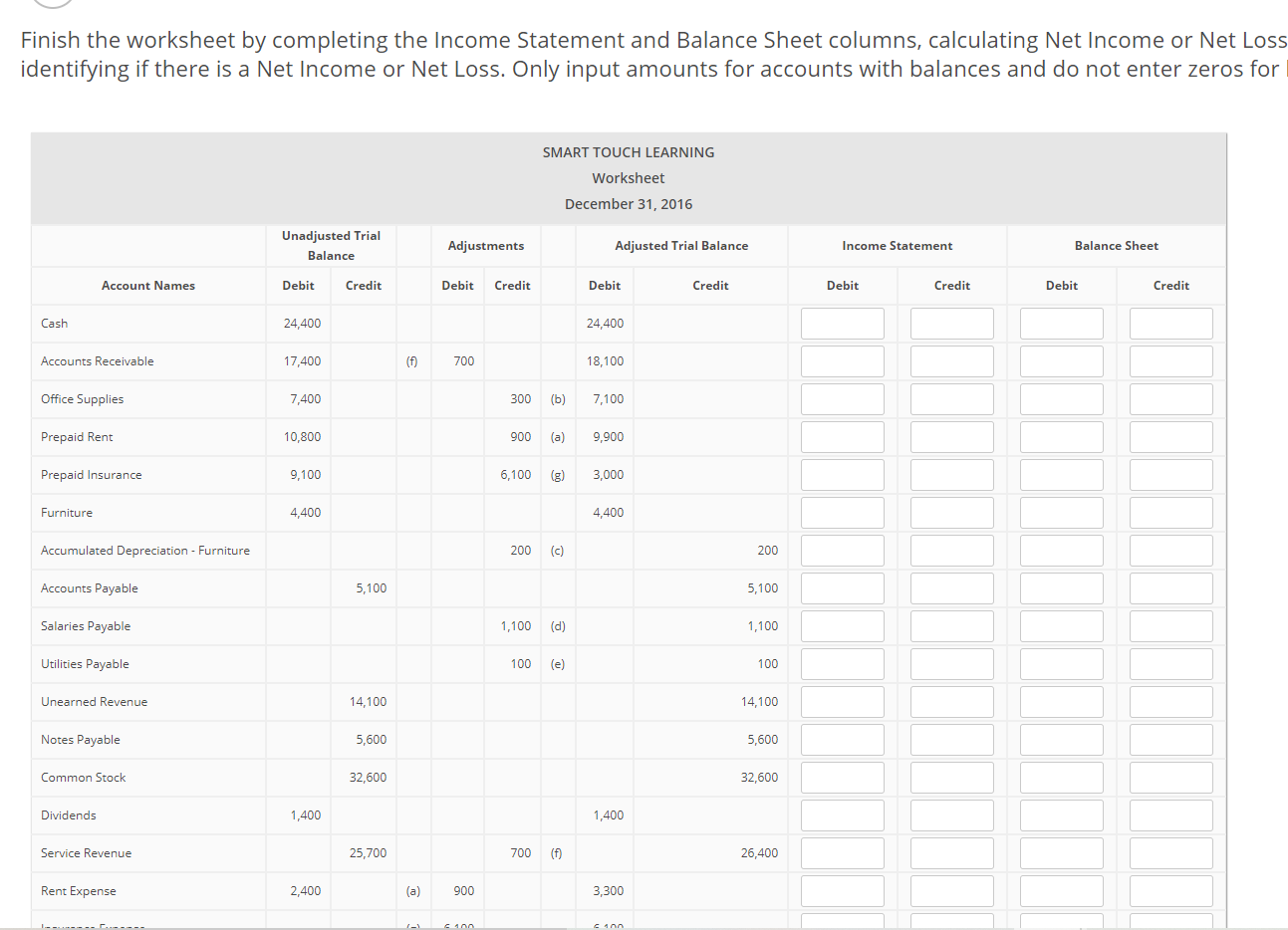

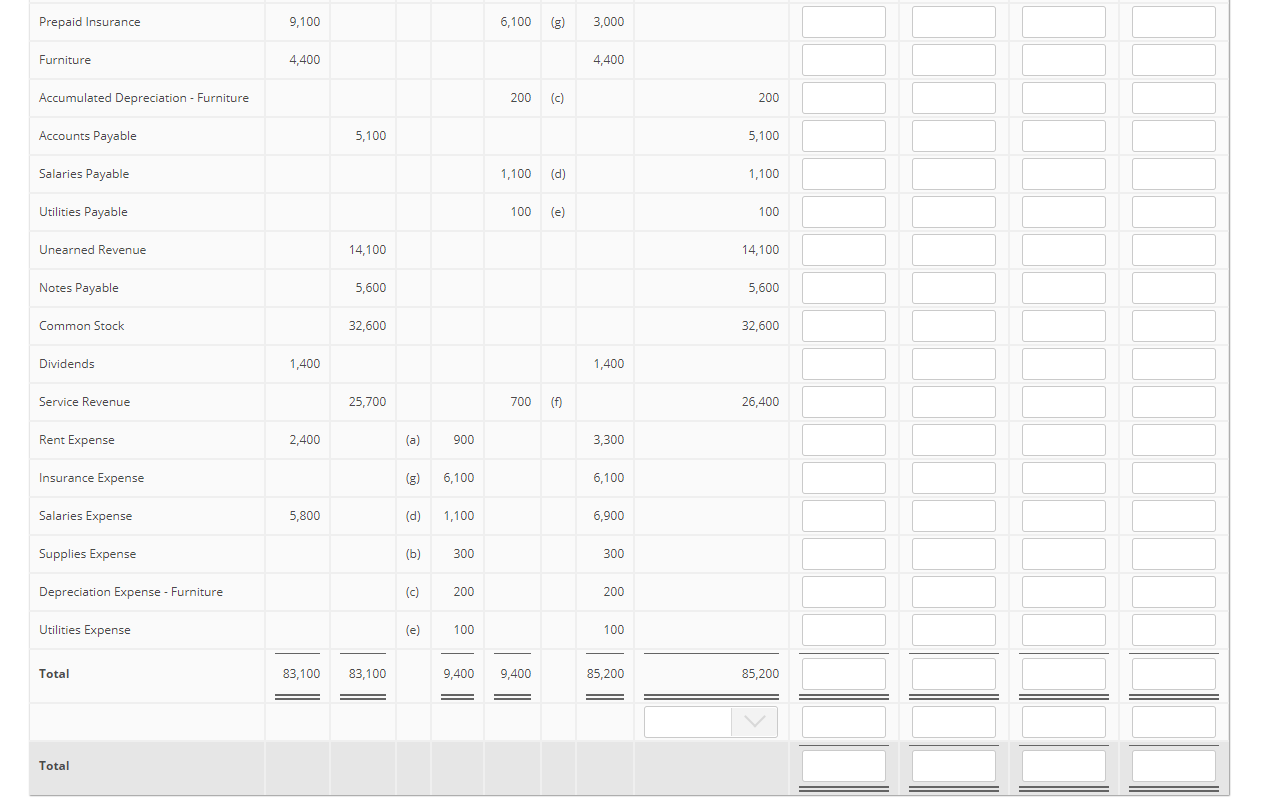

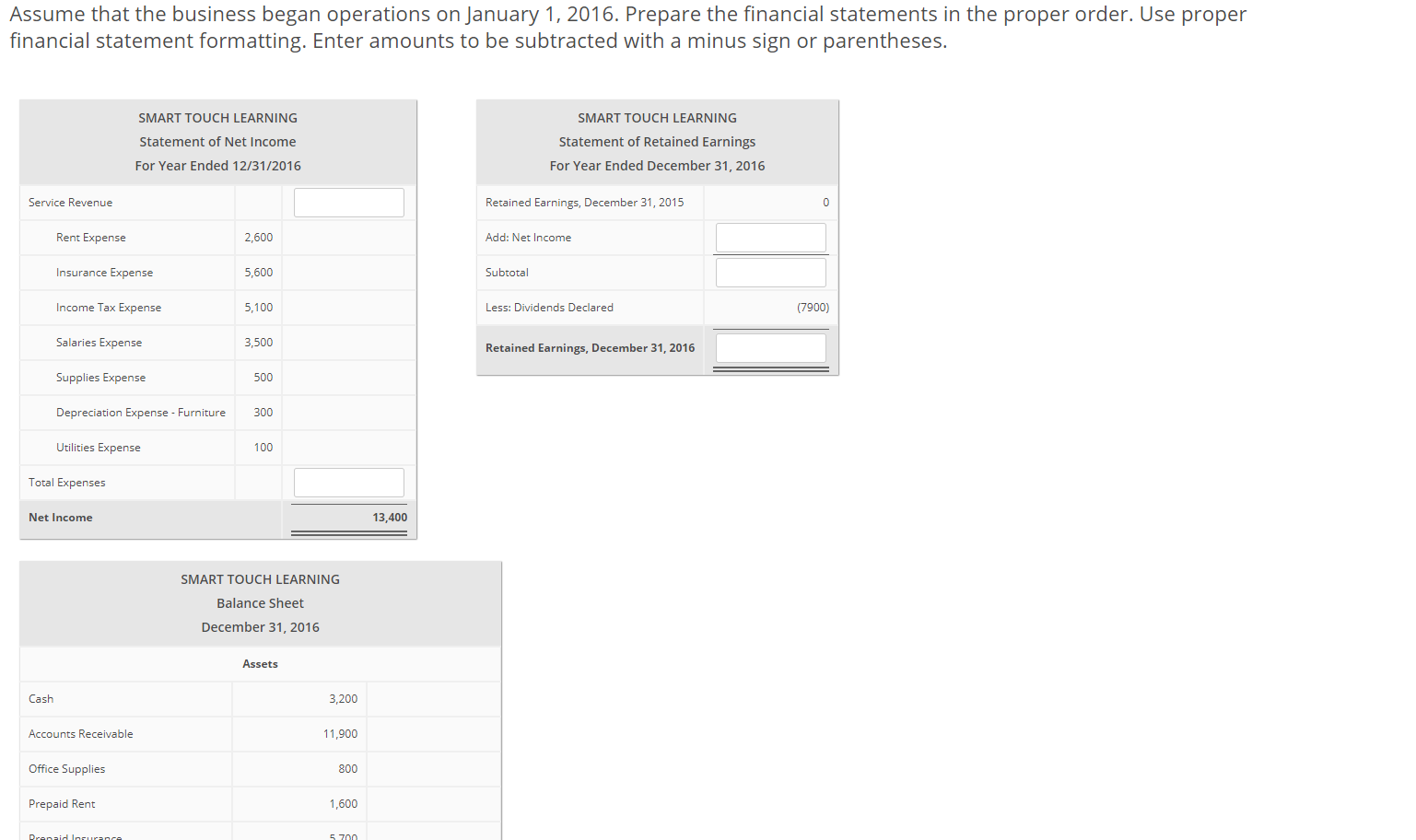

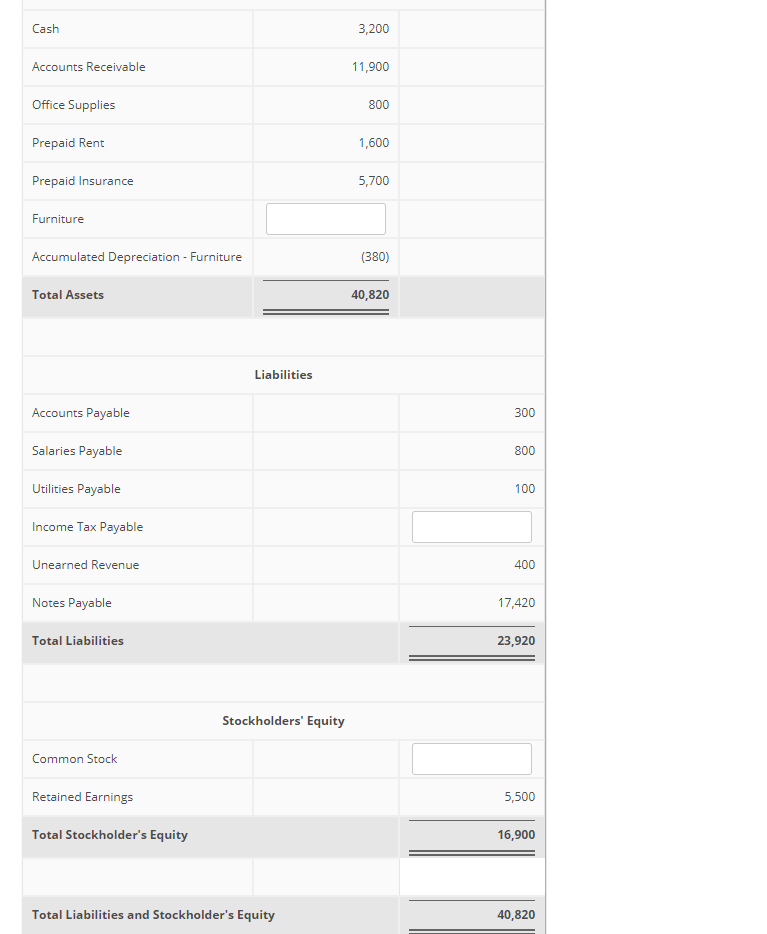

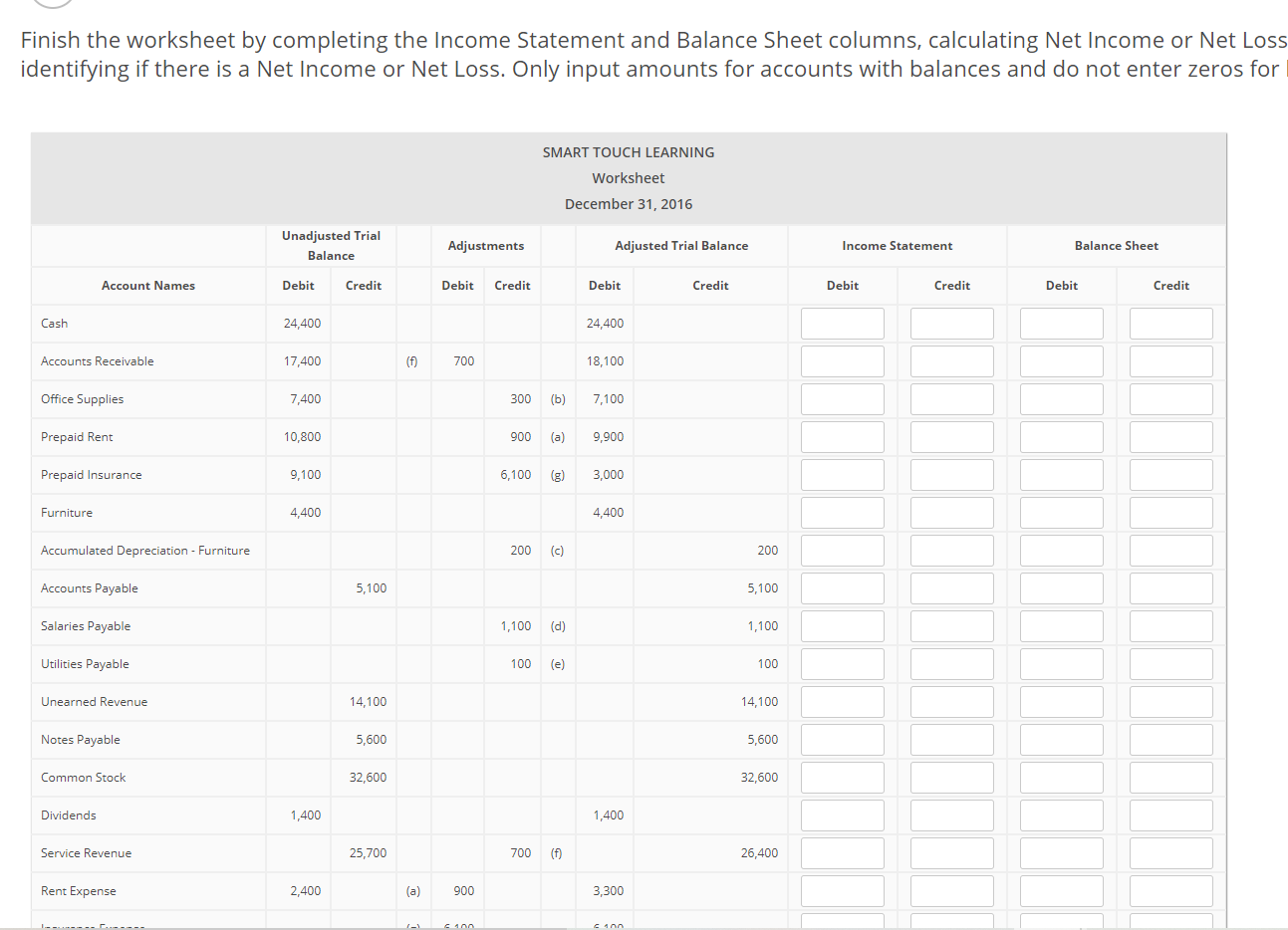

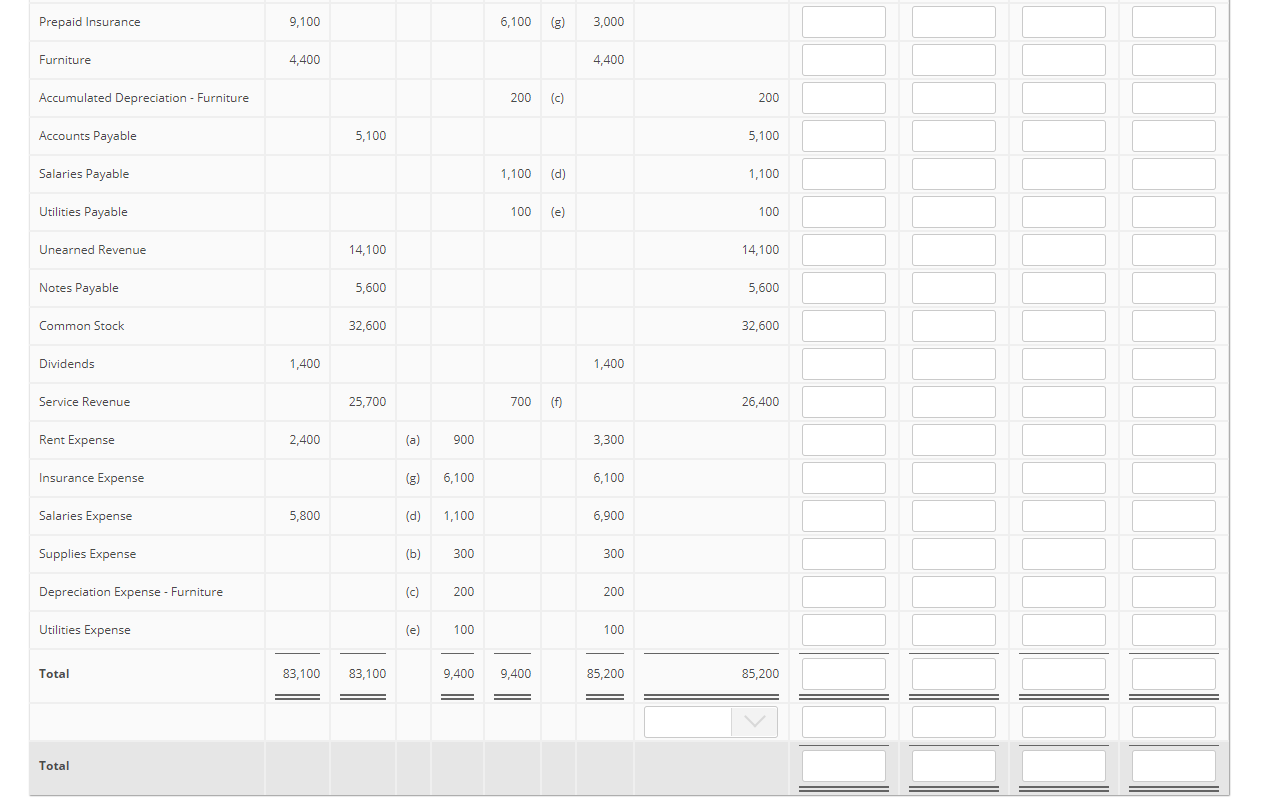

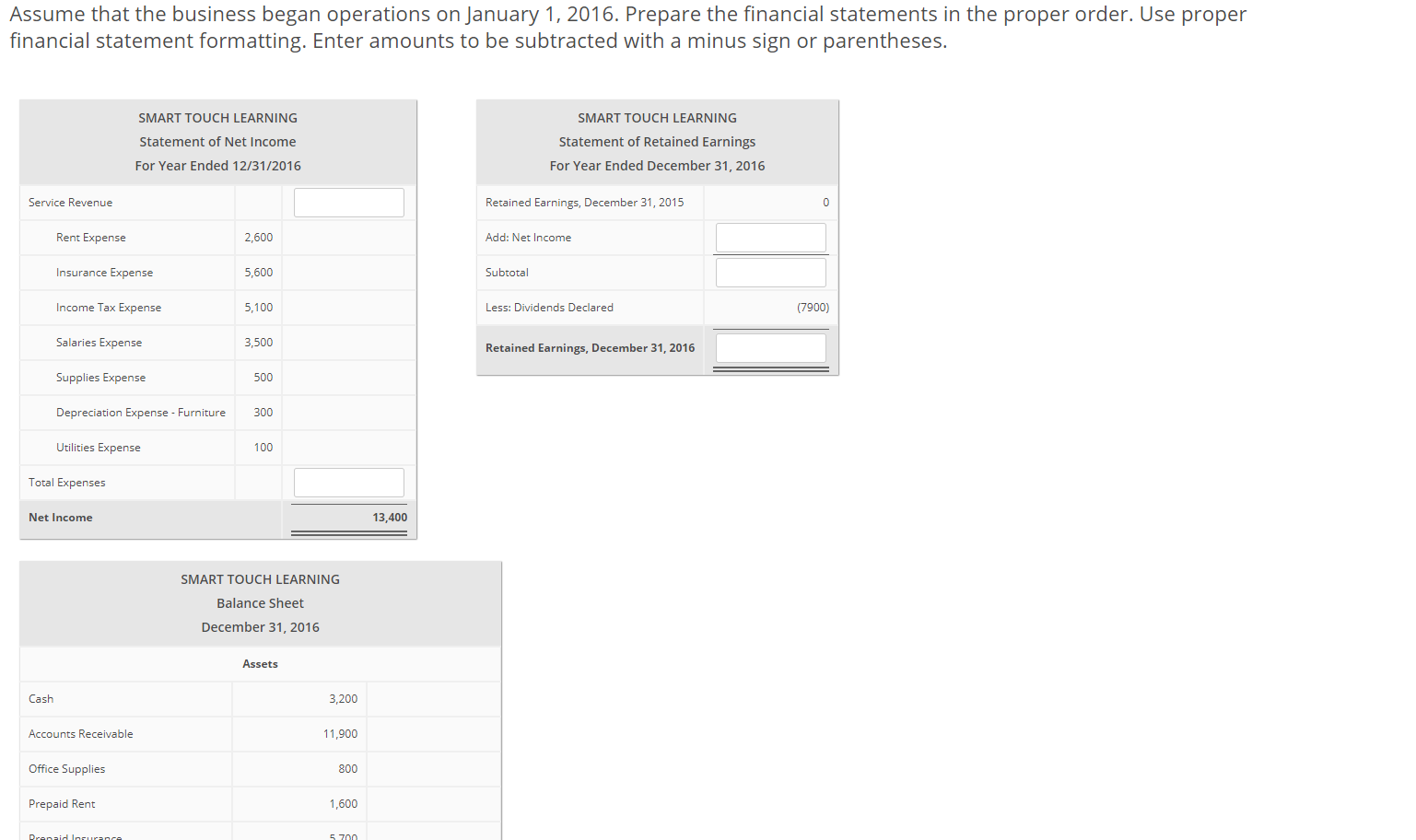

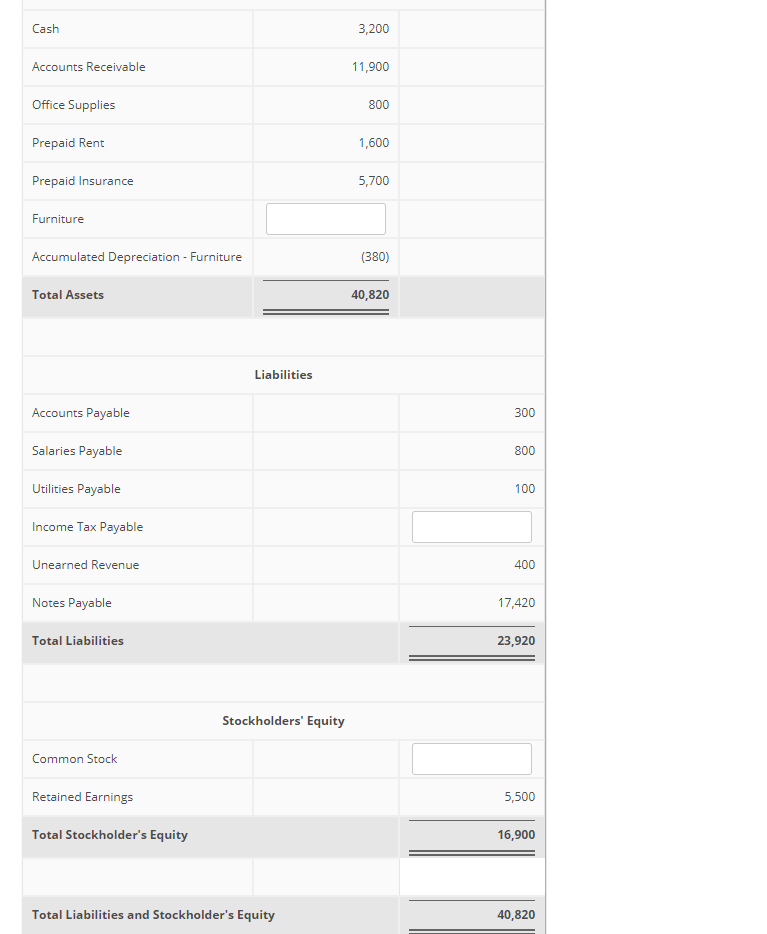

Finish the worksheet by completing the Income Statement and Balance Sheet columns, calculating Net Income or Net Loss identifying