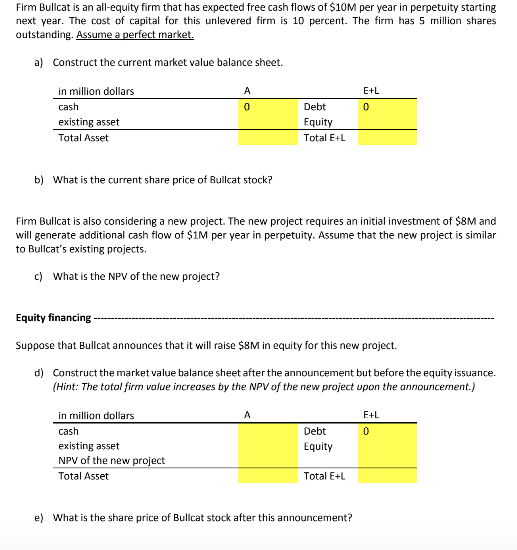

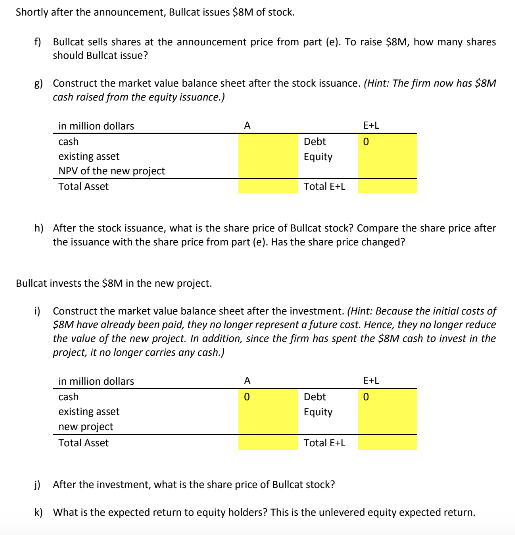

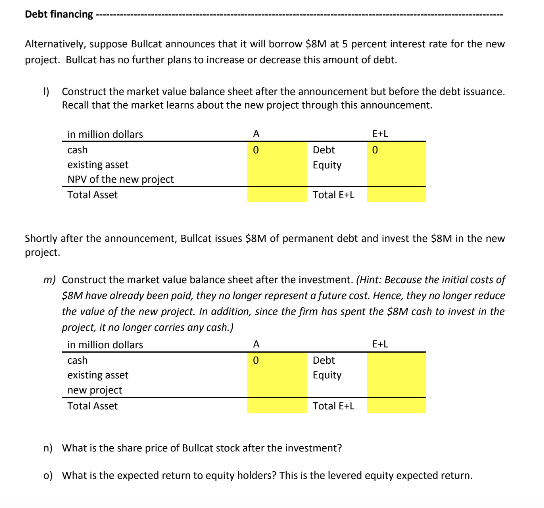

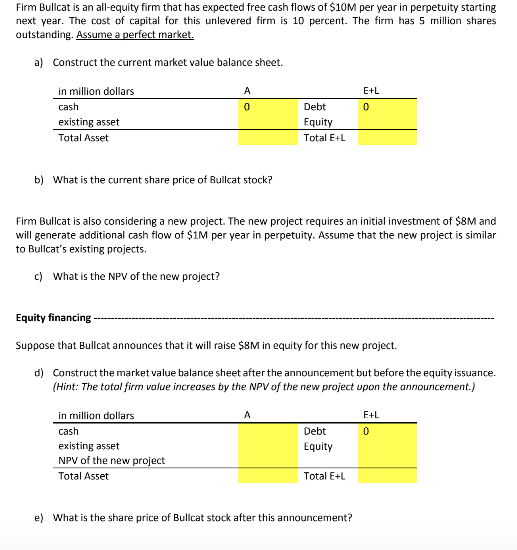

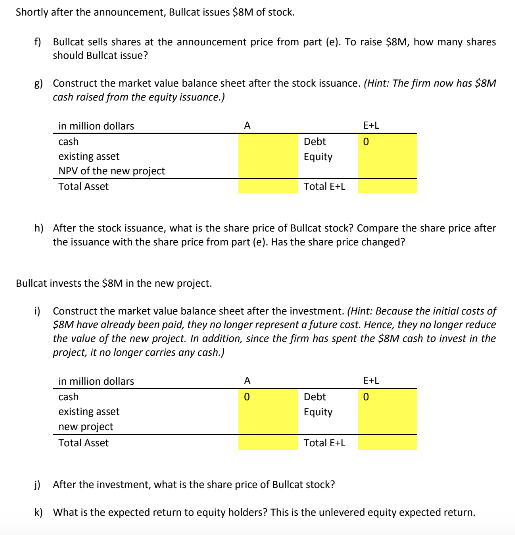

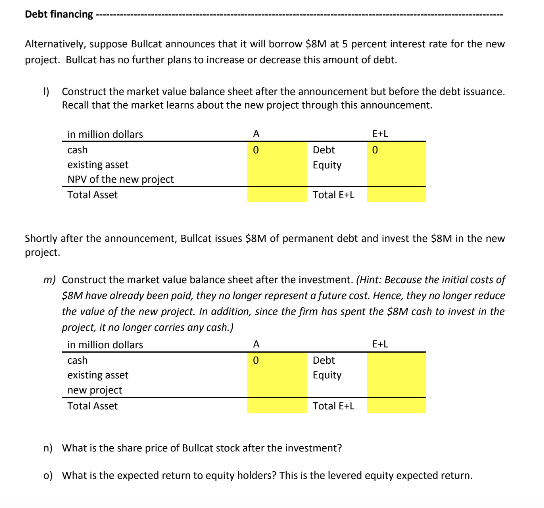

Firm Bullcat is an all-equity firm that has expected free cash flows of $10M per year in perpetuity starting next year. The cost of capital for this unlevered firm is 10 percent. The firm has 5 million shares outstanding. a) Construct the current market value balance sheet. in million dollars cash existing asset Total Asset E+L Debt Equity Total E+L b) What is the current share price of Bullcat stock? Firm Bullcat is also considering a new project. The new project requires an initial investment of $8M and will generate additional cash flow of $1M per year in perpetuity. Assume that the new project is similar to Bullcat's existing projects. c) What is the NPV of the new project? Equity financing Suppose that Bullcat announces that it will raise $8M in equity for this new project. d) Construct the market value balance sheet after the announcement but before the equity issuance. (Hint: The total firm value increases by the NPV of the new project upon the announcement.) E+L in million dollars cash existing asset NPV of the new project Total Asset Debt Equity Total E+L e) What is the share price of Bullcat stock after this announcement? Shortly after the announcement, Bullcat issues $8M of stock f Bullcat sells shares at the announcement price from part (e). To raise $8M, how many shares should Bullcat issue? Construct the market value balance sheet after the stock issuance. (Hint: The firm now has $8M cash raised from the e 8) quity issuonce.) E+L in million dollars cash existing asset NPV of the new project Total Asset Debt Equity Total E+L h) After the stock issuance, what is the share price of Bullcat stock? Compare the share price after the issuance with the share price from part (e). Has the share price changed? Bullcat invests the $8M in the new project i) Construct the market value balance sheet after the investment. (Hint: Because the initial costs of S8M have olready been poid, they no longer represent a future cost. Hence, they no longer reduce the value of the new project. In addition, since the firm has spent the S8M cash to invest in the project, it no longer corries any cash.) in million dollars cash existing asset new project Total Asset E+L Debt Equity Total E+L i) After the investment, what is the