Answered step by step

Verified Expert Solution

Question

1 Approved Answer

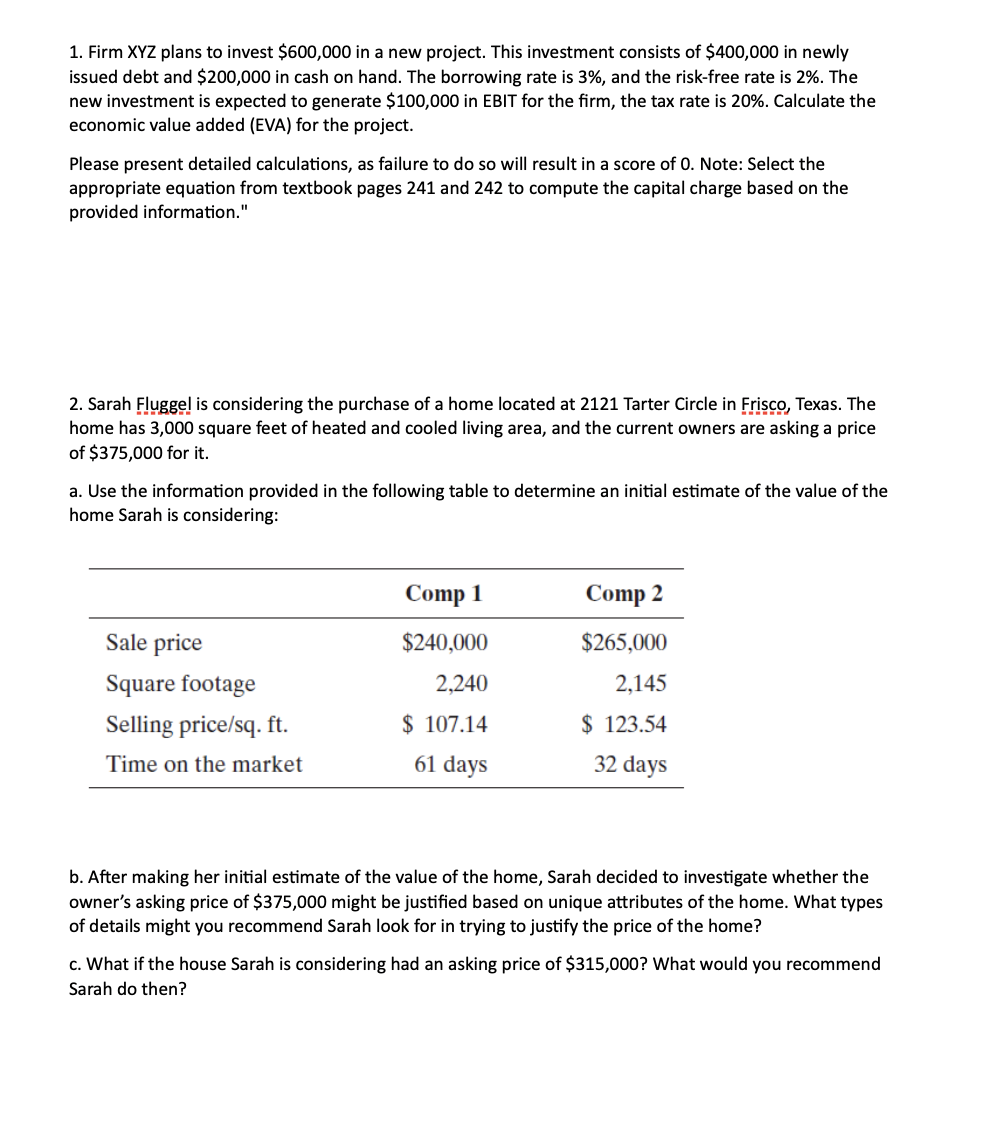

Firm XYZ plans to invest $ 6 0 0 , 0 0 0 in a new project. This investment consists of $ 4 0 0

Firm XYZ plans to invest $ in a new project. This investment consists of $ in newly

issued debt and $ in cash on hand. The borrowing rate is and the riskfree rate is The

new investment is expected to generate $ in EBIT for the firm, the tax rate is Calculate the

economic value added EVA for the project.

Please present detailed calculations, as failure to do so will result in a score of Note: Select the

appropriate equation from textbook pages and to compute the capital charge based on the

provided information."

Sarah Fluggel is considering the purchase of a home located at Tarter Circle in Frisco, Texas. The

home has square feet of heated and cooled living area, and the current owners are asking a price

of $ for it

a Use the information provided in the following table to determine an initial estimate of the value of the

home Sarah is considering:

b After making her initial estimate of the value of the home, Sarah decided to investigate whether the

owner's asking price of $ might be justified based on unique attributes of the home. What types

of details might you recommend Sarah look for in trying to justify the price of the home?

c What if the house Sarah is considering had an asking price of $ What would you recommend

Sarah do then?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started