Answered step by step

Verified Expert Solution

Question

1 Approved Answer

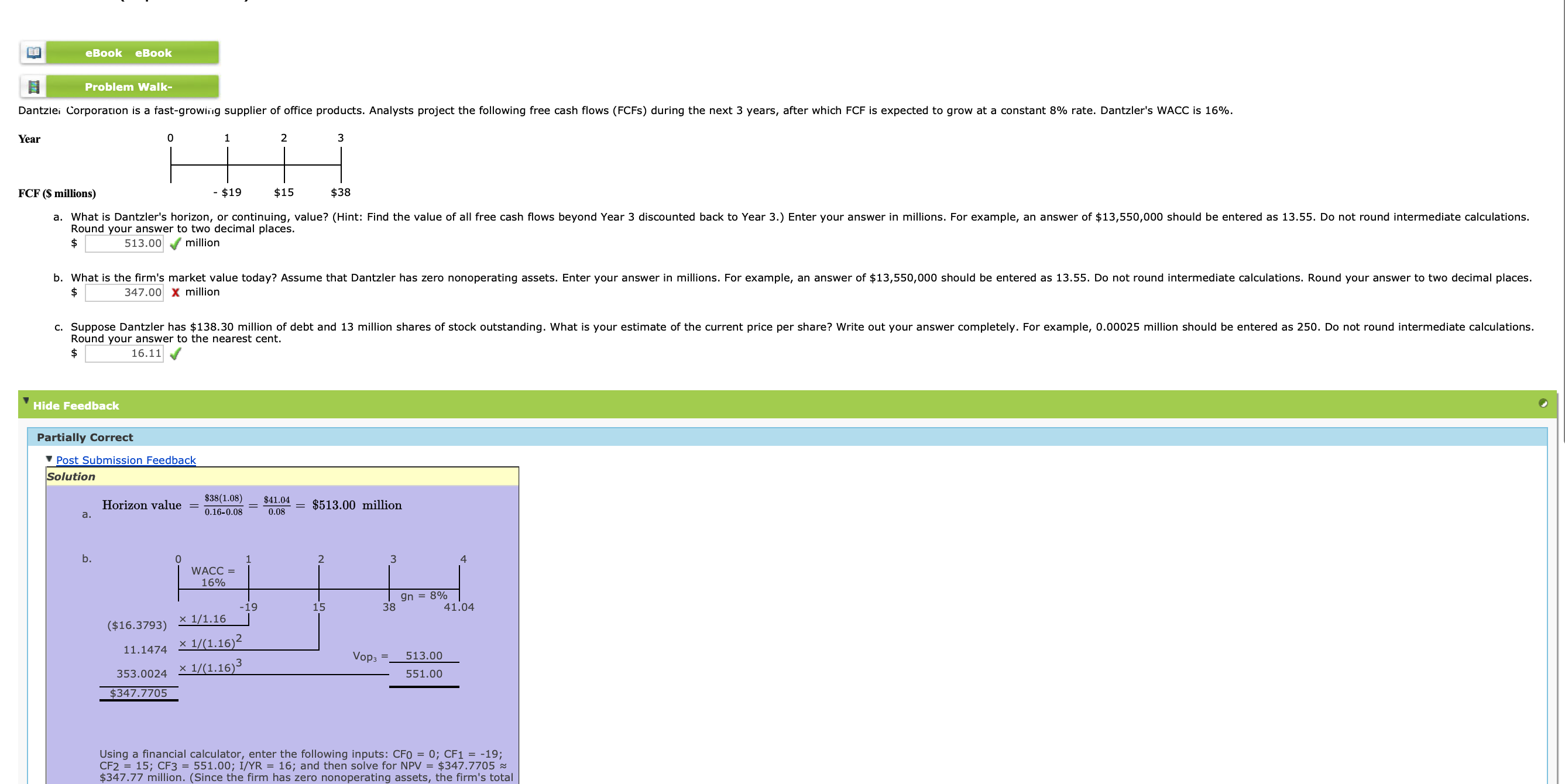

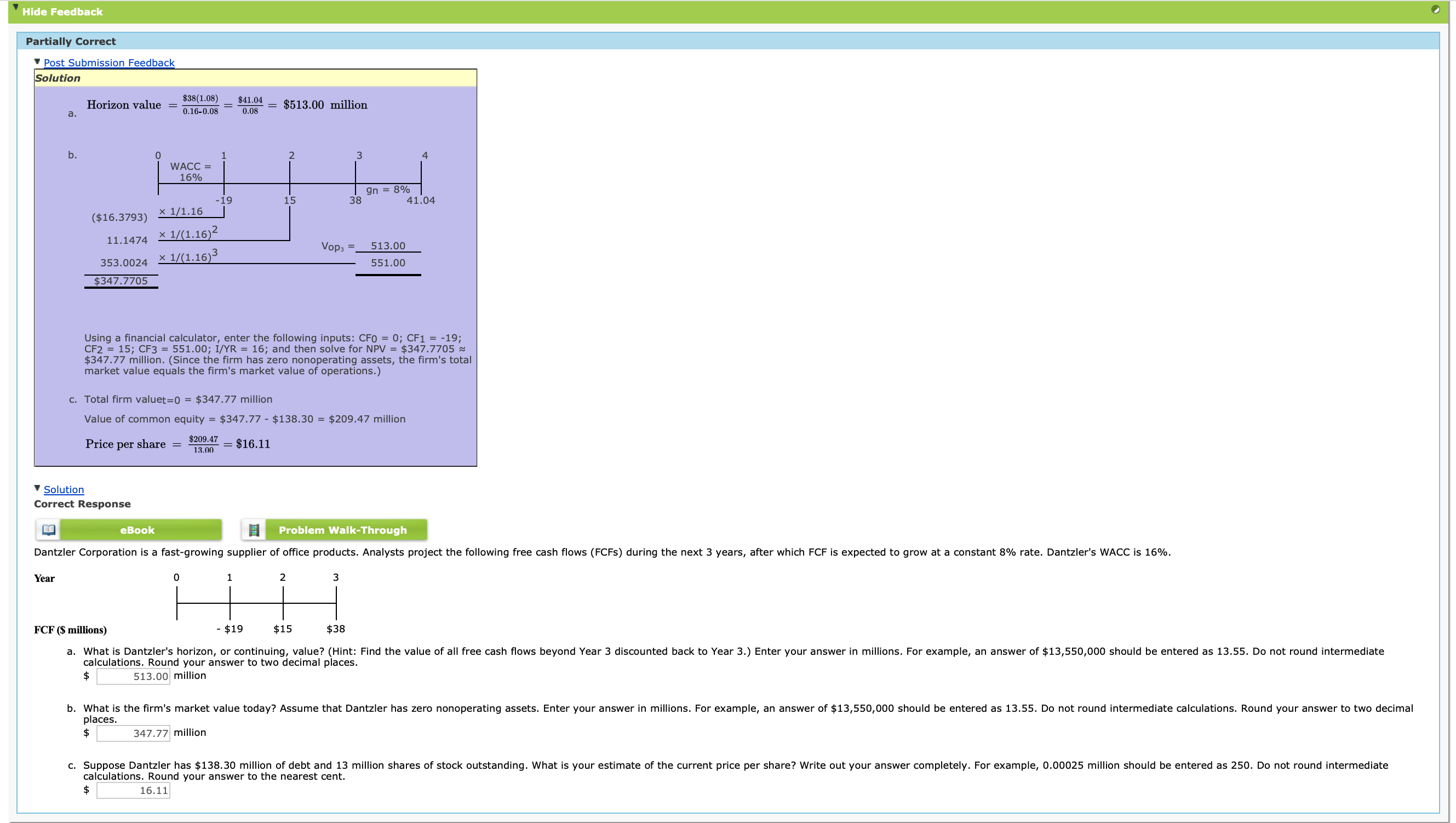

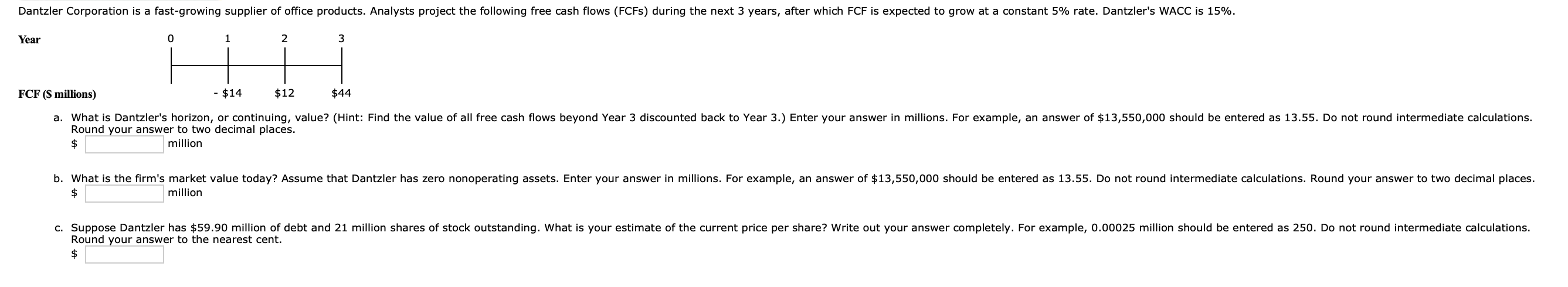

first and second picture Attached below is what i previosuly got wrong they show you the formula to follow then the third picture is what

first and second picture Attached below is what i previosuly got wrong they show you the formula to follow then the third picture is what i need solving. thanks

Using a financial calculator, enter the following inputs: CF0=0; CF1 =19; CF2=15;CF3=551.00; I /YR=16; and then solve for NPV =$347.7705 $347.77 million. (Since the firm has zero nonoperating assets, the firm's total market value equals the firm's market value of operations.) c. Total firm valuet =0=$347.77 million Value of common equity =$347.77$138.30=$209.47 million Price per share =13.00$209.47=$16.11 Solution Correct Response Year FCF (\$ millions) calculations. Round vour answer to two decimal places. $ calculations. Round vour places. $347.77 million calculations. Round your answer to the nearest cent. CF (\$ millions) Rnind voir anciwer to two decimal places. \$ million million Round vour answer to the nearest cent

Using a financial calculator, enter the following inputs: CF0=0; CF1 =19; CF2=15;CF3=551.00; I /YR=16; and then solve for NPV =$347.7705 $347.77 million. (Since the firm has zero nonoperating assets, the firm's total market value equals the firm's market value of operations.) c. Total firm valuet =0=$347.77 million Value of common equity =$347.77$138.30=$209.47 million Price per share =13.00$209.47=$16.11 Solution Correct Response Year FCF (\$ millions) calculations. Round vour answer to two decimal places. $ calculations. Round vour places. $347.77 million calculations. Round your answer to the nearest cent. CF (\$ millions) Rnind voir anciwer to two decimal places. \$ million million Round vour answer to the nearest cent Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started