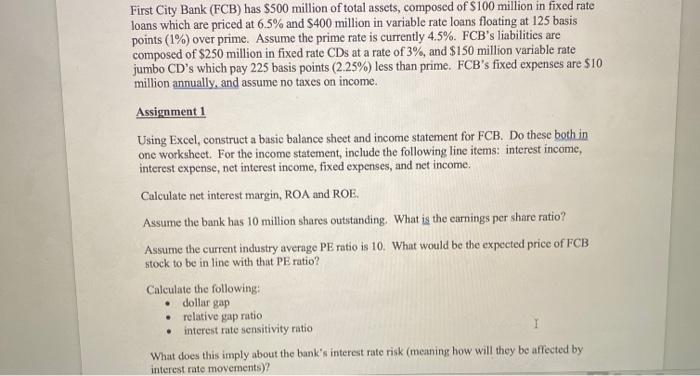

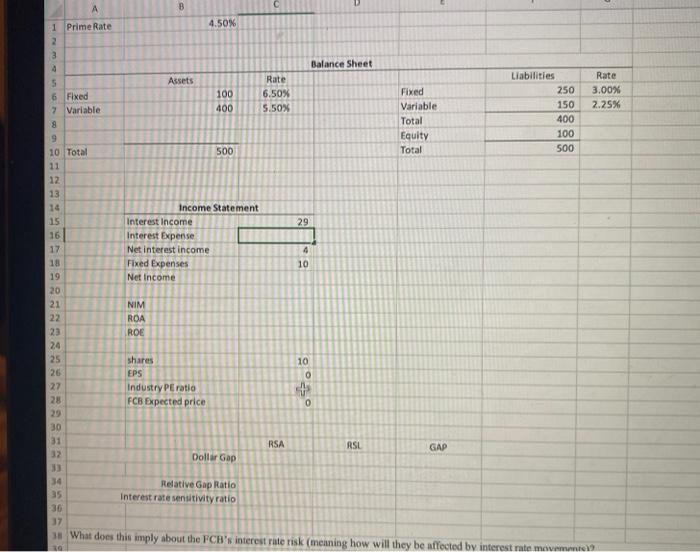

First City Bank (FCB) has $500 million of total assets, composed of $100 million in fixed rate loans which are priced at 6.5% and $400 million in variable rate loans floating at 125 basis points (1%) over prime. Assume the prime rate is currently 4.5%. FCB's liabilities are composed of $250 million in fixed rate CDs at a rate of 3%, and $150 million variable rate jumbo CD's which pay 225 basis points (2.25%) less than prime. FCB's fixed expenses are $10 million annually, and assume no taxes on income. Assignment 1 Using Excel, construct a basic balance sheet and income statement for FCB. Do these both in one worksheet. For the income statement, include the following line items: interest income, interest expense, net interest income, fixed expenses, and net income. Calculate net interest margin, ROA and ROE. Assume the bank has 10 million shares outstanding. What is the earnings per share ratio? Assume the current industry average PE ratio is 10. What would be the expected price of FCB stock to be in line with that PE ratio? Calculate the following: dollar gap relative gap ratio interest rate sensitivity ratio What does this imply about the bank's interest rate risk (morning how will they be affected by interest rate movements)? A B 4.50% Balance Sheet Assets 1 Prime Rate 2 3 4 5 6 Fixed 7 Variable 8 9 10 Total 11 12 13 100 400 Rate 6.50% 5.50% Rate 3.00% 2.25% Fixed Variable Total Equity Total Liabilities 250 150 400 100 500 500 29 15 16 17 Income Statement Interest income Interest Expense Net interest income Fixed Expenses Net Income 4 10 NIM ROA ROE 19 20 21 22 23 24 25 26 27 28 10 0 shares EPS Industry PE ratio FCB Expected price + 0 30 RSA RSL GAP 32 Dollar Gap 34 Relative Gap Ratio 35 Interest rate sensitivity ratio 36 37 3. What does this imply about the FCB's interest rate risk (meaning how will they be affected by interest rate movement First City Bank (FCB) has $500 million of total assets, composed of $100 million in fixed rate loans which are priced at 6.5% and $400 million in variable rate loans floating at 125 basis points (1%) over prime. Assume the prime rate is currently 4.5%. FCB's liabilities are composed of $250 million in fixed rate CDs at a rate of 3%, and $150 million variable rate jumbo CD's which pay 225 basis points (2.25%) less than prime. FCB's fixed expenses are $10 million annually, and assume no taxes on income. Assignment 1 Using Excel, construct a basic balance sheet and income statement for FCB. Do these both in one worksheet. For the income statement, include the following line items: interest income, interest expense, net interest income, fixed expenses, and net income. Calculate net interest margin, ROA and ROE. Assume the bank has 10 million shares outstanding. What is the earnings per share ratio? Assume the current industry average PE ratio is 10. What would be the expected price of FCB stock to be in line with that PE ratio? Calculate the following: dollar gap relative gap ratio interest rate sensitivity ratio What does this imply about the bank's interest rate risk (morning how will they be affected by interest rate movements)? A B 4.50% Balance Sheet Assets 1 Prime Rate 2 3 4 5 6 Fixed 7 Variable 8 9 10 Total 11 12 13 100 400 Rate 6.50% 5.50% Rate 3.00% 2.25% Fixed Variable Total Equity Total Liabilities 250 150 400 100 500 500 29 15 16 17 Income Statement Interest income Interest Expense Net interest income Fixed Expenses Net Income 4 10 NIM ROA ROE 19 20 21 22 23 24 25 26 27 28 10 0 shares EPS Industry PE ratio FCB Expected price + 0 30 RSA RSL GAP 32 Dollar Gap 34 Relative Gap Ratio 35 Interest rate sensitivity ratio 36 37 3. What does this imply about the FCB's interest rate risk (meaning how will they be affected by interest rate movement