Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Firm ABC is expecting a significant growth in revenue in the next few years. Before conducting a financial forecast, Firm ABC would like to analyze

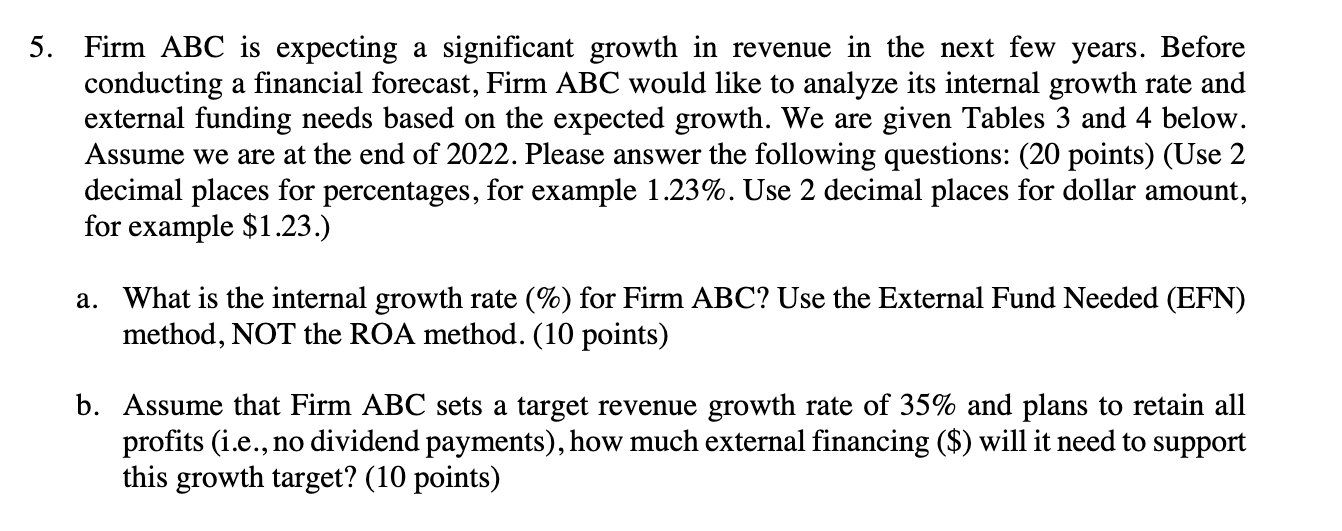

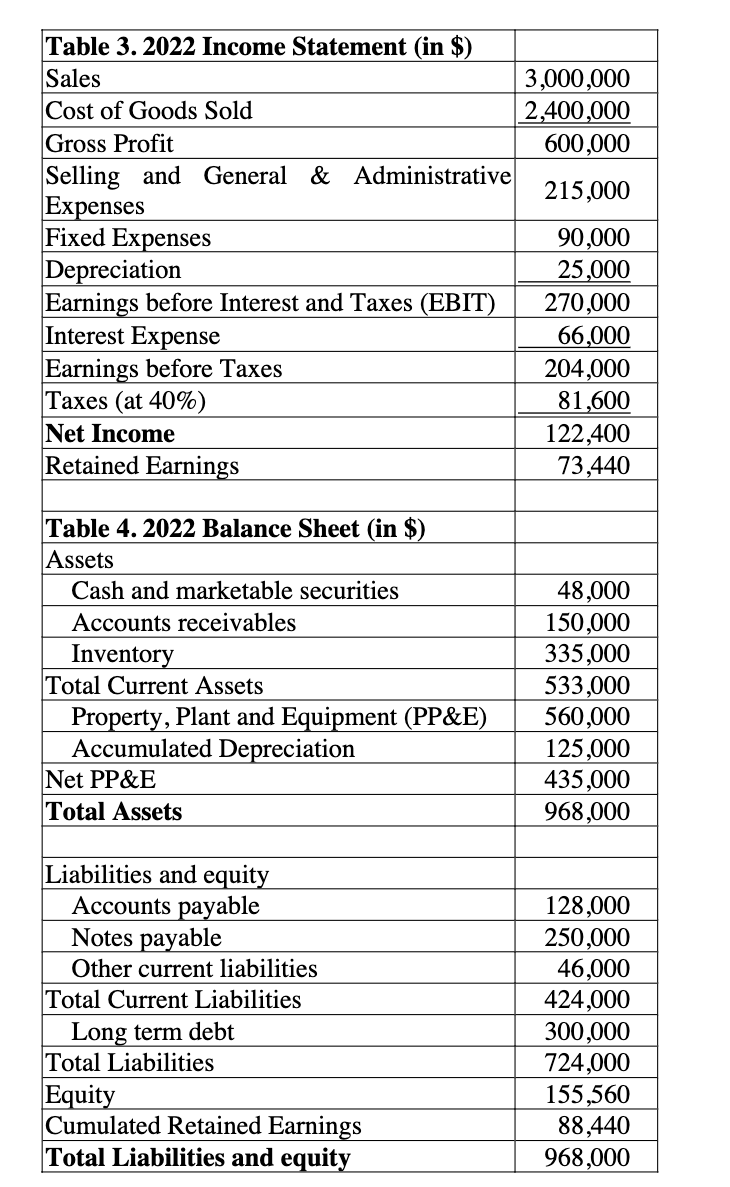

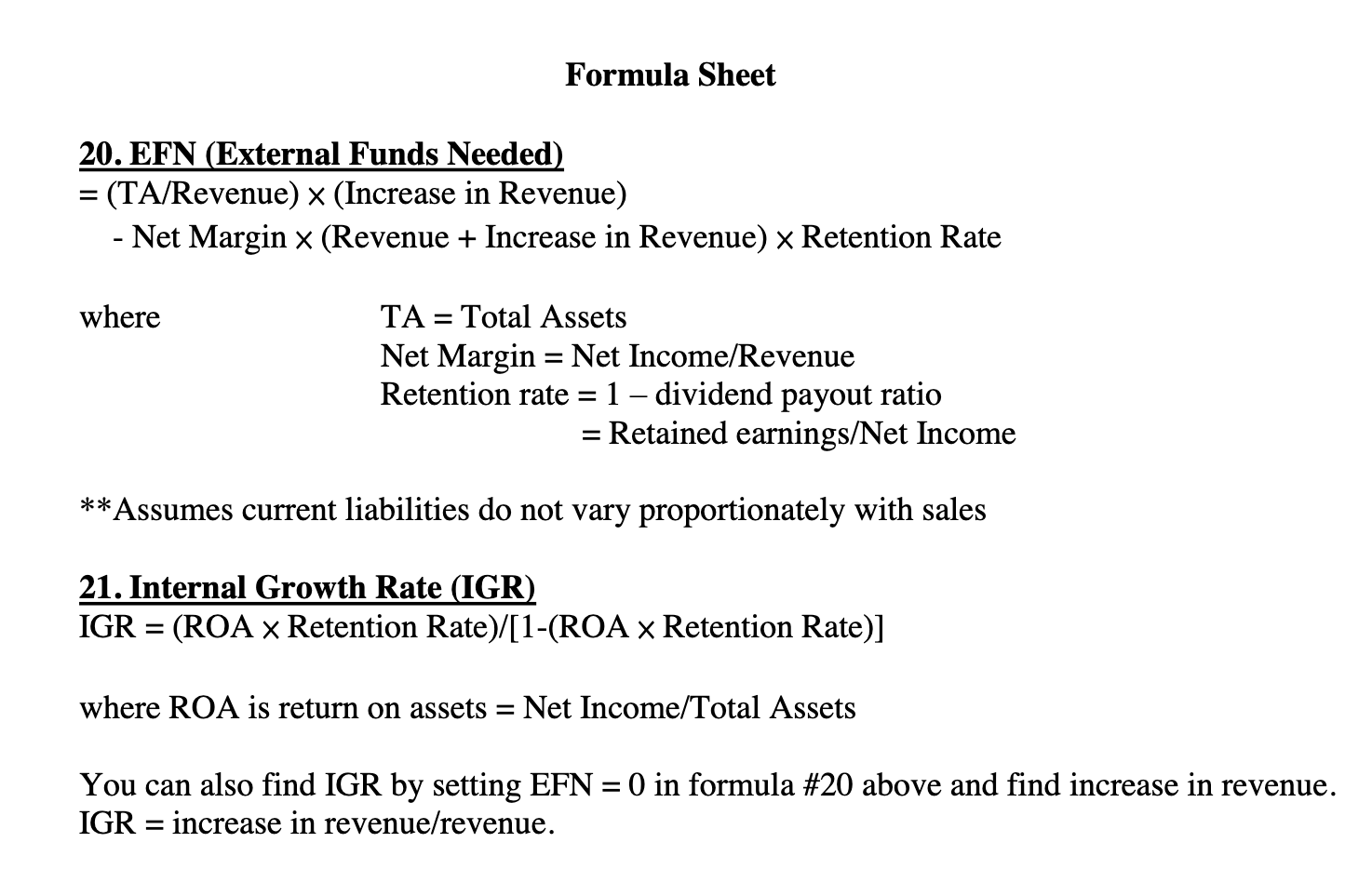

Firm ABC is expecting a significant growth in revenue in the next few years. Before conducting a financial forecast, Firm ABC would like to analyze its internal growth rate and external funding needs based on the expected growth. We are given Tables 3 and 4 below. Assume we are at the end of 2022. Please answer the following questions: (20 points) (Use 2 decimal places for percentages, for example 1.23\%. Use 2 decimal places for dollar amount, for example $1.23.) a. What is the internal growth rate (\%) for Firm ABC? Use the External Fund Needed (EFN) method, NOT the ROA method. (10 points) b. Assume that Firm ABC sets a target revenue growth rate of 35% and plans to retain all profits (i.e., no dividend payments), how much