Answered step by step

Verified Expert Solution

Question

1 Approved Answer

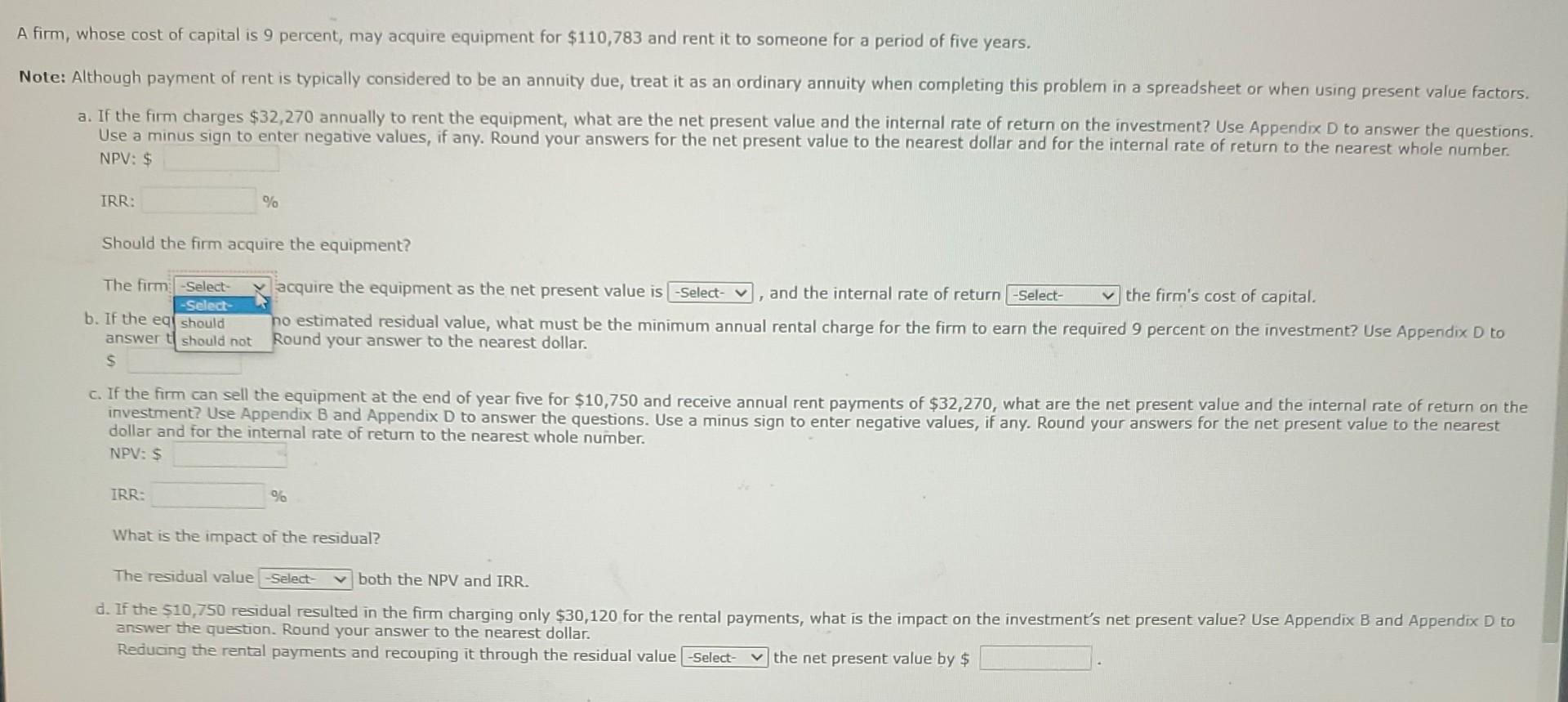

firm, whose cost of capital is 9 percent, may acquire equipment for $110,783 and rent it to someone for a period of five years. NPV:

