Answered step by step

Verified Expert Solution

Question

1 Approved Answer

firm had the following values for the four debt ratios discussed in the chapter: Liabilities to Assets Ratio: less than 1.0 Liabilities to Shareholders' Equity

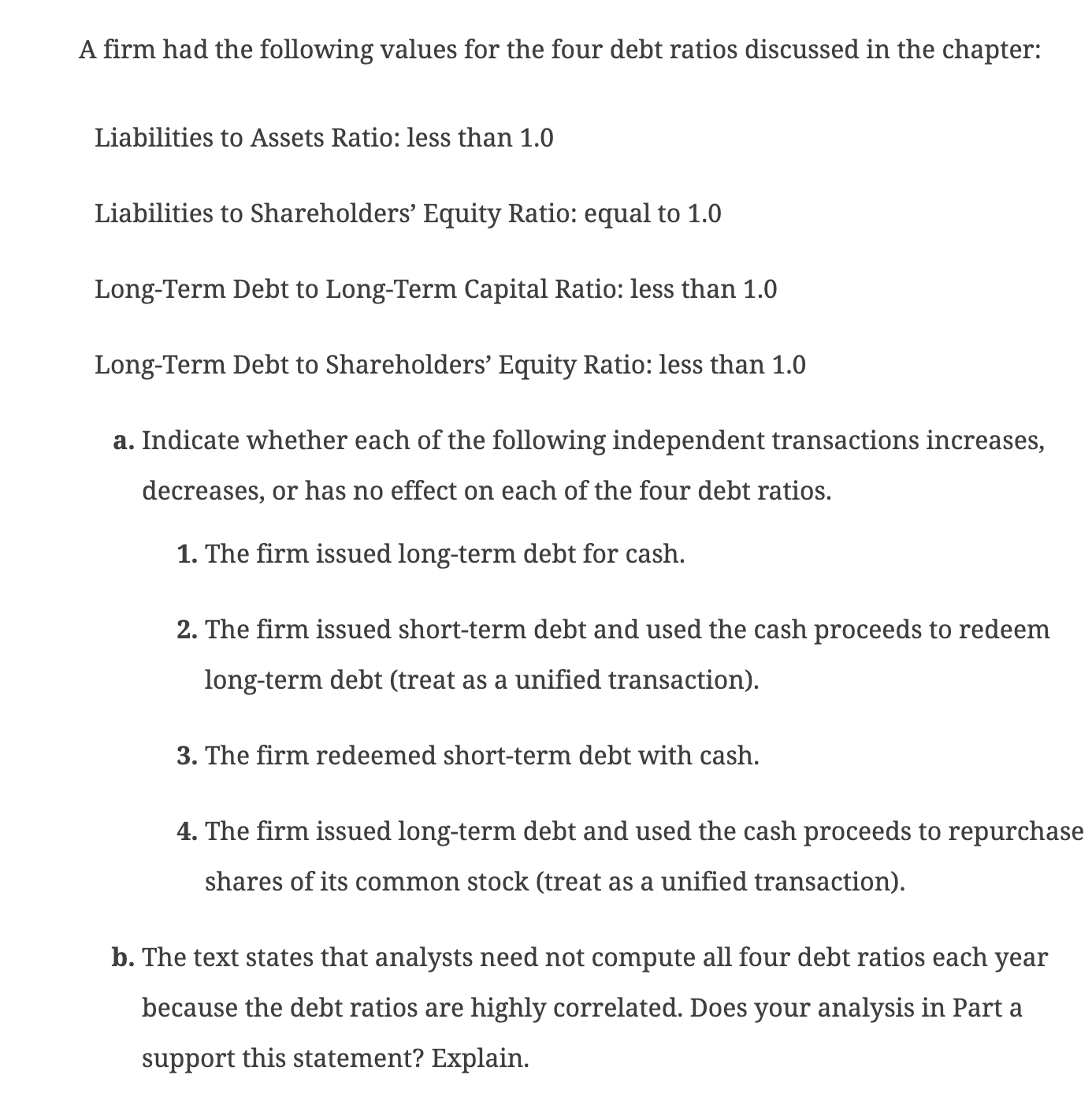

firm had the following values for the four debt ratios discussed in the chapter: Liabilities to Assets Ratio: less than 1.0 Liabilities to Shareholders' Equity Ratio: equal to 1.0 Long-Term Debt to Long-Term Capital Ratio: less than 1.0 Long-Term Debt to Shareholders Equity Ratio: less than 1.0 a. Indicate whether each of the following independent transactions increases, decreases, or has no effect on each of the four debt ratios. 1. The firm issued long-term debt for cash. 2. The firm issued short-term debt and used the cash proceeds to redeem long-term debt (treat as a unified transaction). 3. The firm redeemed short-term debt with cash. 4. The firm issued long-term debt and used the cash proceeds to repurchas shares of its common stock (treat as a unified transaction). b. The text states that analysts need not compute all four debt ratios each year because the debt ratios are highly correlated. Does your analysis in Part a support this statement? Explain

firm had the following values for the four debt ratios discussed in the chapter: Liabilities to Assets Ratio: less than 1.0 Liabilities to Shareholders' Equity Ratio: equal to 1.0 Long-Term Debt to Long-Term Capital Ratio: less than 1.0 Long-Term Debt to Shareholders Equity Ratio: less than 1.0 a. Indicate whether each of the following independent transactions increases, decreases, or has no effect on each of the four debt ratios. 1. The firm issued long-term debt for cash. 2. The firm issued short-term debt and used the cash proceeds to redeem long-term debt (treat as a unified transaction). 3. The firm redeemed short-term debt with cash. 4. The firm issued long-term debt and used the cash proceeds to repurchas shares of its common stock (treat as a unified transaction). b. The text states that analysts need not compute all four debt ratios each year because the debt ratios are highly correlated. Does your analysis in Part a support this statement? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started