Answered step by step

Verified Expert Solution

Question

1 Approved Answer

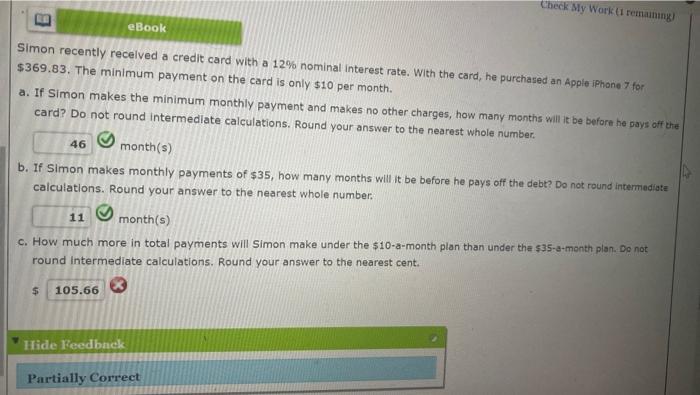

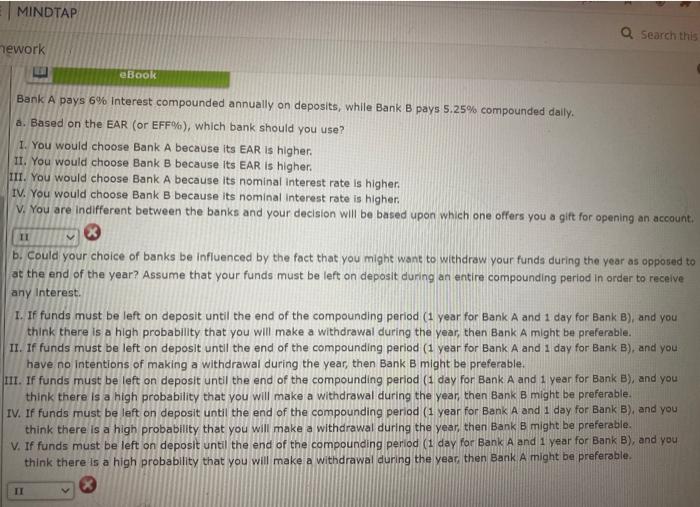

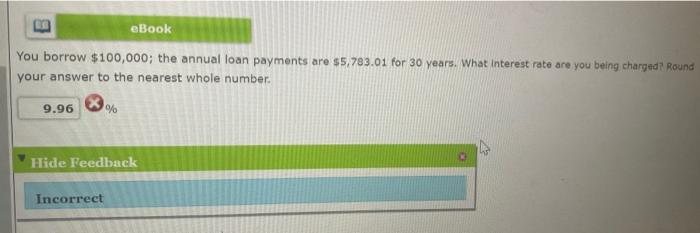

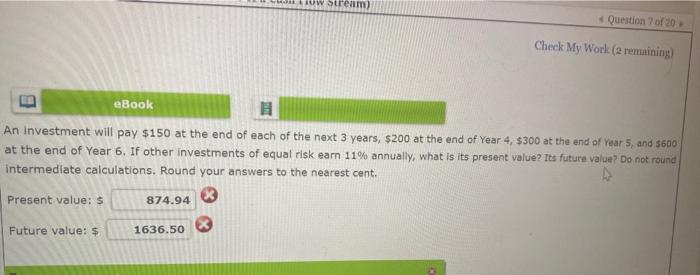

first and third picture only Check My Work (1 remaining eBook Simon recently received a credit card with a 12% nominal Interest rate. With the

