Answered step by step

Verified Expert Solution

Question

1 Approved Answer

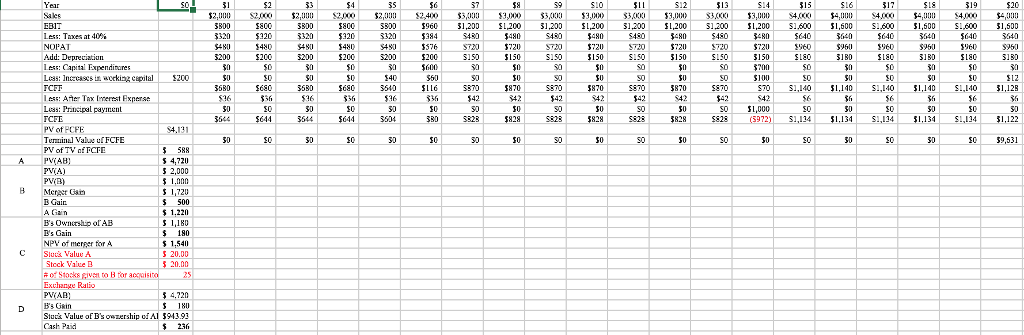

Firm A is considering the acquisition of Firm B. For Firm A, PV = $2000, N = 100. For Firm B, PV = $1000, N

| Firm A is considering the acquisition of Firm B. For Firm A, PV = $2000, N = 100. For Firm B, PV = $1000, N = 50. Proforma financial information for Firm AB is below. The discount rate for Firm AB is 15%. After year 20, cash flows from year 20 will grow at 3% forever. The tax rate is 40%. The correct answers are next to the questions below - I need help figuring out how to get a part of question C and all of E. | |||||

| Firm AB | Years 1-5 | Year 6 | Years 7-13 | Year 14 | Years 15-20 |

| Sales | 2000 | 2400 | 3000 | 3000 | 4000 |

| Depreciation | 200 | 200 | 150 | 150 | 180 |

| EBIT: 40% of Sales | |||||

| Interest | 60 | 60 | 70 | 70 | 10 |

| Capital Expenditures | 0 | 600 | 0 | 700 | 0 |

| Increases in Working Capital: 10% of changes in sales invest the period before the sales increase | |||||

| Principal Payment | 0 | 0 | 0 | 1000 | 0 |

| a. Calculate the PV of AB, rounding the the nearest whole number. (Answer: 4724, no need for help) | |||||

| b. Suppose the owners of B ask for a time 0 cash payment of $1500. If A accepts, what will the split of the GAIN be (in dollars)? (Answer: 500 to B, 1224 to A, no need for help) | |||||

| c. Suppose the owners of B ask for an exchange of common shares, and they want to have a 25% ownership in the merged firm. What would the COST and NPV be? What exchange ratio are the B owners requesting? (Answer: Cost: 181, NPV: 1543 , DON'T KNOW HOW TO FIND EXCHANGE RATIO, NEED HELP) | |||||

| d. Supposed A agrees to the split of the GAIN in part c, but only wants to give B a 20% ownership. How much time 0 cash must now be offered, with the 20% ownership, to achieve the same split as in part c? (Answer: 236.2, no need for help) | |||||

| e. Suppose A agrees to the split of the GAIN in part c, but wants to pay with shares of preferred stock. The preferred will have a $1.50 per share dividend and the market requires an 8% return on preferred stock. How many preferred stock shares would A have to give B? (Answer: 63 -- DON'T KNOW HOW TO FIND, HELP) | |||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started