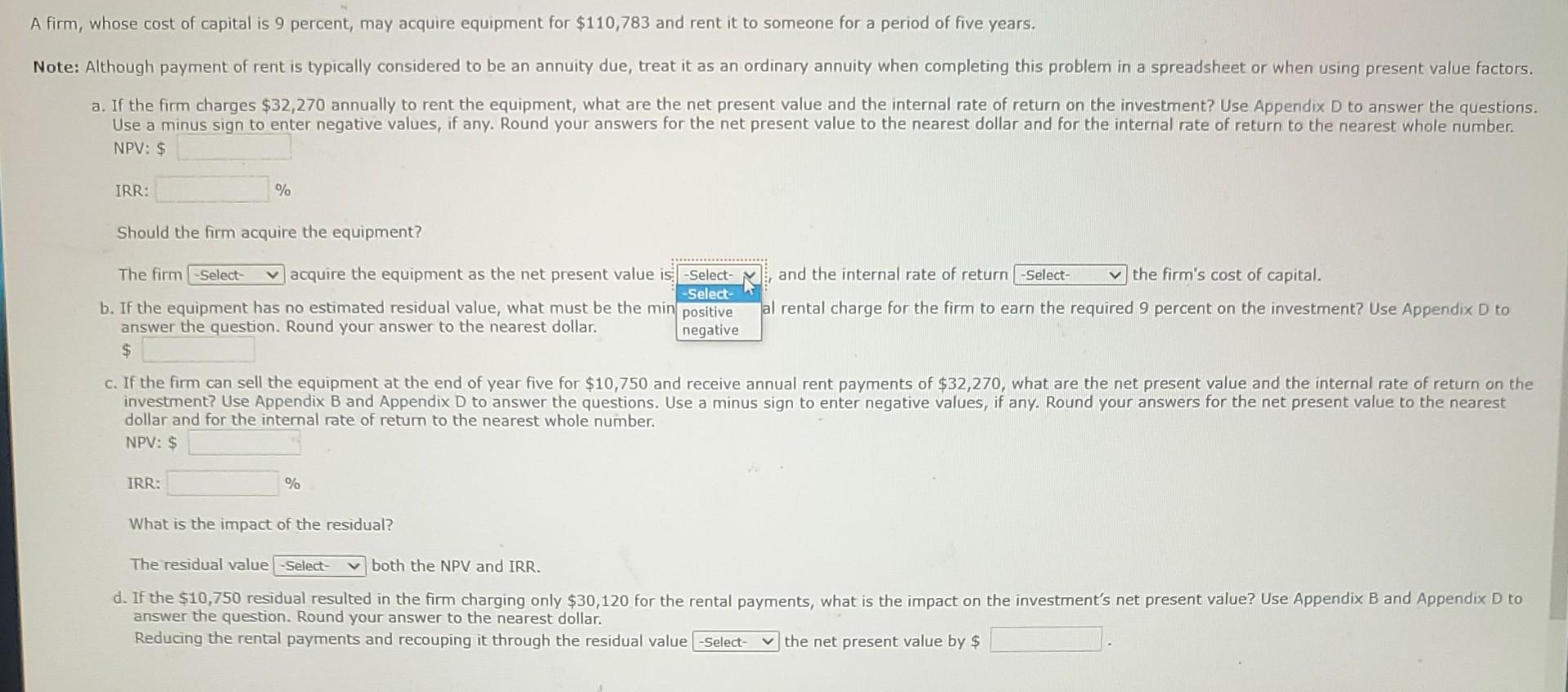

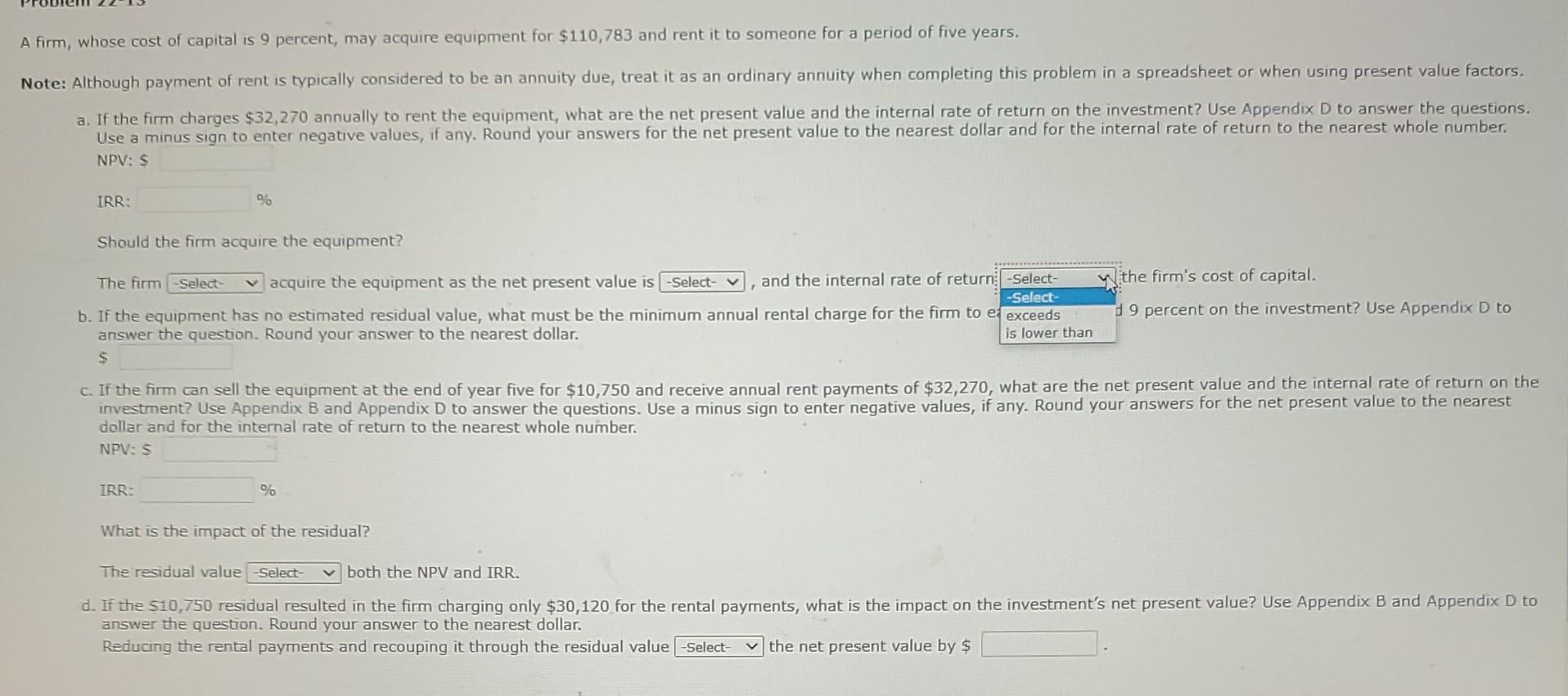

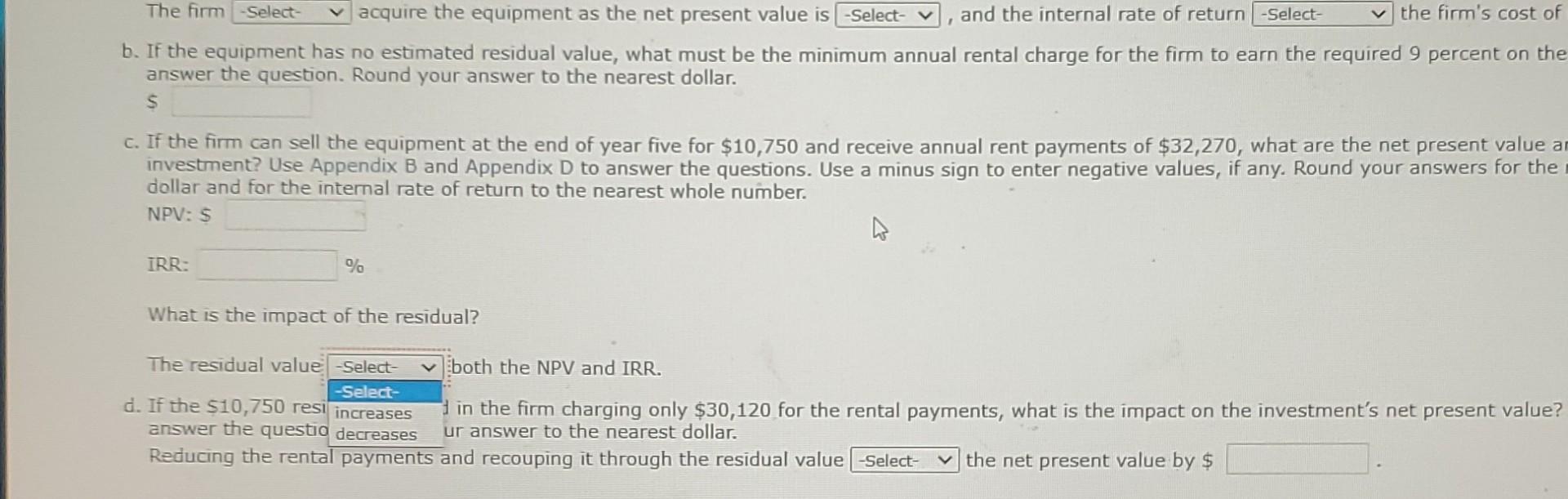

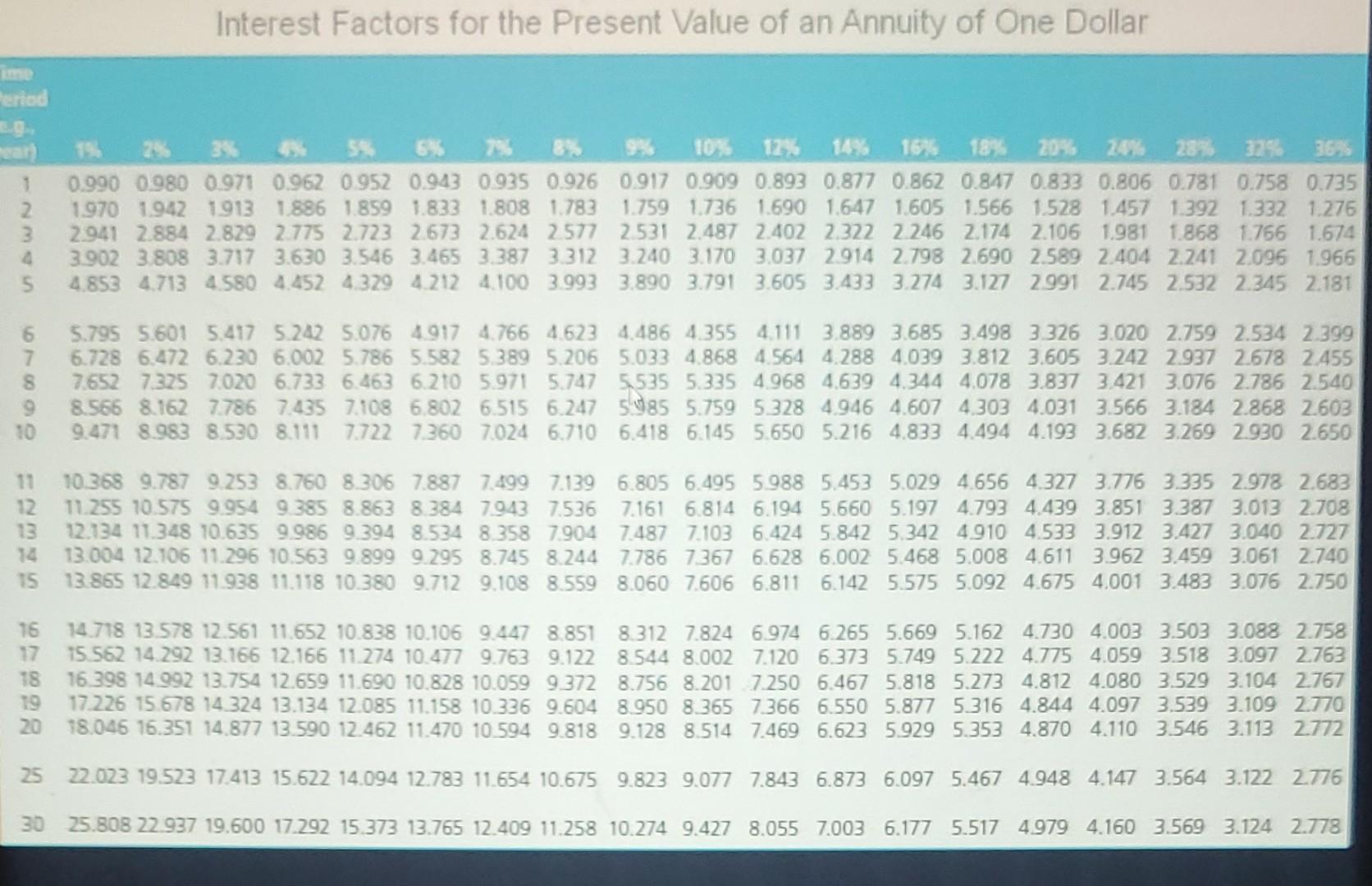

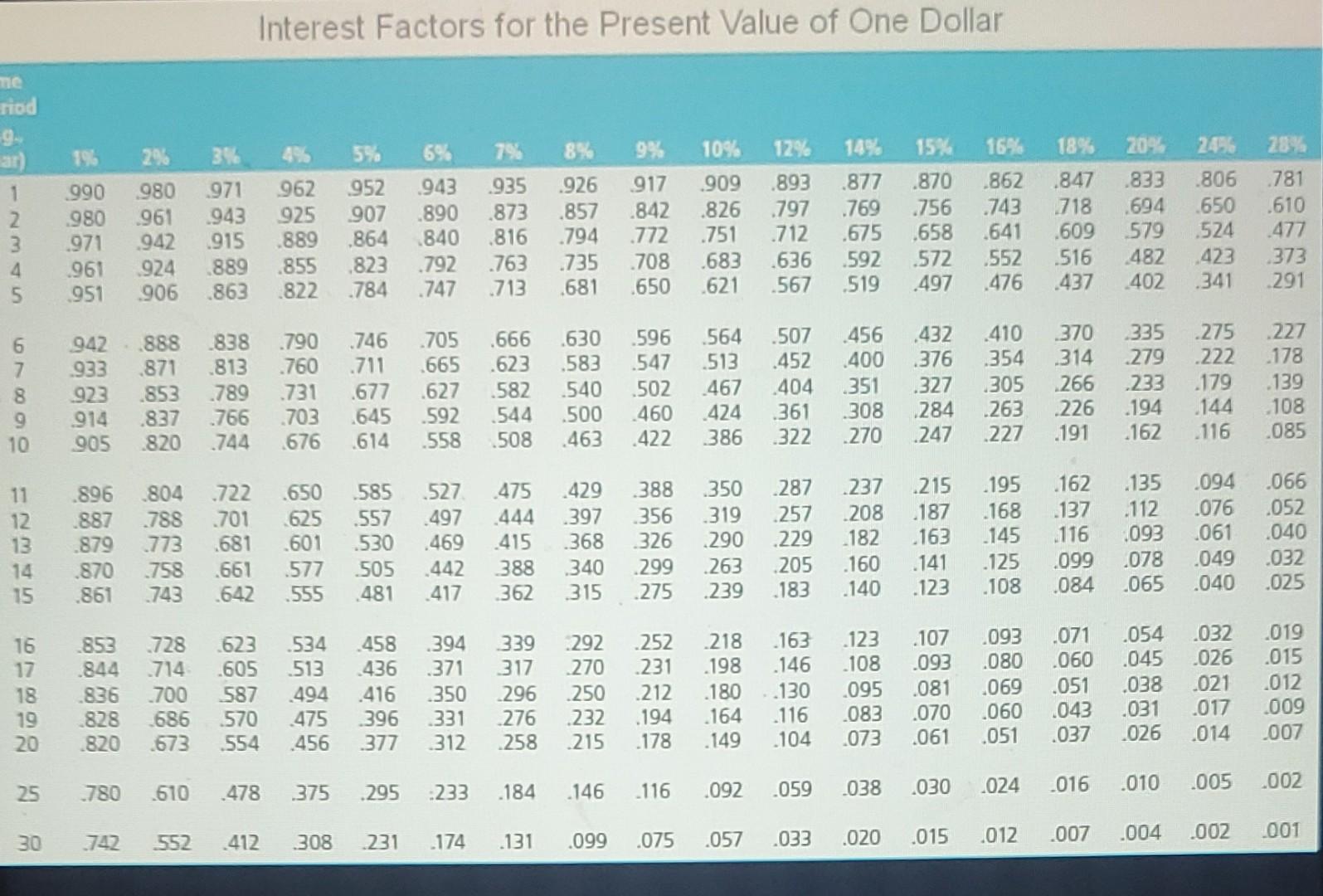

firm, whose cost of capital is 9 percent, may acquire equipment for $110,783 and rent it to someone for a period of five years. NPV: $ IRR: Should the firm acquire the equipment? answer t Round your answer to the nearest dollar. dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: What is the impact of the residual? The residual value both the NPV and IRR. answer the question. Round your answer to the nearest dollar. Reduang the rental