Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fiona Bouquet records all prepaid costs as assets and all revenue collected in advance as liabilities, and adjusts only at its fiscal year end, which

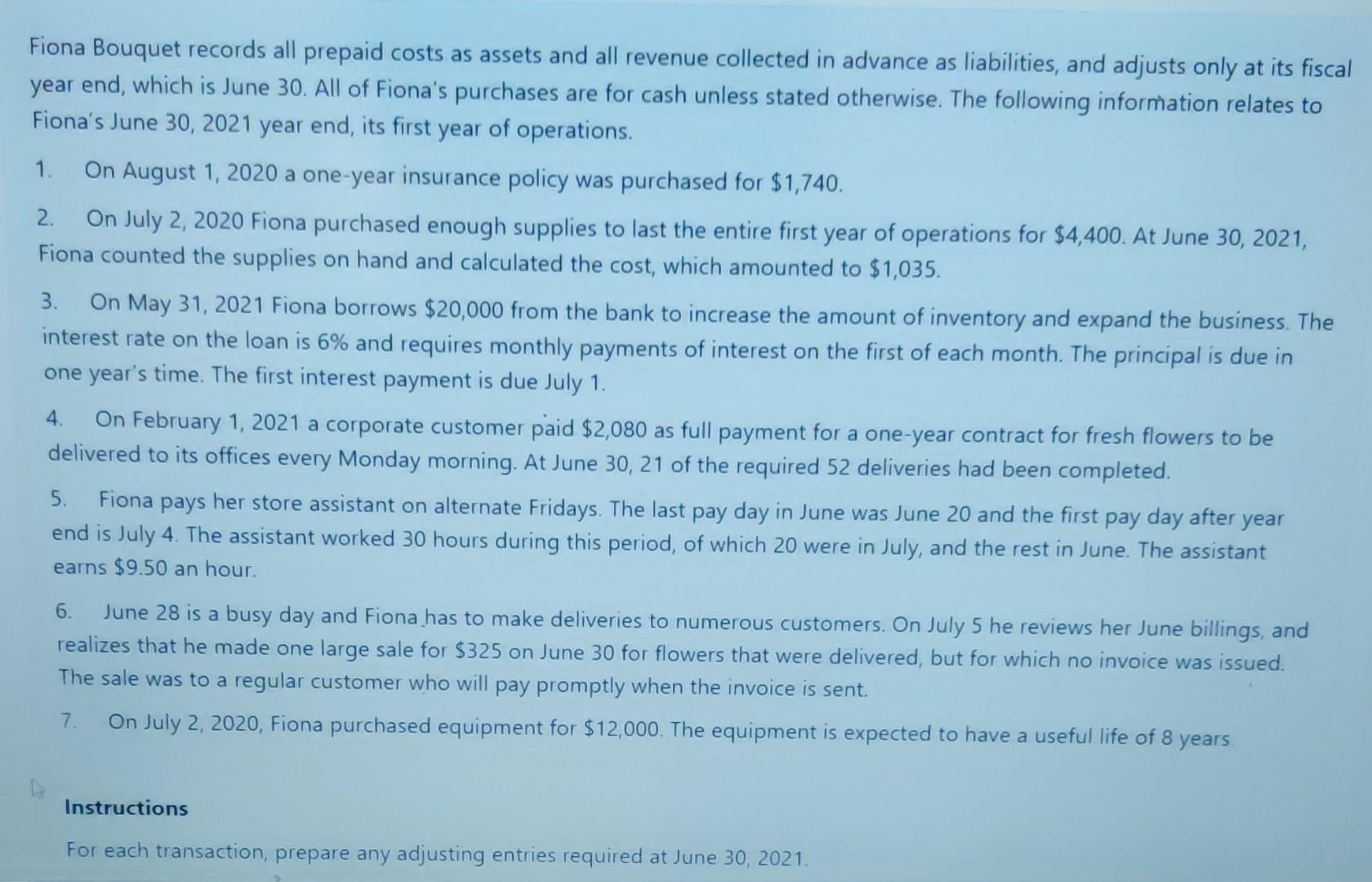

Fiona Bouquet records all prepaid costs as assets and all revenue collected in advance as liabilities, and adjusts only at its fiscal year end, which is June 30. All of Fiona's purchases are for cash unless stated otherwise. The following information relates to Fiona's June 30, 2021 year end, its first year of operations. 1. On August 1, 2020 a one-year insurance policy was purchased for $1,740. 2. On July 2, 2020 Fiona purchased enough supplies to last the entire first year of operations for $4,400. At June 30, 2021, Fiona counted the supplies on hand and calculated the cost, which amounted to $1,035. 3. On May 31, 2021 Fiona borrows $20,000 from the bank to increase the amount of inventory and expand the business. The interest rate on the loan is 6% and requires monthly payments of interest on the first of each month. The principal is due in one year's time. The first interest payment is due July 1. On February 1, 2021 a corporate customer paid $2,080 as full payment for a one-year contract for fresh flowers to be delivered to its offices every Monday morning. At June 30, 21 of the required 52 deliveries had been completed. 5. Fiona pays her store assistant on alternate Fridays. The last pay day in June was June 20 and the first pay day after year end is July 4. The assistant worked 30 hours during this period, of which 20 were in July, and the rest in June. The assistant earns $9.50 an hour. 4. 6. June 28 is a busy day and Fiona has to make deliveries to numerous customers. On July 5 he reviews her June billings, and realizes that he made one large sale for $325 on June 30 for flowers that were delivered, but for which no invoice was issued. The sale was to a regular customer who will pay promptly when the invoice is sent. 7. On July 2, 2020, Fiona purchased equipment for $12,000. The equipment is expected to have a useful life of 8 years Instructions For each transaction, prepare any adjusting entries required at June 30, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started