first and third picture only

Check My Work (1 remaining eBook Simon recently received a credit card with a 12% nominal Interest rate. With the card, he purchased an Apple iPhone 7 for $369.83. The minimum payment on the card is only $10 per month. a. If Simon makes the minimum monthly payment and makes no other charges, how many months will it be before he pays off the card? Do not round Intermediate calculations. Round your answer to the nearest whole number 46 month(s) b. If Simon makes monthly payments of $35, how many months will it be before he pays off the debt? Do not round intermediate calculations. Round your answer to the nearest whole number. month(s) c. How much more in total payments will Simon make under the $10-a-month plan than under the $35-a-month plan. Do not round Intermediate calculations. Round your answer to the nearest cent. $ 105.66 Hide Feedback Partially Correct E MINDTAP a Search this mework eBook Bank A pays 6% Interest compounded annually on deposits, while Bank B pays 5.25% compounded daily. a. Based on the EAR (or EFF%), which bank should you use? 1. You would choose Bank A because its EAR is higher. II. You would choose Bank B because its EAR is higher. III. You would choose Bank A because its nominal Interest rate is higher IV. You would choose Bank B because its nominal Interest rate is higher. V. You are indifferent between the banks and your decision will be based upon which one offers you a gift for opening an account. b. Could your choice of banks be influenced by the fact that you might want to withdraw your funds during the year as opposed to at the end of the year? Assume that your funds must be left on deposit during an entire compounding period in order to receive any Interest 1. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. II. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you have no intentions of making a withdrawal during the year, then Bank B might be preferable. III. If funds must be left on deposit until the end of the compounding period (1 day for Bank A and 1 year for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. IV. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. V. If funds must be left on deposit until the end of the compounding period (1 day for Bank A and 1 year for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. TI eBook You borrow $100,000; the annual loan payments are $5,783.01 for 30 years. What interest rate are you being charged Round your answer to the nearest whole number. 9.96 % Hide Feedback Incorrect w stream Question 7 of 20 Check My Work (2 remaining) B eBook . An investment will pay $150 at the end of each of the next 3 years, $200 at the end of Year 4, $300 at the end of Year 5 and 5600 at the end of Year 6. If other investments of equal risk earn 11% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent. Present value: $ 874.94 Future value: $ 1636.50 Check My Work (1 remaining eBook Simon recently received a credit card with a 12% nominal Interest rate. With the card, he purchased an Apple iPhone 7 for $369.83. The minimum payment on the card is only $10 per month. a. If Simon makes the minimum monthly payment and makes no other charges, how many months will it be before he pays off the card? Do not round Intermediate calculations. Round your answer to the nearest whole number 46 month(s) b. If Simon makes monthly payments of $35, how many months will it be before he pays off the debt? Do not round intermediate calculations. Round your answer to the nearest whole number. month(s) c. How much more in total payments will Simon make under the $10-a-month plan than under the $35-a-month plan. Do not round Intermediate calculations. Round your answer to the nearest cent. $ 105.66 Hide Feedback Partially Correct E MINDTAP a Search this mework eBook Bank A pays 6% Interest compounded annually on deposits, while Bank B pays 5.25% compounded daily. a. Based on the EAR (or EFF%), which bank should you use? 1. You would choose Bank A because its EAR is higher. II. You would choose Bank B because its EAR is higher. III. You would choose Bank A because its nominal Interest rate is higher IV. You would choose Bank B because its nominal Interest rate is higher. V. You are indifferent between the banks and your decision will be based upon which one offers you a gift for opening an account. b. Could your choice of banks be influenced by the fact that you might want to withdraw your funds during the year as opposed to at the end of the year? Assume that your funds must be left on deposit during an entire compounding period in order to receive any Interest 1. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. II. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you have no intentions of making a withdrawal during the year, then Bank B might be preferable. III. If funds must be left on deposit until the end of the compounding period (1 day for Bank A and 1 year for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. IV. If funds must be left on deposit until the end of the compounding period (1 year for Bank A and 1 day for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank B might be preferable. V. If funds must be left on deposit until the end of the compounding period (1 day for Bank A and 1 year for Bank B), and you think there is a high probability that you will make a withdrawal during the year, then Bank A might be preferable. TI eBook You borrow $100,000; the annual loan payments are $5,783.01 for 30 years. What interest rate are you being charged Round your answer to the nearest whole number. 9.96 % Hide Feedback Incorrect w stream Question 7 of 20 Check My Work (2 remaining) B eBook . An investment will pay $150 at the end of each of the next 3 years, $200 at the end of Year 4, $300 at the end of Year 5 and 5600 at the end of Year 6. If other investments of equal risk earn 11% annually, what is its present value? Its future value? Do not round intermediate calculations. Round your answers to the nearest cent. Present value: $ 874.94 Future value: $ 1636.50 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started