Answered step by step

Verified Expert Solution

Question

1 Approved Answer

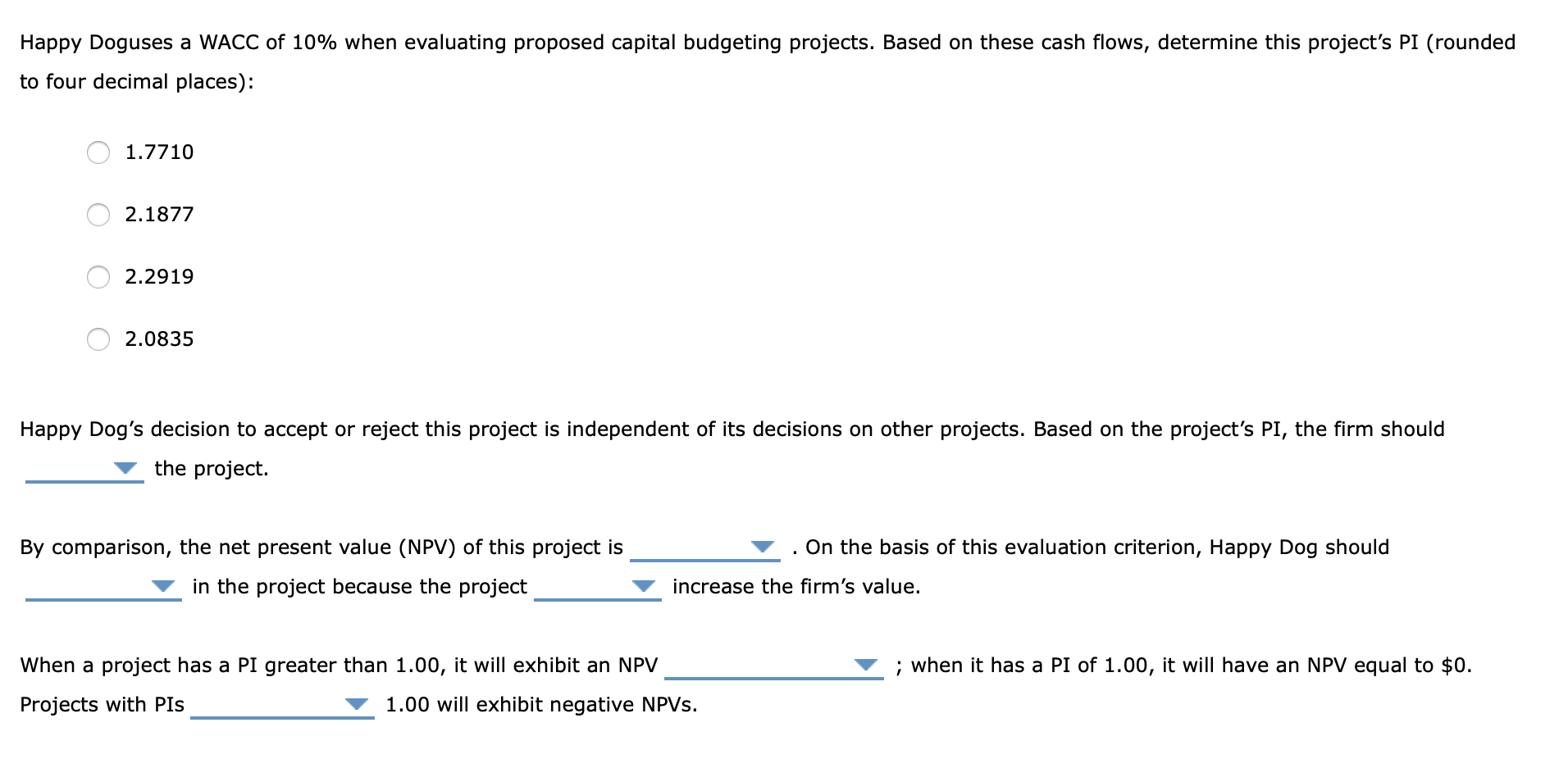

First Blank: accept, reject Second Blank: $715,112, $617,597, $520,082, -$50,102, $650,102, $780,122 Third Blank: invest, not invest Fourth Blank: will, will not Fifth Blank: less