if there is a Net Income or Net Loss. Only input amounts for accounts with balances and do not enter zeros for SMART TOUCH LEARNING Worksheet December 31, 2016 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Names Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit Cash 24,400 24,400 Accounts Receivable 17,400 (f) 700 18,100 Office Supplies 7,400 300 (b) 7,100 Prepaid Rent 10,800 900 9,900 Prepaid Insurance 9,100 6,100 (g) 3,000 Furniture 4,400 4,400 Accumulated Depreciation - Furniture 200 (c) 200 Accounts Payable 5,100 5,100 Salaries Payable 1,100 (d) 1,100 Utilities Payable 100 (e) 100 Unearned Revenue 14,100 14,100 Notes Payable 5,600 5,600 Common Stock 32,600 32,600 Dividends 1,400 1,400 Service Revenue 25,700 700 (f) 26,400 Rent Expense 2,400 (a) 900 3,300 C100 Prepaid Insurance 9,100 6,100 (8 (g) 3,000 Furniture 4,400 4,400 Accumulated Depreciation - Furniture 200 (0) 200 Accounts Payable 5,100 5,100 Salaries Payable 1,100 (d) 1,100 Utilities Payable 100 (e) 100 Unearned Revenue 14,100 14,100 Notes Payable 5,600 5,600 Common Stock 32,600 32,600 Dividends 1,400 1,400 Service Revenue 25,700 700 (f) 26,400 Rent Expense 2,400 (a) 900 3,300 Insurance Expense (3) 6,100 6,100 Salaries Expense 5,800 (d) 1,100 6,900 Supplies Expense (b) 300 300 Depreciation Expense - Furniture (c) 200 200 Utilities Expense (e) 100 100 Total 83,100 83,100 9,400 9,400 85,200 