Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Firm B plans to acquire firm T. Both firms have no debt. B believes the acquisition will increase its total after-tax annual cash flow

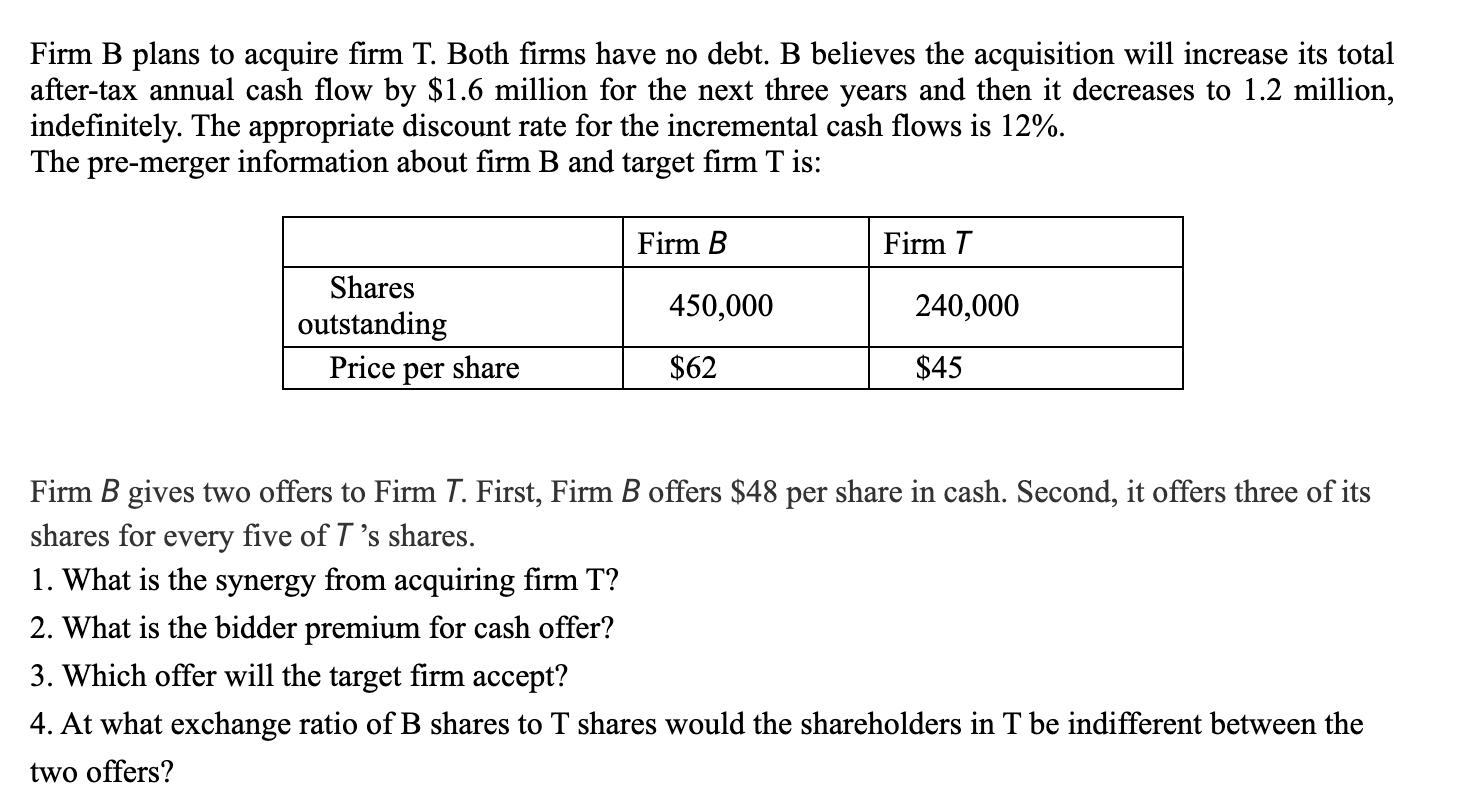

Firm B plans to acquire firm T. Both firms have no debt. B believes the acquisition will increase its total after-tax annual cash flow by $1.6 million for the next three years and then it decreases to 1.2 million, indefinitely. The appropriate discount rate for the incremental cash flows is 12%. The pre-merger information about firm B and target firm T is: Shares outstanding Price per share Firm B 450,000 $62 Firm T 240,000 $45 Firm B gives two offers to Firm T. First, Firm B offers $48 per share in cash. Second, it offers three of its shares for every five of T's shares. 1. What is the synergy from acquiring firm T? 2. What is the bidder premium for cash offer? 3. Which offer will the target firm accept? 4. At what exchange ratio of B shares to T shares would the shareholders in T be indifferent between the two offers?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Acquisition Analysis of Firm B and Firm T 1 Synergy from Acquiring Firm T Synergy refers to the additional value created by the merger that neither fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started