Question

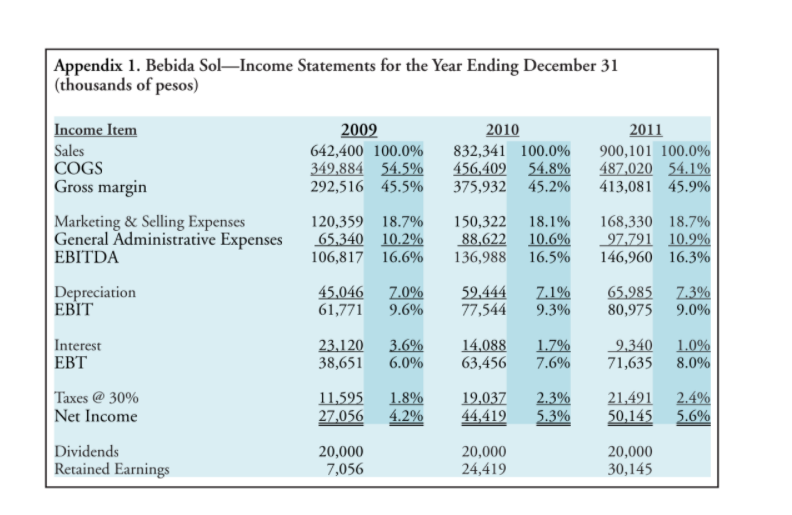

First add these assumptions to the Income statement and balance. Then work through the discounted cash flow analysis. The soft drink market in Mexico is

-

First add these assumptions to the Income statement and balance. Then work through the discounted cash flow analysis.

-

The soft drink market in Mexico is growing at a compounded annual rate of 6.3% (4.5% CAGR from volume & 1.7% CAGR from price ). Bebida Sol will hope, and lets assume, that if Hola-Kola is launched it will experience annual volume (liters) increases of 3.75% in years 2 through 5, and annual price (pesos) increases of 1.25% in years 2 through 5.

-

Bebida Sol will instead purchase new machinery with an all-in cost of 54 million pesos. The maximum production capacity of this new machinery is 775,000 liters per month. This machinery will be depreciated straight-line to zero value over 5 years, and at the end of year 5 this machinery is expected to sell for 4.4 million pesos.

-

The estimated annual increase in business space rental costs is 3.7% in years 2 through 5.

-

The estimated annual increase in operating costs in years 2 through 5 is 1.3% for raw materials, 2.5% for labor, and 2.6% for energy.

-

General, administrative, and selling expenses will experience an annual increase of 3.4% in years 2 through 5.

-

The cost allocation by the accounting department of 1.5% of sales is to create fully-burdened income statements for each product family. This allocation does not involve any expenditure of pesos.

-

Any erosion that Hola-Kola generates from Bebida Sols existing product lines will likely also increase every year. Our estimate is the annual increase in erosion is 3.3%.

-

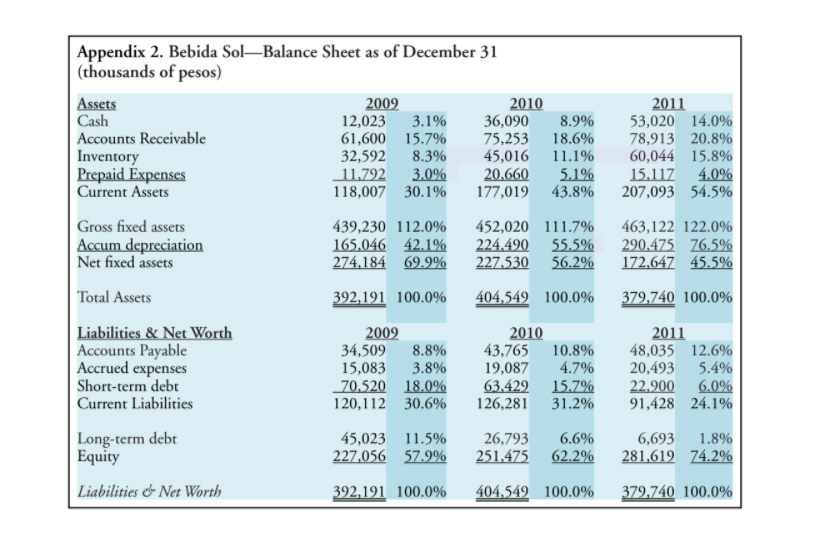

All working capital accounts discussed in page 4 of the case text will increase in year 1 through 4, to maintain the same relationship to raw materials, sales revenue, and purchases from vendors (all for raw materials), as stated in the relevant paragraph. Remember NWC balances at the end of year 0 support year 1 operations. Year 1 support year 2 operations, and so on.

As you work through your discounted cash flow analysis of Hola-Kola, be sure to answer the following questions:

-

What are the investment cash outflows for Hola-Kola (years 0 through 4)?

-

What are the operating cash inflows for Hola-Kola (years 1 through 5)?

-

What are the terminal cash flows for Hola-Kola (year 5)?

-

What are the total incremental cash flows for Hola-Kola (years 0 through 5)?

-

What is the payback period, net present value, and internal rate of return from Hola-Kola?

-

Should owner/CEO Antonio Ortega accept or reject the Hola-Kola proposal?

-

Suppose another competitor in carbonated soft drinks, who competes in the same market niche as Bebida Sol, is also considering an investment in a zero-calorie carbonate. What impact should this knowledge have on the net present value of Hola-Kola? I am looking for a precise peso amount here. It should take you about 6 minutes to get your solution; 5 minutes to figure it out and 1 minute to calculate the precise peso amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started