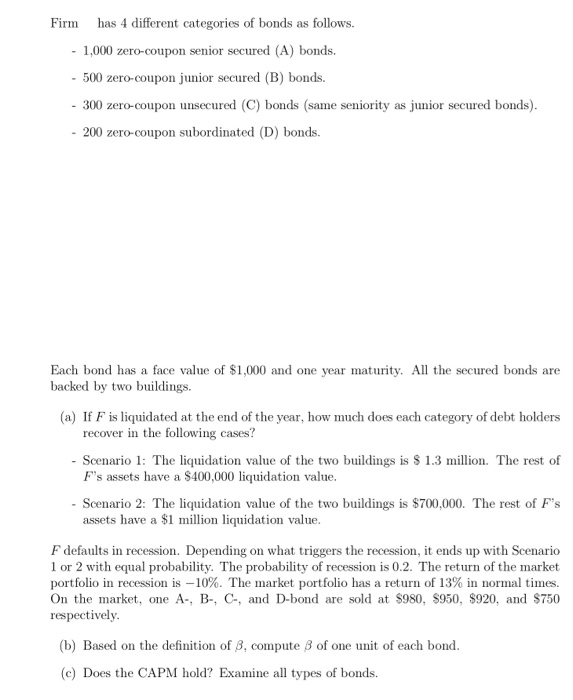

Firm has 4 different categories of bonds as follows. - 1,000 zero-coupon senior secured (A) bonds. - 500 zero-coupon junior secured (B) bonds. - 300 zero-coupon unsecured (C) bonds (same seniority as junior secured bonds). - 200 zero-coupon subordinated (D) bonds. Each bond has a face value of $1,000 and one year maturity. All the secured bonds are backed by two buildings. (a) If F is liquidated at the end of the year, how much does each category of debt holders recover in the following cases? Scenario 1: The liquidation value of the two buildings is $ 1.3 million. The rest of F's assets have a $400,000 liquidation value. - Scenario 2: The liquidation value of the two buildings is $700,000. The rest of F's assets have a $1 million liquidation value. F defaults in recession. Depending on what triggers the recession, it ends up with Scenario 1 or 2 with equal probability. The probability of recession is 0.2. The return of the market portfolio in recession is -10%. The market portfolio has a return of 13% in normal times. On the market, one A-, B-, C-, and D-bond are sold at $980, $950, $920, and $750 respectively. (b) Based on the definition of 8, compute 8 of one unit of each bond. (e) Does the CAPM hold? Examine all types of bonds. Firm has 4 different categories of bonds as follows. - 1,000 zero-coupon senior secured (A) bonds. - 500 zero-coupon junior secured (B) bonds. - 300 zero-coupon unsecured (C) bonds (same seniority as junior secured bonds). - 200 zero-coupon subordinated (D) bonds. Each bond has a face value of $1,000 and one year maturity. All the secured bonds are backed by two buildings. (a) If F is liquidated at the end of the year, how much does each category of debt holders recover in the following cases? Scenario 1: The liquidation value of the two buildings is $ 1.3 million. The rest of F's assets have a $400,000 liquidation value. - Scenario 2: The liquidation value of the two buildings is $700,000. The rest of F's assets have a $1 million liquidation value. F defaults in recession. Depending on what triggers the recession, it ends up with Scenario 1 or 2 with equal probability. The probability of recession is 0.2. The return of the market portfolio in recession is -10%. The market portfolio has a return of 13% in normal times. On the market, one A-, B-, C-, and D-bond are sold at $980, $950, $920, and $750 respectively. (b) Based on the definition of 8, compute 8 of one unit of each bond. (e) Does the CAPM hold? Examine all types of bonds