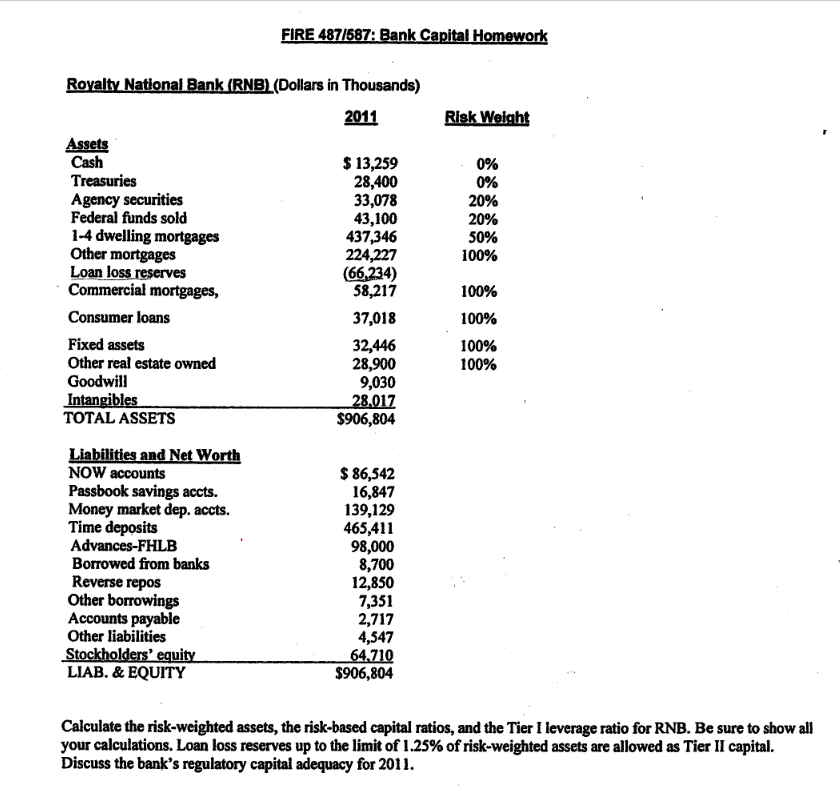

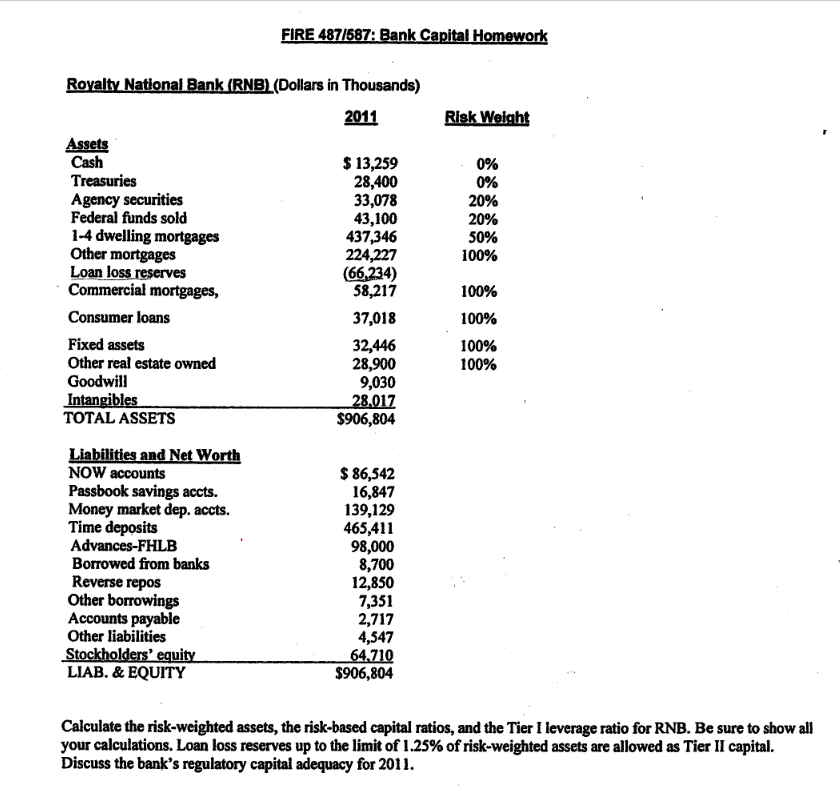

FIRE 487/587: Bank Capital Homework Risk Weight Royalty National Bank (RNB) (Dollars in Thousands) 2011 Assets Cash $ 13,259 Treasuries 28,400 Agency securities 33,078 Federal funds sold 43,100 1-4 dwelling mortgages 437,346 Other mortgages 224,227 Loan loss reserves (66,234) Commercial mortgages, 58,217 Consumer loans 37,018 Fixed assets 32,446 Other real estate owned 28,900 Goodwill 9,030 Intangibles 28.017 TOTAL ASSETS $906,804 0% 0% 20% 20% 50% 100% 100% 100% 100% 100% Liabilities and Net Worth NOW accounts Passbook savings accts. Money market dep. accts. Time deposits Advances-FHLB Borrowed from banks Reverse repos Other borrowings Accounts payable Other liabilities Stockholders' equity LIAB. & EQUITY $ 86,542 16,847 139,129 465,411 98,000 8,700 12,850 7,351 2,717 4,547 64.710 $906,804 Calculate the risk-weighted assets, the risk-based capital ratios, and the Tier I leverage ratio for RNB. Be sure to show all your calculations. Loan loss reserves up to the limit of 1.25% of risk-weighted assets are allowed as Tier II capital. Discuss the bank's regulatory capital adequacy for 2011. FIRE 487/587: Bank Capital Homework Risk Weight Royalty National Bank (RNB) (Dollars in Thousands) 2011 Assets Cash $ 13,259 Treasuries 28,400 Agency securities 33,078 Federal funds sold 43,100 1-4 dwelling mortgages 437,346 Other mortgages 224,227 Loan loss reserves (66,234) Commercial mortgages, 58,217 Consumer loans 37,018 Fixed assets 32,446 Other real estate owned 28,900 Goodwill 9,030 Intangibles 28.017 TOTAL ASSETS $906,804 0% 0% 20% 20% 50% 100% 100% 100% 100% 100% Liabilities and Net Worth NOW accounts Passbook savings accts. Money market dep. accts. Time deposits Advances-FHLB Borrowed from banks Reverse repos Other borrowings Accounts payable Other liabilities Stockholders' equity LIAB. & EQUITY $ 86,542 16,847 139,129 465,411 98,000 8,700 12,850 7,351 2,717 4,547 64.710 $906,804 Calculate the risk-weighted assets, the risk-based capital ratios, and the Tier I leverage ratio for RNB. Be sure to show all your calculations. Loan loss reserves up to the limit of 1.25% of risk-weighted assets are allowed as Tier II capital. Discuss the bank's regulatory capital adequacy for 2011