external financing (\$) will it need to support this growth target? (10 points) Formula Sheet 20. EFN (External Funds Needed) =( TA / Revenue )( Increase in Revenue ) - Net Margin ( Revenue + Increase in Revenue ) Retention Rate where TA=TotalAssetsNetMargin=NetIncome/RevenueRetentionrate=1dividendpayoutratio=Retainedearnings/NetIncome **Assumes current liabilities do not vary proportionately with sales 21. Internal Growth Rate (IGR) IGR =(ROA Retention Rate) /[1(ROA Retention Rate )] where ROA is return on assets = Net Income/Total Assets You can also find IGR by setting EFN =0 in formula \#20 above and find increase in revenue. IGR = increase in revenue/revenue

Firm ABC is expecting a significant growth in revenue in the next few years. Before conducting a financial forecast, Firm ABC would like to analyze its internal growth rate and external funding needs based on the expected growth. We are given Tables 3 and 4 below. Assume we are at the end of 2022. Please answer the following questions: (20 points) (Use 2 decimal places for percentages, for example 1.23\%. Use 2 decimal places for dollar amount, for example $1.23.) a. What is the internal growth rate (\%) for Firm ABC? Use the External Fund Needed (EFN) method, NOT the ROA method. (10 points) b. Assume that Firm ABC sets a target revenue growth rate of 35% and plans to retain all profits (i.e., no dividend payments), how much external financing (\$) will it need to support this growth target? (10 points) Formula Sheet 20. EFN (External Funds Needed) =( TA / Revenue )( Increase in Revenue ) - Net Margin ( Revenue + Increase in Revenue ) Retention Rate where TA=TotalAssetsNetMargin=NetIncome/RevenueRetentionrate=1dividendpayoutratio=Retainedearnings/NetIncome **Assumes current liabilities do not vary proportionately with sales 21. Internal Growth Rate (IGR) IGR =(ROA Retention Rate) /[1(ROA Retention Rate )] where ROA is return on assets = Net Income/Total Assets You can also find IGR by setting EFN =0 in formula \#20 above and find increase in revenue. IGR = increase in revenue/revenue Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started