Answered step by step

Verified Expert Solution

Question

1 Approved Answer

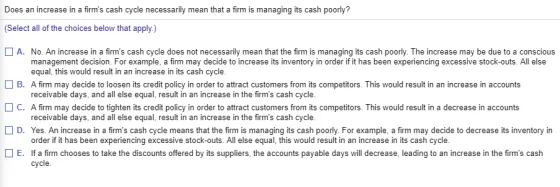

Does an increase in a firm's cash cycle necessarily mean that a firm is managing its cash poorly? (Select all of the choices below

Does an increase in a firm's cash cycle necessarily mean that a firm is managing its cash poorly? (Select all of the choices below that apply.) A. No. An increase in a firm's cash cycle does not necessarily mean that the firm is managing its cash poorly. The increase may be due to a conscious management decision. For example, a firm may decide to increase its inventory in order if it has been experiencing excessive stock-outs. All else equal, this would result in an increase in its cash cycle. B. A firm may decide to loosen its credit policy in order to attract customers from its competitors. This would result in an increase in accounts receivable days, and all else equal, result in an increase in the firm's cash cycle. C. A firm may decide to tighten its credit policy in order to attract customers from its competitors. This would result in a decrease in accounts receivable days, and all else equal, result in an increase in the firm's cash cycle D. Yes. An increase in a firm's cash cycle means that the firm is managing its cash poorly. For example, a firm may decide to decrease its inventory in order if it has been experiencing excessive stock-outs. All else equal, this would result in an increase in its cash cycle. E. If a firm chooses to take the discounts offered by its suppliers, the accounts payable days will decrease, leading to an increase in the firm's cash cycle.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Apply A No An increase in a firms cash cycle does not necessarily mean that the firm is managing its ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started