share price of Bullcat stock? k) What is the expected return to equity holders? This is the unlevered equity expected return Firm Bullcat is an all-equity firm that has expected free cash flows of $10M per year in perpetuity starting next year. The cost of capital for this unlevered firm is 10 percent. The firm has 5 million shares outstanding. a) Construct the current market value balance sheet. in million dollars cash existing asset Total Asset E+L Debt Equity Total E+L b) What is the current share price of Bullcat stock? Firm Bullcat is also considering a new project. The new project requires an initial investment of $8M and will generate additional cash flow of $1M per year in perpetuity. Assume that the new project is similar to Bullcat's existing projects. c) What is the NPV of the new project? Equity financing Suppose that Bullcat announces that it will raise $8M in equity for this new project. d) Construct the market value balance sheet after the announcement but before the equity issuance. (Hint: The total firm value increases by the NPV of the new project upon the announcement.) E+L in million dollars cash existing asset NPV of the new project Total Asset Debt Equity Total E+L e) What is the share price of Bullcat stock after this announcement? Shortly after the announcement, Bullcat issues $8M of stock f Bullcat sells shares at the announcement price from part (e). To raise $8M, how many shares should Bullcat issue? Construct the market value balance sheet after the stock issuance. (Hint: The firm now has $8M cash raised from the e 8) quity issuonce.) E+L in million dollars cash existing asset NPV of the new project Total Asset Debt Equity Total E+L h) After the stock issuance, what is the share price of Bullcat stock? Compare the share price after the issuance with the share price from part (e). Has the share price changed? Bullcat invests the $8M in the new project i) Construct the market value balance sheet after the investment. (Hint: Because the initial costs of S8M have olready been poid, they no longer represent a future cost. Hence, they no longer reduce the value of the new project. In addition, since the firm has spent the S8M cash to invest in the project, it no longer corries any cash.) in million dollars cash existing asset new project Total Asset E+L Debt Equity Total E+L i) After the investment, what is the share price of Bullcat stock? k) What is the expected return to equity holders? This is the unlevered equity expected return