Answered step by step

Verified Expert Solution

Question

1 Approved Answer

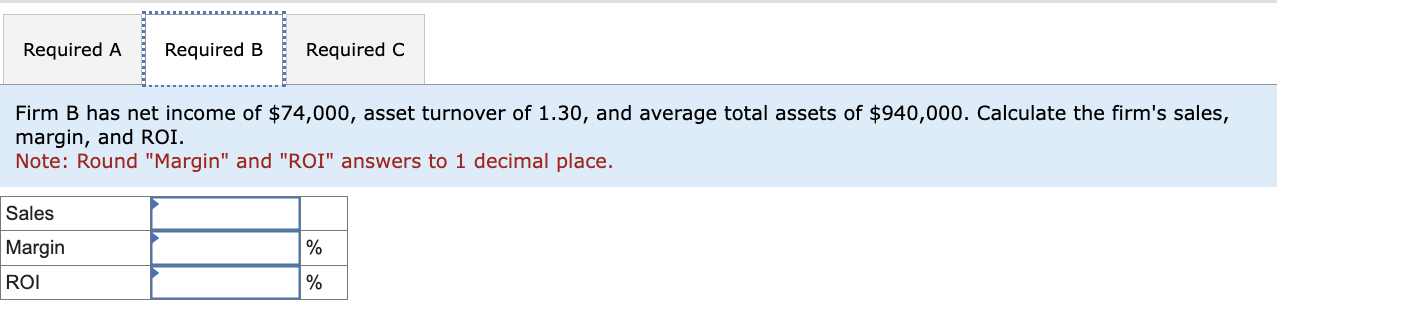

Firm B has net income of $74,000, asset turnover of 1.30 , and average total assets of $940,000. Calculate the firm's sales, margin, and ROI.

