Question

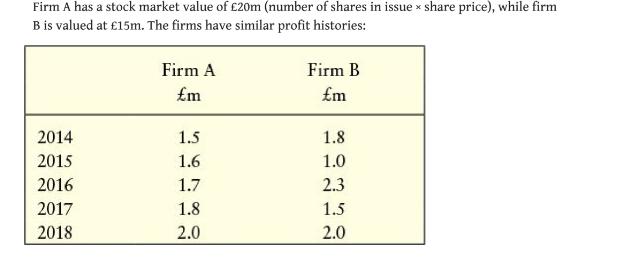

Firm A has a stock market value of 20m (number of shares in issue x share price), while firm B is valued at 15m.

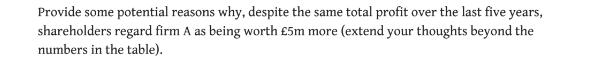

Firm A has a stock market value of 20m (number of shares in issue x share price), while firm B is valued at 15m. The firms have similar profit histories: Firm B Firm A m m 2014 1.5 1.8 2015 1.6 1.0 2016 1.7 2.3 2017 1.8 1.5 2018 2.0 2.0 Provide some potential reasons why, despite the same total profit over the last five years, shareholders regard firm A as being worth 5m more (extend your thoughts beyond the numbers in the table).

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution If you look at the numbers Profits of firm A ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Banking questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App