First Blank: accept, reject

Second Blank: $715,112, $617,597, $520,082, -$50,102, $650,102, $780,122

Third Blank: invest, not invest

Fourth Blank: will, will not

Fifth Blank: less than 0, greater than 0, equal to 0

Sixth Blank: less than, equal to, greater than

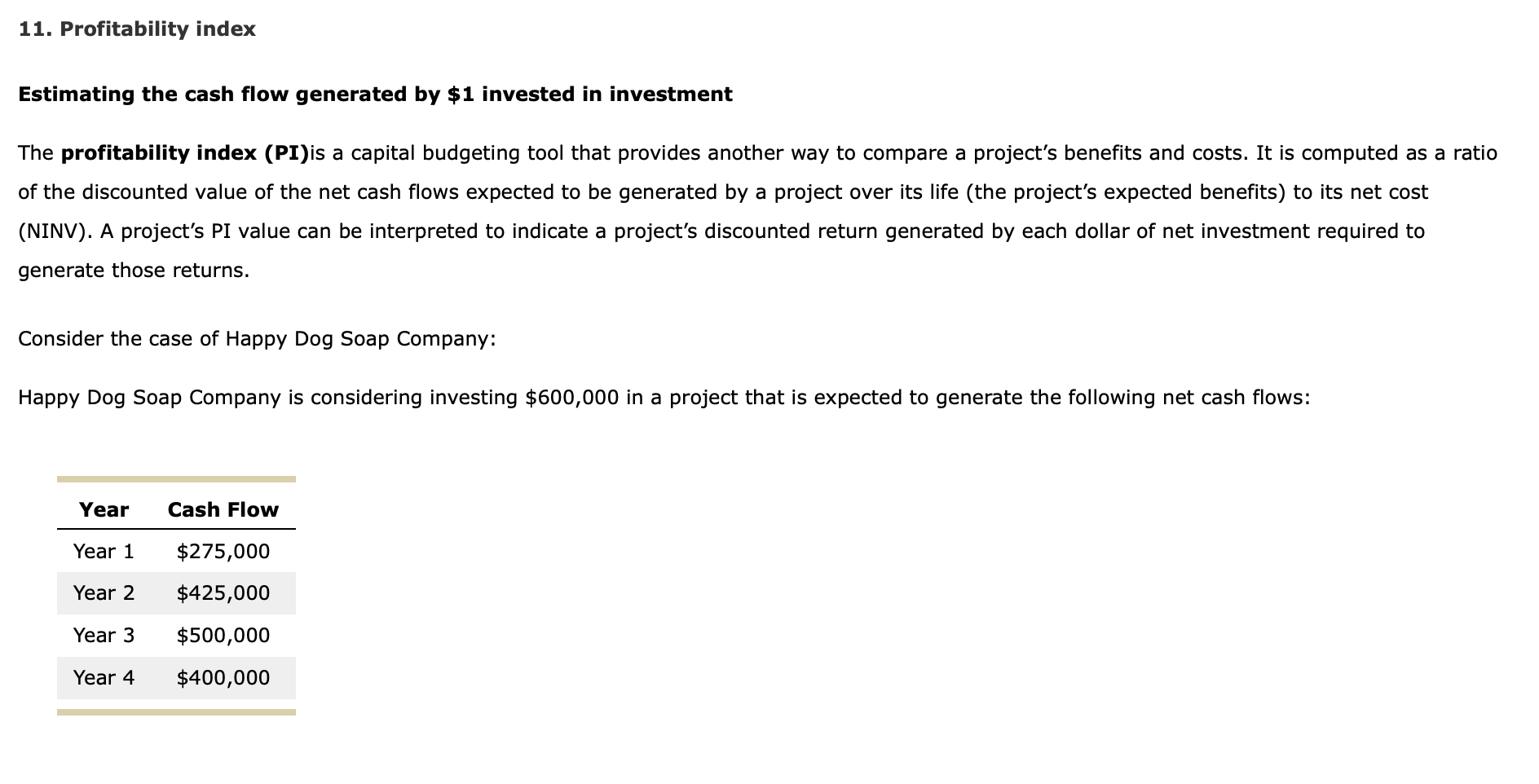

11. Profitability index Estimating the cash flow generated by $1 invested in investment The profitability index (PI)is a capital budgeting tool that provides another way to compare a project's benefits and costs. It is computed as a ratio of the discounted value of the net cash flows expected to be generated by a project over its life (the project's expected benefits) to its net cost (NINV). A project's PI value can be interpreted to indicate a project's discounted return generated by each dollar of net investment required to generate those returns. Consider the case of Happy Dog Soap Company: Happy Dog Soap Company is considering investing $600,000 in a project that is expected to generate the following net cash flows: Year Cash Flow Year 1 Year 2 Year 3 Year 4 $275,000 $425,000 $500,000 $400,000 Happy Doguses a WACC of 10% when evaluating proposed capital budgeting projects. Based on these cash flows, determine this project's PI (rounded to four decimal places): 0 1.7710 02.1877 0 2.2919 02.0835 Happy Dog's decision to accept or reject this project is independent of its decisions on other projects. Based on the project's PI, the firm should the project. . On the basis of this evaluation criterion, Happy Dog should By comparison, the net present value (NPV) of this project is in the project because the project increase the firm's value. ; when it has a PI of 1.00, it will have an NPV equal to $0. When a project has a PI greater than 1.00, it will exhibit an NPV Projects with PIS 1.00 will exhibit negative NPVsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started