payments and recouping it through the residual value the net present value by $ A firm, whose cost of capital is 9 percent, may acquire equipment for $110,783 and rent it to someone for a period of five years. NPV: $ IRR: % Should the firm acquire the equipment? The firm -Select- acquire the equipment as the net present value is $ dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: % What is the impact of the residual? The residual value Select- both the NPV and IRR. answer the question. Round your answer to the nearest dollar. Reducing the rental payments and recouping it through the residual value -select- the net present value by $ A firm, whose cost of capital is 9 percent, may acquire equipment for $110,783 and rent it to someone for a period of five years. NPV: $ IRR: Should the firm acquire the equipment? $ dollar and for the internal rate of return to the nearest whole number. NPV: 5 IRR: % What is the impact of the residual? The residual value - Select- v both the NPV and IRR. answer the question. Round your answer to the nearest dollar. Reducing the rental payments and recouping it through the residual value -Select- the net present value by $ The firm acquire the equipment as the net present value is , and the internal rate of return the firm's cost of b. If the equipment has no estimated residual value, what must be the minimum annual rental charge for the firm to earn the required 9 percent on the answer the question. Round your answer to the nearest dollar. $ c. If the firm can sell the equipment at the end of year five for $10,750 and receive annual rent payments of $32,270, what are the net present value al investment? Use Appendix B and Appendix D to answer the questions. Use a minus sign to enter negative values, if any. Round your answers for the dollar and for the internal rate of return to the nearest whole number. NPV: $ IRR: What is the impact of the residual? The residual value both the NPV and IRR. d. If the $10,750 resi in the firm charging only $30,120 for the rental payments, what is the impact on the investment's net present value? answer the questic ueueases ur answer to the nearest dollar. Reducing the rental payments and recouping it through the residual value the net present value by $ the firm charging only $30,120 for the rental payments, what is the impact on the investment's ne answer to the nearest dollar. recouping it through the residual value the net present value by $ Interest Factors for the Present Value of an Annuity of One Dollar Interest Factors for the Present Value of One Dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started