Answered step by step

Verified Expert Solution

Question

1 Approved Answer

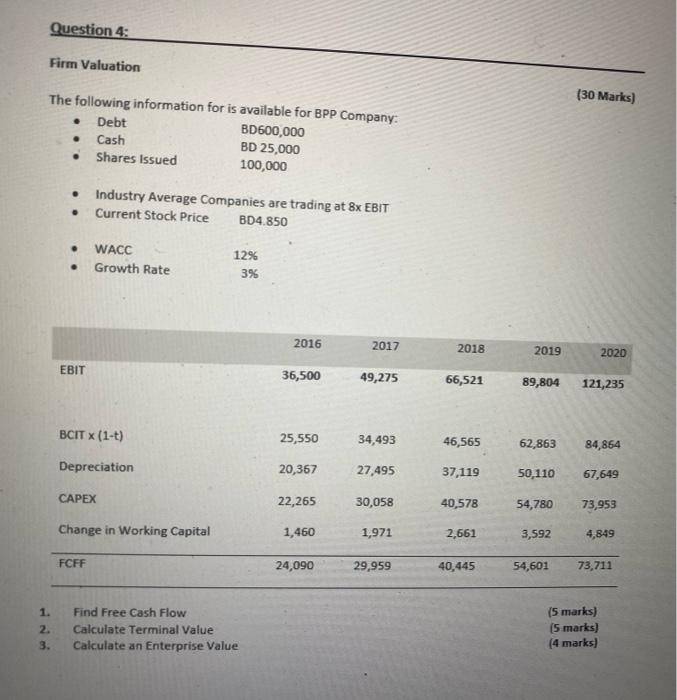

Firm valuation related question Question 4: Firm Valuation (30 Marks) The following information for is available for BPP Company: Debt BD600,000 Cash BD 25,000 Shares

Firm valuation related question

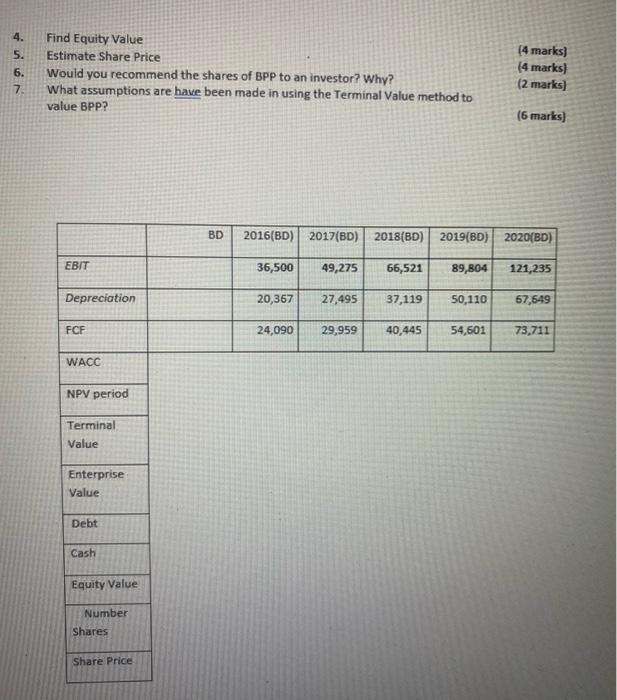

Question 4: Firm Valuation (30 Marks) The following information for is available for BPP Company: Debt BD600,000 Cash BD 25,000 Shares Issued 100,000 . Industry Average Companies are trading at 8x EBIT . Current Stock Price BD4.850 . WACC Growth Rate . 12% 3% 2016 2017 2018 2019 2020 EBIT 36,500 49,275 66,521 89,804 121,235 BCIT (1-t) 25,550 34,493 46,565 62,863 84,864 Depreciation 20,367 27,495 37,119 50,110 67,649 CAPEX 22,265 30,058 40,578 54,780 73,953 Change in Working Capital 1,460 1,971 2,661 3,592 4,849 FCFF 24,090 29,959 40,445 54,601 73,711 1. 2. 3. Find Free Cash Flow Calculate Terminal Value Calculate an Enterprise Value (5 marks) (5 marks) (4 marks) 5. & non Find Equity Value Estimate Share Price Would you recommend the shares of BPP to an investor? Why? What assumptions are have been made in using the Terminal Value method to value BPP? (4 marks) (4 marks) (2 marks) 7 (6 marks) BD 2016(BD) 2017(BD) 2018(BD) 2019(BD) 2020(BD) EBIT 36,500 49,275 66,521 89,804 121,235 Depreciation 20,367 27,495 37,119 50,110 67,549 FCF 24,090 29,959 40,445 54,601 73,711 WACC NPV period Terminal Value Enterprise Value Debt Cash Equity Value Number Shares Share Price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started