85,200 I Total Assume that the business began operations on January 1, 2016. Prepare the financial statements in the proper order. Use proper financial statement formatting. Enter amounts to be subtracted with a minus sign or parentheses. SMART TOUCH LEARNING Statement of Net Income SMART TOUCH LEARNING Statement of Retained Earnings For Year Ended December 31, 2016 For Year Ended 12/31/2016 Service Revenue Retained Earnings, December 31, 2015 0 Rent Expense 2,600 Add: Net Income Insurance Expense 5,600 Subtotal Income Tax Expense 5,100 Less: Dividends Declared (7900) Salaries Expense 3,500 Retained Earnings, December 31, 2016 Supplies Expense 500 Depreciation Expense - Furniture 300 Utilities Expense 100 Total Expenses Net Income 13,400 SMART TOUCH LEARNING Balance Sheet December 31, 2016 Assets Cash 3,200 Accounts Receivable 11,900 Office Supplies 800 Prepaid Rent 1,600 Prepaid Insurance 5700 Cash 3,200 Accounts Receivable 11,900 Office Supplies 800 Prepaid Rent 1,600 Prepaid Insurance 5,700 Furniture Accumulated Depreciation - Furniture (380) Total Assets 40,820 Liabilities Accounts Payable 300 Salaries Payable 800 Utilities Payable 100 Income Tax Payable Unearned Revenue 400 Notes Payable 17,420 Total Liabilities 23,920 Stockholders' Equity Common Stock Retained Earnings 5,500 Total Stockholder's Equity 16,900 Total Liabilities and Stockholder's Equity 40,820