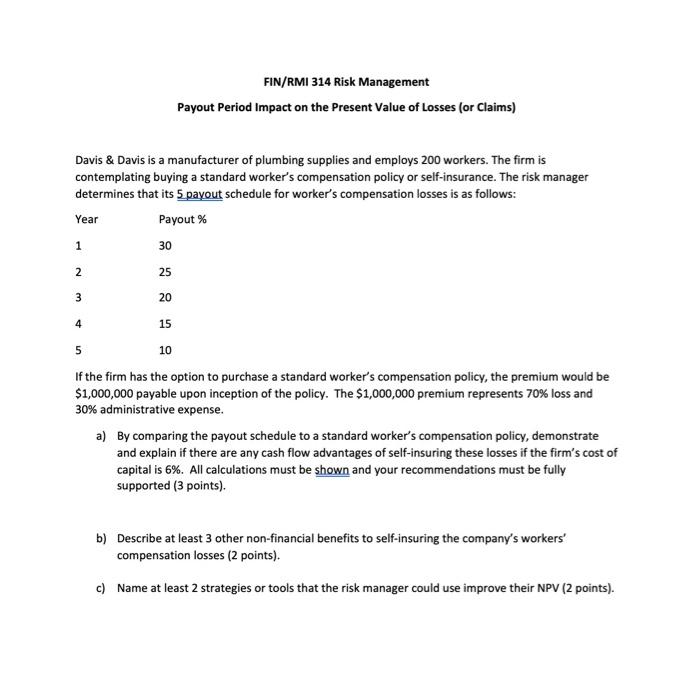

FIN/RMI 314 Risk Management Payout Period Impact on the Present Value of Losses (or Claims) Davis & Davis is a manufacturer of plumbing supplies and employs 200 workers. The firm is contemplating buying a standard worker's compensation policy or self-insurance. The risk manager determines that its 5 payout schedule for worker's compensation losses is as follows: Payout % Year 1 30 2 25 3 20 4 15 5 10 If the firm has the option to purchase a standard worker's compensation policy, the premium would be $1,000,000 payable upon inception of the policy. The $1,000,000 premium represents 70% loss and 30% administrative expense. a) By comparing the payout schedule to a standard worker's compensation policy, demonstrate and explain if there are any cash flow advantages of self-insuring these losses if the firm's cost of capital is 6%. All calculations must be shown and your recommendations must be fully supported (3 points) b) Describe at least 3 other non-financial benefits to self-insuring the company's workers' compensation losses (2 points). c) Name at least 2 strategies or tools that the risk manager could use improve their NPV (2 points). FIN/RMI 314 Risk Management Payout Period Impact on the Present Value of Losses (or Claims) Davis & Davis is a manufacturer of plumbing supplies and employs 200 workers. The firm is contemplating buying a standard worker's compensation policy or self-insurance. The risk manager determines that its 5 payout schedule for worker's compensation losses is as follows: Payout % Year 1 30 2 25 3 20 4 15 5 10 If the firm has the option to purchase a standard worker's compensation policy, the premium would be $1,000,000 payable upon inception of the policy. The $1,000,000 premium represents 70% loss and 30% administrative expense. a) By comparing the payout schedule to a standard worker's compensation policy, demonstrate and explain if there are any cash flow advantages of self-insuring these losses if the firm's cost of capital is 6%. All calculations must be shown and your recommendations must be fully supported (3 points) b) Describe at least 3 other non-financial benefits to self-insuring the company's workers' compensation losses (2 points). c) Name at least 2 strategies or tools that the risk manager could use improve their NPV (2 points)