Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finish the Problem Please: Download spreadsheet Ch 0 9 P 1 0 Build a Model - 3 3 6 a 8 5 . xlsx a

Finish the Problem Please: Download spreadsheet Ch P Build a Modelaxlsx

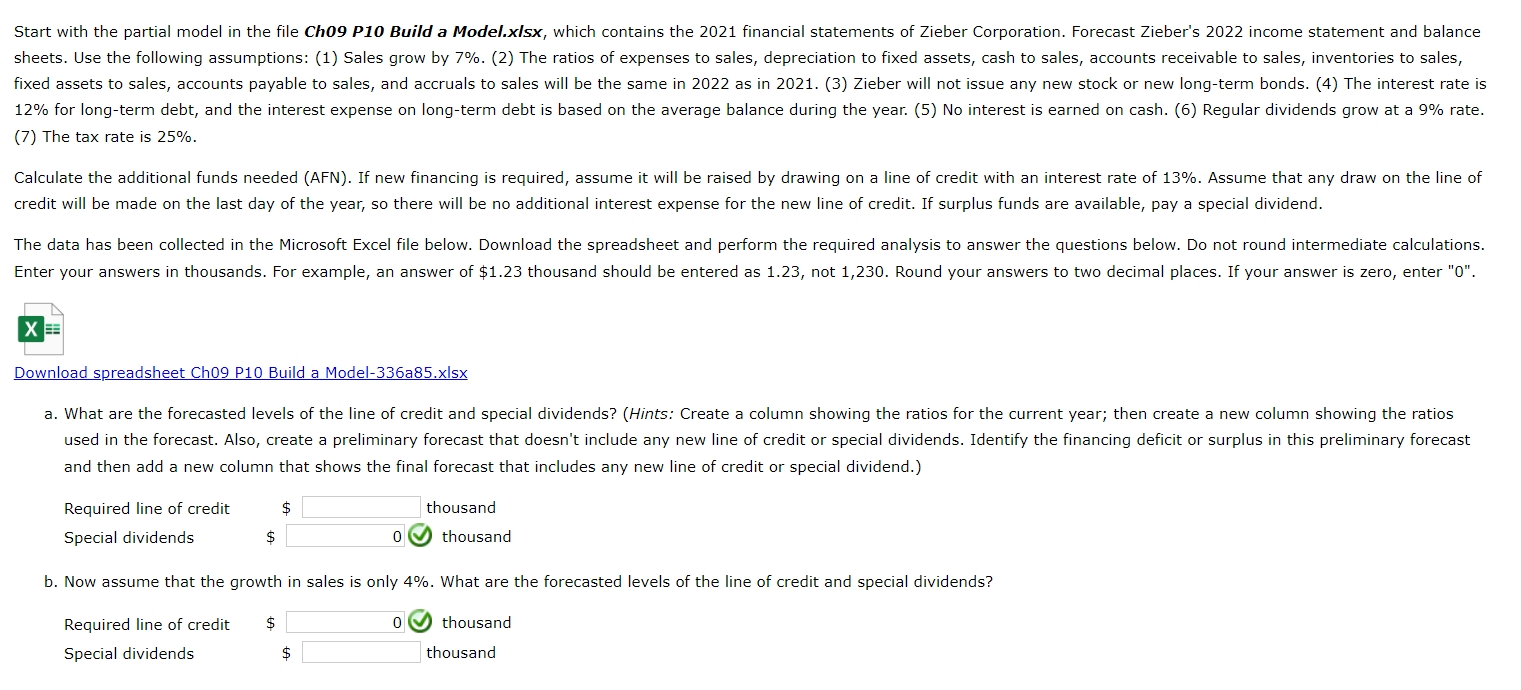

a What are the forecasted levels of the line of credit and special dividends? Hints: Create a column showing the ratios for the current year; then create a new column showing the ratios

used in the forecast. Also, create a preliminary forecast that doesn't include any new line of credit or special dividends. Identify the financing deficit or surplus in this preliminary forecast

and then add a new column that shows the final forecast that includes any new line of credit or special dividend.

Required line of credit

$

thousand

Special dividends

$

thousand

b Now assume that the growth in sales is only What are the forecasted levels of the line of credit and special dividends?

Required line of credit

$

thousand

Special dividends

$

thousand

Important Numbers provided from excel:

Sales growth rate Dividend growth rate Interest rate on longterm debt Interest rate on line of credit Tax rate a Determining the forecasted levels of the line of credit and special dividends Zeiber's Projected Financial Statements Thousands of Dollars Balance Sheets Assets: Cash $ Accounts receivable Inventories Total current assets $ Fixed assets Total assets $ Liabilities and equity Accounts payable $ Accruals Line of credit Total current liabilities $ Longterm debt Total liabilities $ Common stock Retained earnings Total common equity $ Total liabilities and equity $ Income Statements Sales $ Expenses excluding depr. & amort. Depreciation and amortization EBIT $ Interest expense on longterm debt Interest expense on line of credit EBT $ Taxes Net income $ Regular common dividends $ Special dividends Addition to retained earnings $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started