Answered step by step

Verified Expert Solution

Question

1 Approved Answer

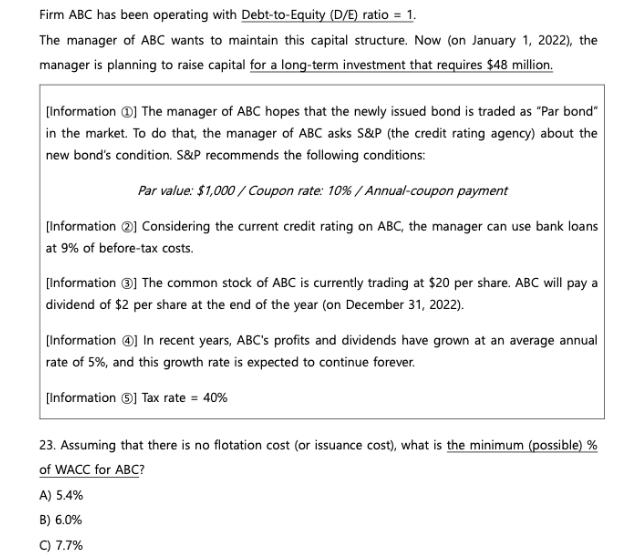

Firm ABC has been operating with Debt-to-Equity (D/E) ratio = 1. The manager of ABC wants to maintain this capital structure. Now (on January

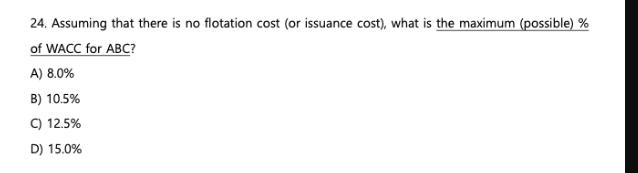

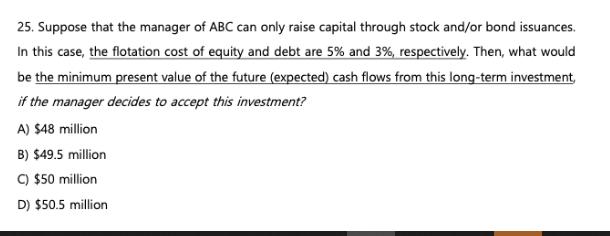

Firm ABC has been operating with Debt-to-Equity (D/E) ratio = 1. The manager of ABC wants to maintain this capital structure. Now (on January 1, 2022), the manager is planning to raise capital for a long-term investment that requires $48 million. [Information ] The manager of ABC hopes that the newly issued bond is traded as "Par bond" in the market. To do that, the manager of ABC asks S&P (the credit rating agency) about the new bond's condition. S&P recommends the following conditions: Par value: $1,000/ Coupon rate: 10% / Annual-coupon payment [Information 2] Considering the current credit rating on ABC, the manager can use bank loans at 9% of before-tax costs. [Information 3] The common stock of ABC is currently trading at $20 per share. ABC will pay a dividend of $2 per share at the end of the year (on December 31, 2022). [Information 4] In recent years, ABC's profits and dividends have grown at an average annual rate of 5%, and this growth rate is expected to continue forever. [Information 5] Tax rate = 40% 23. Assuming that there is no flotation cost (or issuance cost), what is the minimum (possible) % of WACC for ABC? A) 5.4% B) 6.0% C) 7.7% 24. Assuming that there is no flotation cost (or issuance cost), what is the maximum (possible) % of WACC for ABC? A) 8.0% B) 10.5% C) 12.5% D) 15.0% 25. Suppose that the manager of ABC can only raise capital through stock and/or bond issuances. In this case, the flotation cost of equity and debt are 5% and 3%, respectively. Then, what would be the minimum present value of the future (expected) cash flows from this long-term investment, if the manager decides to accept this investment? A) $48 million B) $49.5 million C) $50 million D) $50.5 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Part 1 WACC calculation 23 The minimum possible WACC for ABC is A 54 based on the cost of equity with a beta of 10 and a riskfree rate of 54 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started