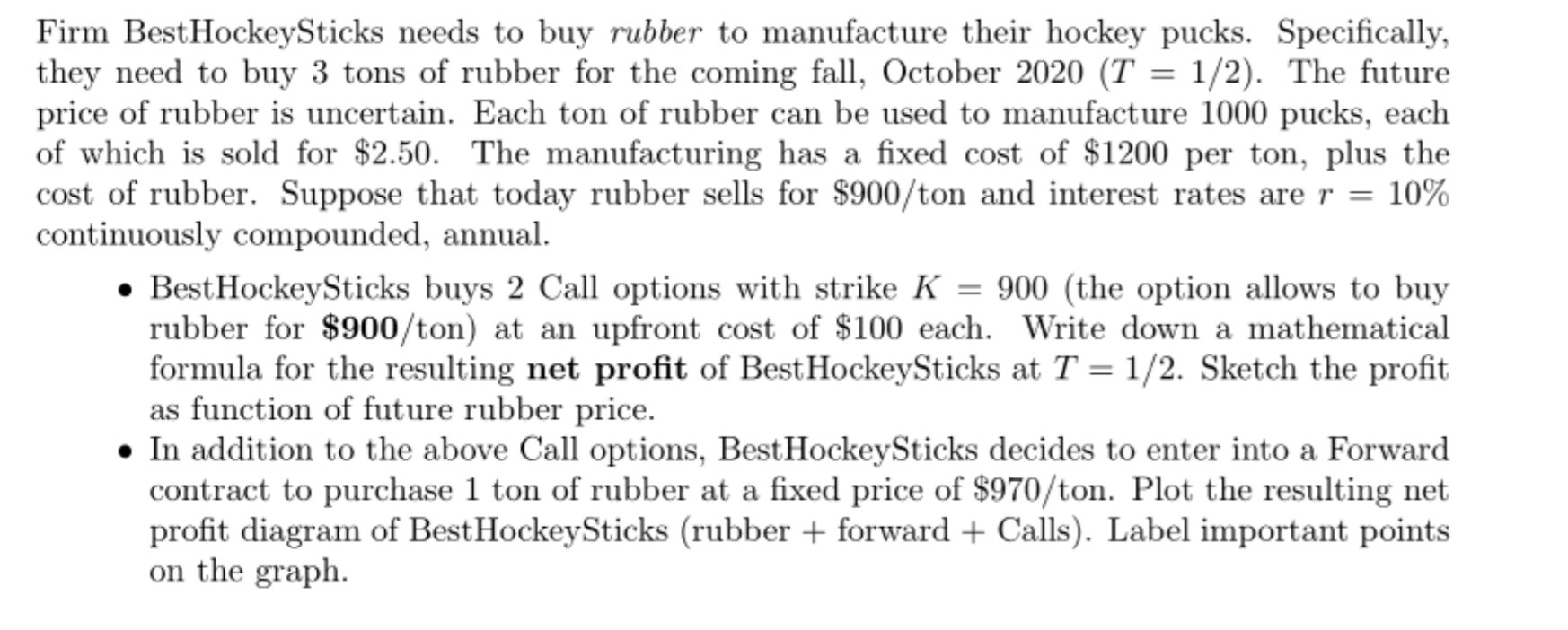

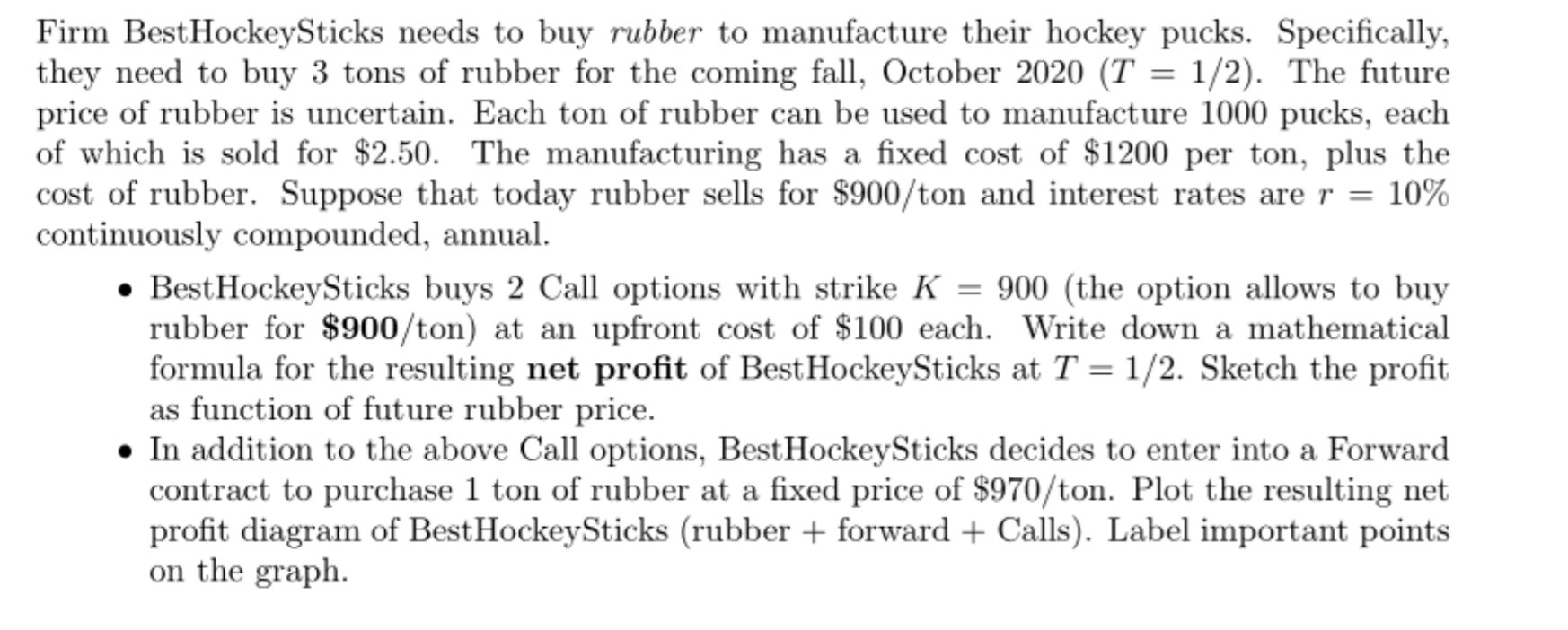

Firm Best HockeySticks needs to buy rubber to manufacture their hockey pucks. Specifically, they need to buy 3 tons of rubber for the coming fall, October 2020 (T = 1/2). The future price of rubber is uncertain. Each ton of rubber can be used to manufacture 1000 pucks, each of which is sold for $2.50. The manufacturing has a fixed cost of $1200 per ton, plus the cost of rubber. Suppose that today rubber sells for $900/ton and interest rates are r = 10% continuously compounded, annual. BestHockeySticks buys 2 Call options with strike K = 900 (the option allows to buy rubber for $900/ton) at an upfront cost of $100 each. Write down a mathematical formula for the resulting net profit of Best HockeySticks at T = 1/2. Sketch the profit as function of future rubber price. In addition to the above Call options, Best Hockey Sticks decides to enter into a Forward contract to purchase 1 ton of rubber at a fixed price of $970/ton. Plot the resulting net profit diagram of Best Hockey Sticks (rubber + forward + Calls). Label important points on the graph. Firm Best HockeySticks needs to buy rubber to manufacture their hockey pucks. Specifically, they need to buy 3 tons of rubber for the coming fall, October 2020 (T = 1/2). The future price of rubber is uncertain. Each ton of rubber can be used to manufacture 1000 pucks, each of which is sold for $2.50. The manufacturing has a fixed cost of $1200 per ton, plus the cost of rubber. Suppose that today rubber sells for $900/ton and interest rates are r = 10% continuously compounded, annual. BestHockeySticks buys 2 Call options with strike K = 900 (the option allows to buy rubber for $900/ton) at an upfront cost of $100 each. Write down a mathematical formula for the resulting net profit of Best HockeySticks at T = 1/2. Sketch the profit as function of future rubber price. In addition to the above Call options, Best Hockey Sticks decides to enter into a Forward contract to purchase 1 ton of rubber at a fixed price of $970/ton. Plot the resulting net profit diagram of Best Hockey Sticks (rubber + forward + Calls). Label important points on the graph