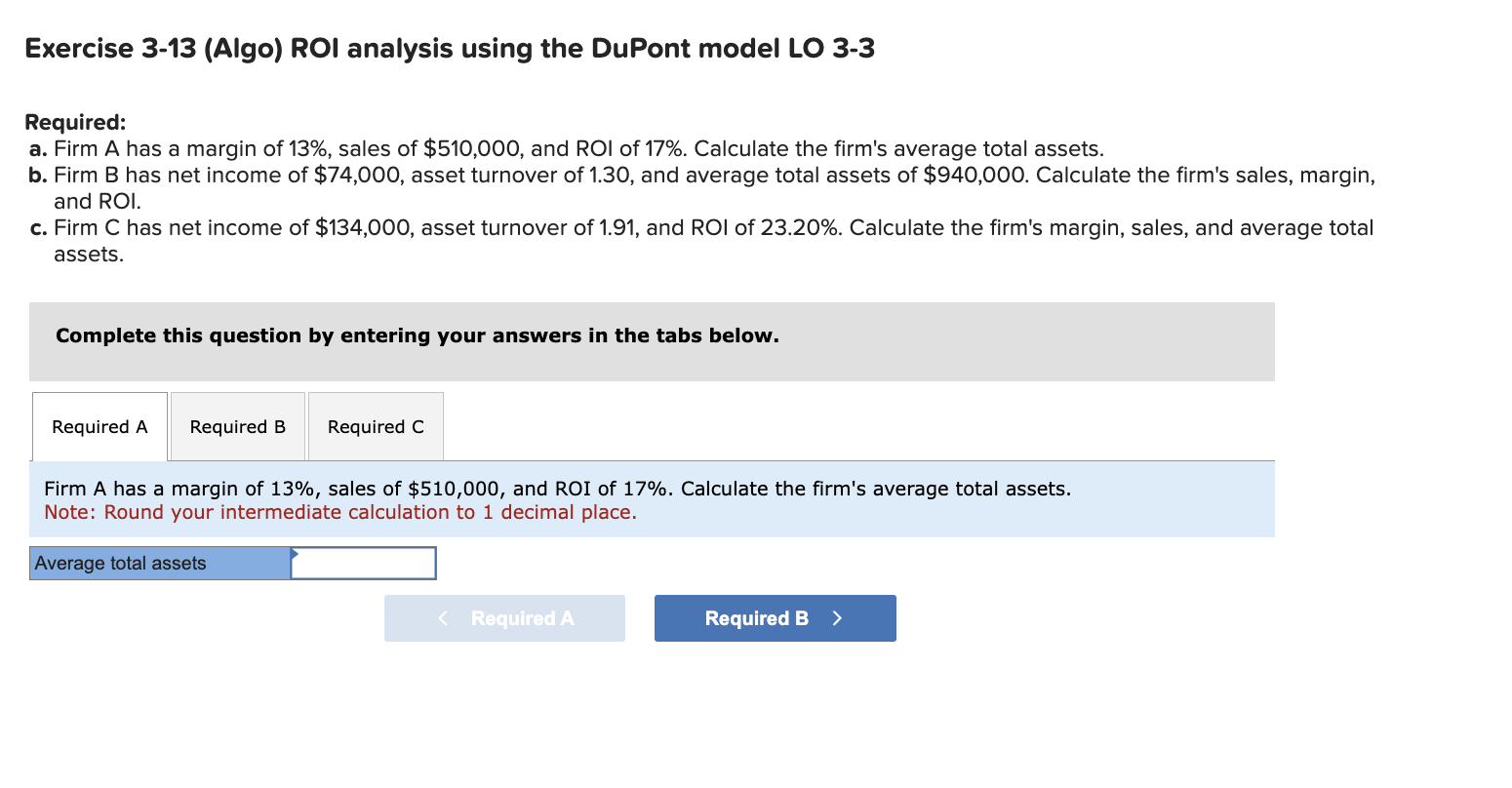

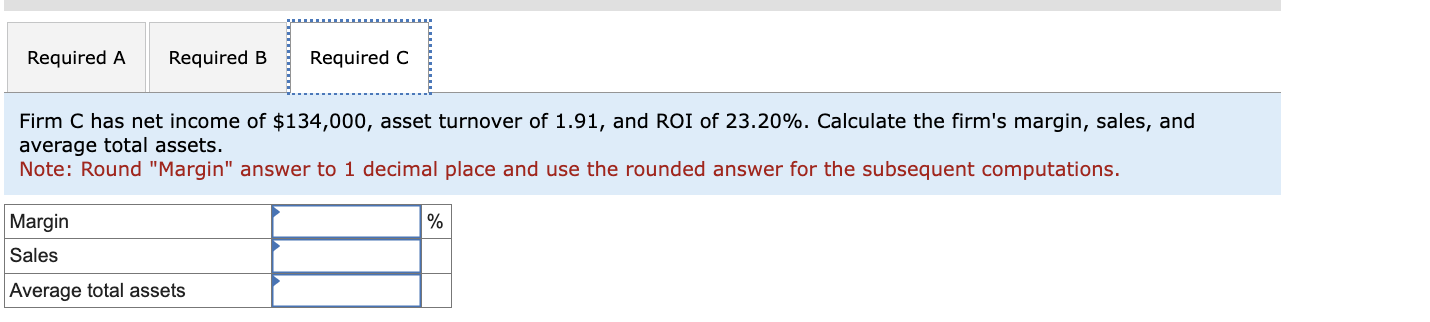

Firm B has net income of $74,000, asset turnover of 1.30 , and average total assets of $940,000. Calculate the firm's sales, margin, and ROI. Note: Round "Margin" and "ROI" answers to 1 decimal place. Firm C has net income of $134,000, asset turnover of 1.91 , and ROI of 23.20%. Calculate the firm's margin, sales, and average total assets. Note: Round "Margin" answer to 1 decimal place and use the rounded answer for the subsequent computations. Exercise 3-13 (Algo) ROI analysis using the DuPont model LO 3-3 Required: a. Firm A has a margin of 13%, sales of $510,000, and RO o of 17%. Calculate the firm's average total assets. b. Firm B has net income of $74,000, asset turnover of 1.30 , and average total assets of $940,000. Calculate the firm's sales, margin, and ROI. c. Firm C has net income of $134,000, asset turnover of 1.91 , and ROI of 23.20%. Calculate the firm's margin, sales, and average total assets. Complete this question by entering your answers in the tabs below. Firm A has a margin of 13%, sales of $510,000, and ROI of 17%. Calculate the firm's average total assets. Note: Round your intermediate calculation to 1 decimal place

Firm B has net income of $74,000, asset turnover of 1.30 , and average total assets of $940,000. Calculate the firm's sales, margin, and ROI. Note: Round "Margin" and "ROI" answers to 1 decimal place. Firm C has net income of $134,000, asset turnover of 1.91 , and ROI of 23.20%. Calculate the firm's margin, sales, and average total assets. Note: Round "Margin" answer to 1 decimal place and use the rounded answer for the subsequent computations. Exercise 3-13 (Algo) ROI analysis using the DuPont model LO 3-3 Required: a. Firm A has a margin of 13%, sales of $510,000, and RO o of 17%. Calculate the firm's average total assets. b. Firm B has net income of $74,000, asset turnover of 1.30 , and average total assets of $940,000. Calculate the firm's sales, margin, and ROI. c. Firm C has net income of $134,000, asset turnover of 1.91 , and ROI of 23.20%. Calculate the firm's margin, sales, and average total assets. Complete this question by entering your answers in the tabs below. Firm A has a margin of 13%, sales of $510,000, and ROI of 17%. Calculate the firm's average total assets. Note: Round your intermediate calculation to 1 decimal place Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started