Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Finn Sports Authority purchased inventory costing $28,000 by signing a 9% short-term, one-year note payable. The purchase occurred on July 31,2021 . Finn pays annual

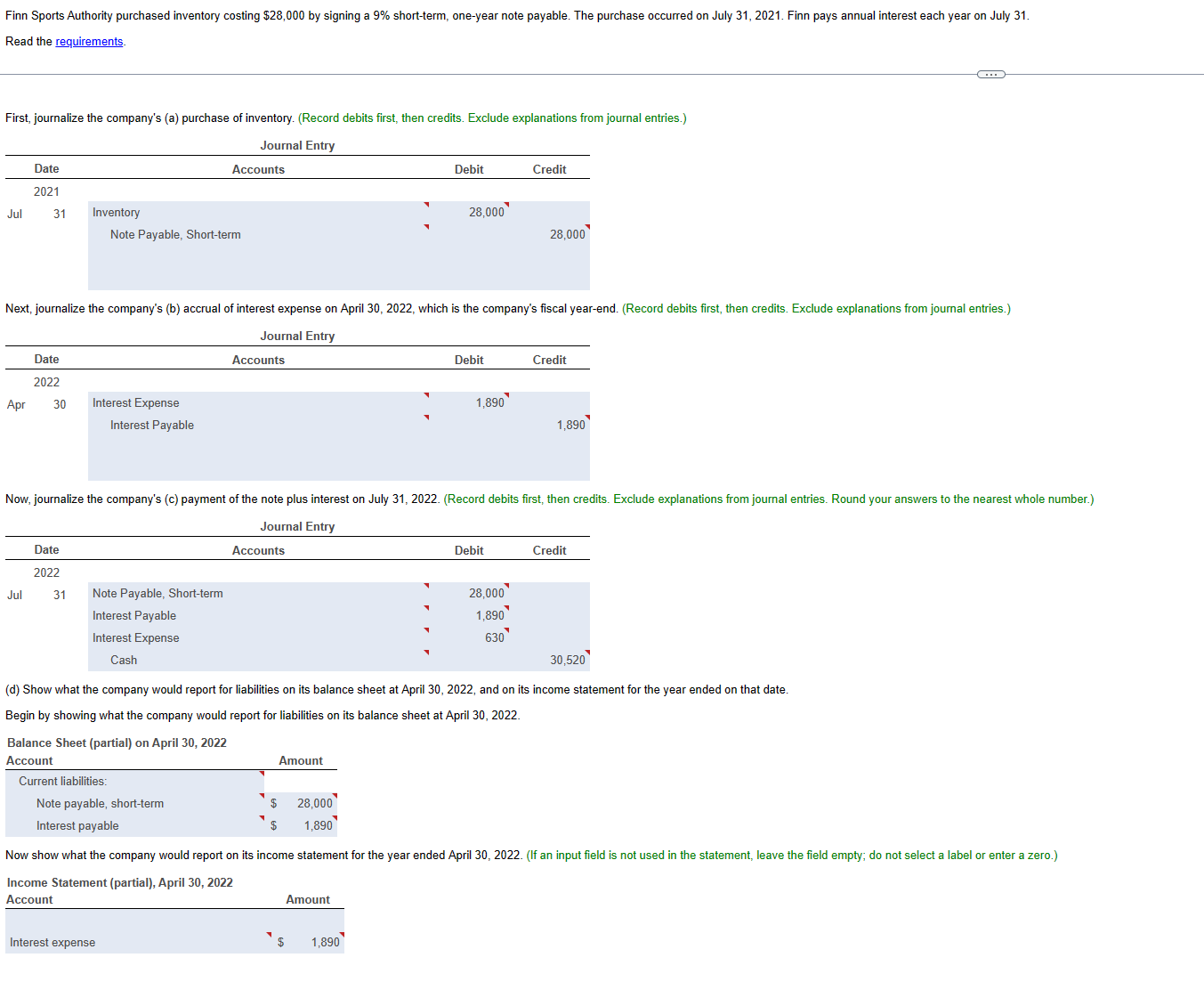

Finn Sports Authority purchased inventory costing $28,000 by signing a 9% short-term, one-year note payable. The purchase occurred on July 31,2021 . Finn pays annual interest each year on July 31 . Read the requirements. First, journalize the company's (a) purchase of inventory. (Record debits first, then credits. Exclude explanations from journal entries.) Next, journalize the company's (b) accrual of interest expense on April 30, 2022, which is the company's fiscal year-end. (Record debits first, then credits. Exclude explanations from journal entries.) Now, journalize the company's (c) payment of the note plus interest on July 31, 2022. (Record debits first, then credits. Exclude explanations from journal entries. Round your answers to the nearest whole (d) Show what the company would report for liabilities on its balance sheet at April 30,2022 , and on its income statement for the year ended on that date. Begin by showing what the company would report for liabilities on its balance sheet at April 30, 2022. Balance Sheet (partial) on April 30, 2022 Now show what the company would report on its income statement for the year ended April 30, 2022. (If an input field is not used in the statement, leave the field empty; do not select a label or enter a zer Income Statement (partial), April 30, 2022

Finn Sports Authority purchased inventory costing $28,000 by signing a 9% short-term, one-year note payable. The purchase occurred on July 31,2021 . Finn pays annual interest each year on July 31 . Read the requirements. First, journalize the company's (a) purchase of inventory. (Record debits first, then credits. Exclude explanations from journal entries.) Next, journalize the company's (b) accrual of interest expense on April 30, 2022, which is the company's fiscal year-end. (Record debits first, then credits. Exclude explanations from journal entries.) Now, journalize the company's (c) payment of the note plus interest on July 31, 2022. (Record debits first, then credits. Exclude explanations from journal entries. Round your answers to the nearest whole (d) Show what the company would report for liabilities on its balance sheet at April 30,2022 , and on its income statement for the year ended on that date. Begin by showing what the company would report for liabilities on its balance sheet at April 30, 2022. Balance Sheet (partial) on April 30, 2022 Now show what the company would report on its income statement for the year ended April 30, 2022. (If an input field is not used in the statement, leave the field empty; do not select a label or enter a zer Income Statement (partial), April 30, 2022 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started