Firm ABC is considering launching a new product but there is some uncertainty about how the product will actually be received. Accordingly, your junior

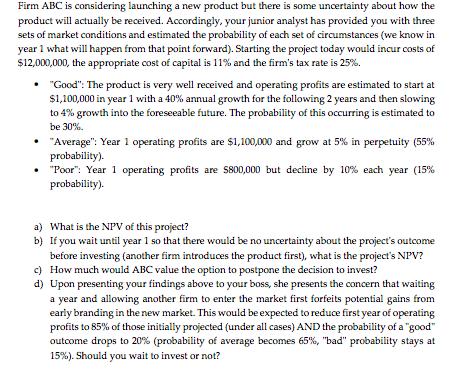

Firm ABC is considering launching a new product but there is some uncertainty about how the product will actually be received. Accordingly, your junior analyst has provided you with three sets of market conditions and estimated the probability of each set of circumstances (we know in year 1 what will happen from that point forward). Starting the project today would incur costs of $12,000,000, the appropriate cost of capital is 11% and the firm's tax rate is 25%. "Good": The product is very well received and operating profits are estimated to start at $1,100,000 in year 1 with a 40% annual growth for the following 2 years and then slowing to 4% growth into the foreseeable future. The probability of this occurring is estimated to be 30%. "Average": Year 1 operating profits are $1,100,000 and grow at 5% in perpetuity (55% probability). "Poor": Year 1 operating profits are $800,000 but decline by 10% each year (15% probability). a) What is the NPV of this project? b) If you wait until year I so that there would be no uncertainty about the project's outcome before investing (another firm introduces the product first), what is the project's NPV? c) How much would ABC value the option to postpone the decision to invest? d) Upon presenting your findings above to your boss, she presents the concern that waiting a year and allowing another firm to enter the market first forfeits potential gains from early branding in the new market. This would be expected to reduce first year of operating profits to 85% of those initially projected (under all cases) AND the probability of a "good" outcome drops to 20% (probability of average becomes 65%, "bad" probability stays at 15%). Should you wait to invest or not?

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a What is the NPV of this project ANSWER The NPV of this project is 12641905 WORKING We can use the NPV formula to calculate the NPV of this project NPV 12000000 1100000 1 011 1165000 1 0112 1231650 1 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started