATE & ACCOUNT & REF & DMBT & CRDDT \\ \hline \multirow[t]{2}{*}{1231} & Wages Expense & & 4,000 & \\ \hline & Wages Payable & & & 4,000 \\ \hline \multirow[t]{2}{*}{1231} & Jeweliny Store expense & & & \\ \hline & Jewelry Store Inventory & & & \\ \hline \multirow[t]{2}{*}{1231} & Supplies Expense & & & \\ \hline & Supplies inventory & & & \\ \hline \multirow[t]{2}{*}{1231} & Rent Expense & & 8,650 & \\ \hline & Prepaid Store Rental & & & 8,650 \\ \hline \multirow[t]{2}{*}{1231} & Depreciation Expense Equipment & & 19,450 & \\ \hline & Accumulated Depreciation Building & & & 19,450 \\ \hline \multirow[t]{2}{*}{1231} & Utilities Expense & & 2,500 & \\ \hline & Utilities Payable & & & 2,500 \\ \hline \multirow[t]{2}{*}{ 12-31 } & Interest Expense & & 4,300 & \\ \hline & Interest Payable & & & 4,300 \\ \hline \multirow[t]{3}{*}{1231} & Jewelry Service Revenue & & 1,700 & \\ \hline & Uneamed Service Revenue & & & 1,700 \\ \hline & & & & 7 \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ GBNORAL JOURNAL Jenny's Jewelry Boutique } \\ \hline DATE & ACCOUNT & REF & DMBT & CRDDT \\ \hline \multirow[t]{2}{*}{1231} & Wages Expense & & 4,000 & \\ \hline & Wages Payable & & & 4,000 \\ \hline \multirow[t]{2}{*}{1231} & Jeweliny Store expense & & & \\ \hline & Jewelry Store Inventory & & & \\ \hline \multirow[t]{2}{*}{1231} & Supplies Expense & & & \\ \hline & Supplies inventory & & & \\ \hline \multirow[t]{2}{*}{1231} & Rent Expense & & 8,650 & \\ \hline & Prepaid Store Rental & & & 8,650 \\ \hline \multirow[t]{2}{*}{1231} & Depreciation Expense Equipment & & 19,450 & \\ \hline & Accumulated Depreciation Building & & & 19,450 \\ \hline \multirow[t]{2}{*}{1231} & Utilities Expense & & 2,500 & \\ \hline & Utilities Payable & & & 2,500 \\ \hline \multirow[t]{2}{*}{ 12-31 } & Interest Expense & & 4,300 & \\ \hline & Interest Payable & & & 4,300 \\ \hline \multirow[t]{3}{*}{1231} & Jewelry Service Revenue & & 1,700 & \\ \hline & Uneamed Service Revenue & & & 1,700 \\ \hline & & & & 7 \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} 3. Prepare adjusting joumal entries based on the following: a. Unpaid wages were $4,000 as of December 31 . b. The supplies balance was $13,000 on December 31 . c. The unexpired portion of the prepaid store rental was $8,650 as of December 31 . d. Depreciation for the year on the equipment was $13,000. e. Depreciation for the year on the building was $19,450. f. Unpaid utilities expense for December was $2,500. g. Interest expense on the note payable for 2022 was $4,300, to be paid in 202S. h. Jewelry service gift certificates still unredeemed at December 31 totaled $1,700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started