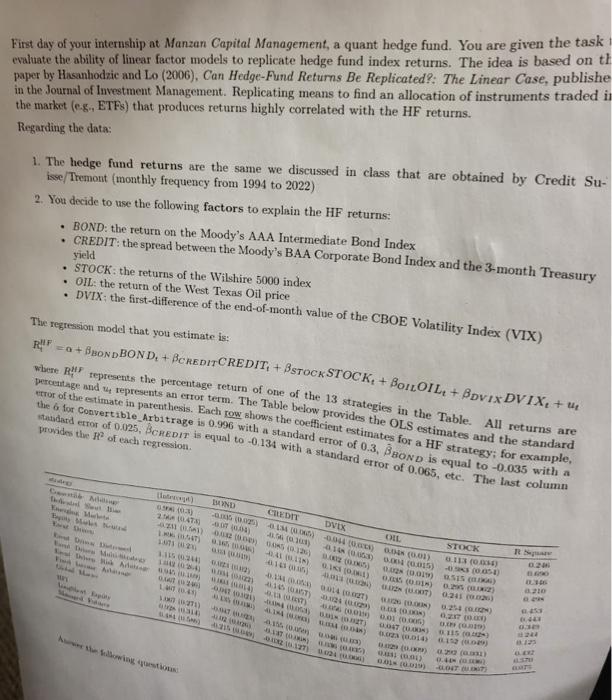

Fint day of your internship at Manzan Capital Management, a quant hedge fund. You are given the task evaluate the ability of linear factor models to replicate hedge fund index returns. The idea is based on tl paper by Hasanhodzic and Lo (2006), Can Hedge-Fund Returns Be Replicated?: The Linear Case, publishe in the Journal of lnvestment Management. Replicating means to find an allocation of instruments traded is the market (eg., ETFs) that produces returns highly correlated with the HF returns. Regarding the data: 1. The hedge fund returns are the same we discussed in class that are obtained by Credit Suisse/Tremont (monthly frequency from 1994 to 2022) 2. You decide to use the following factors to explain the HF returns: - BOND: the return on the Moody's AAA Intermediate Bond Index - CREDIT: the spread between the Moody's BAA Corporate Bond Index and the 3-month Treasury yield STOCK: the returns of the Wilshire 5000 index - OIL: the return of the West Texas Oil price - DVIX the first-difference of the end-of-month value of the CBOE Volatility Index (VIX) The regression model that you estimate is: RU/F=+BONDBONDt+CREDITCREDITi+STOCKSTOCKKt+OILOIL+DVIXDVIXXt+ut peroentage and u4 represents an error term. The Table below provides the OLS estimates and returns are tror of the etimate in parenthesis. Each row shows the coefficient estitnates for a HF strategy; for examplard the 6 for Convertible Fint day of your internship at Manzan Capital Management, a quant hedge fund. You are given the task evaluate the ability of linear factor models to replicate hedge fund index returns. The idea is based on tl paper by Hasanhodzic and Lo (2006), Can Hedge-Fund Returns Be Replicated?: The Linear Case, publishe in the Journal of lnvestment Management. Replicating means to find an allocation of instruments traded is the market (eg., ETFs) that produces returns highly correlated with the HF returns. Regarding the data: 1. The hedge fund returns are the same we discussed in class that are obtained by Credit Suisse/Tremont (monthly frequency from 1994 to 2022) 2. You decide to use the following factors to explain the HF returns: - BOND: the return on the Moody's AAA Intermediate Bond Index - CREDIT: the spread between the Moody's BAA Corporate Bond Index and the 3-month Treasury yield STOCK: the returns of the Wilshire 5000 index - OIL: the return of the West Texas Oil price - DVIX the first-difference of the end-of-month value of the CBOE Volatility Index (VIX) The regression model that you estimate is: RU/F=+BONDBONDt+CREDITCREDITi+STOCKSTOCKKt+OILOIL+DVIXDVIXXt+ut peroentage and u4 represents an error term. The Table below provides the OLS estimates and returns are tror of the etimate in parenthesis. Each row shows the coefficient estitnates for a HF strategy; for examplard the 6 for Convertible