Question

First, complete page one of the worksheet first by closely following the directions of each question. Much of the assignment is subjective based on your

- First, complete page one of the worksheet first by closely following the directions of each question. Much of the assignment is subjective based on your own financial goals, but the math is objective - and you must show your work to demonstrate your understanding of the assignment.

- Next, complete #9 of the worksheet using your best estimate of you future earnings. If the time period set forth isn't appropriate due to your age, feel free to adjust the timeframes as needed.

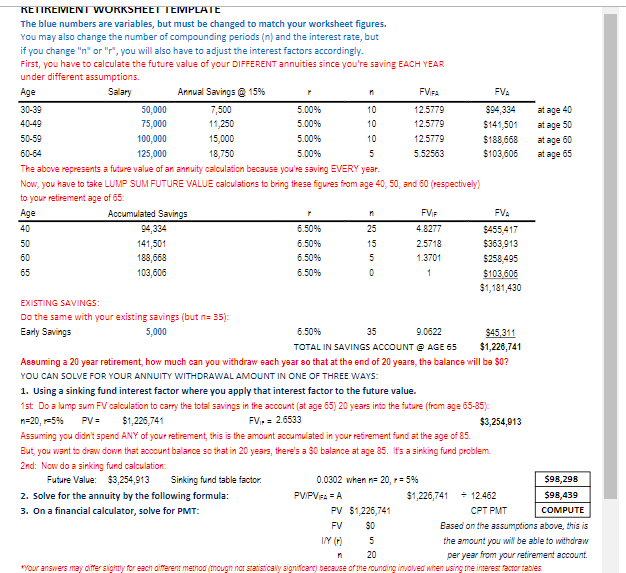

- Input the values from #9 on the worksheet into the Retirement Excel Template (Type directly over my values. They are there for illustrative purposes). It is important the values from the spreadsheet match the values you input into the Excel template. Also, don't forget to include the amount of savings you estimate to have accumulated. The worksheet is designed to be flexible to meet your own individual goals. If you are an older student, then change the variables accordingly or you may create a completely fictional scenario. Just be sure that if you change time (n) or rate (r) then you also change the associated interest factors.

- The spreadsheet will then calculate much of the work for you. But please calculate the very last box at the bottom of the Excel template using your financial calculator. The variables are there for you. This assignment isn't designed to have you crunch a lot of numbers. You're doing enough of that type of practice inside of Connect. Rather, this exercise is the practical application of what you have learned about the time value of money from Chapter 9.

- Go back and complete the remainder of the worksheet based on the values computed in the Excel template.

Retirement Worksheet

YOUR ESTIMATE/BEST GUESS

: I intend to withdraw $_________________ at the END of each year

from my retirement account to support my lifestyle. Input how much you think you need to live

comfortably in your retirement years. To help you with your estimate, experts estimate you should

plan to have approximately 70% of your ending salary in your retirement years in order to maintain

your standard of living. (Assume no pension or Social Security benefits.)

- YOUR ESTIMATE/BEST GUESS: I intend to withdraw $__20,000_______________ at the END of each year from my retirement account to support my lifestyle. Input how much you think you need to live comfortably in your retirement years. To help you with your estimate, experts estimate you should plan to have approximately 70% of your ending salary in your retirement years in order to maintain your standard of living. (Assume no pension or Social Security benefits.)

- When I retire, my goal is to have saved $____500,000___________________ in a retirement account. I believe these funds will be sufficient to maintain my desired lifestyle through my retirement years. Input this figure BEFORE you calculate anything on the Excel template. Just take a guess. What do you think is a reasonable amount to have as your nest egg on the day you retire (age 65 in this example) that would support the annuity withdrawal from the previous question.

6. Based on my total retirement savings from question #5, assuming those funds are invested at 5%

compounded annually, I am able to withdraw $______________ from my retirement fund each year

over the next 20 years.

(Show all inputs below.) Compute with the financial calculator (solve for PMT).

INPUTS:

N =

I/Y =

FV =

PV =

PMT =

7.

In order to meet your retirement goals (withdrawing an annuity stream for 20 years) from question #4,

how much would you need to have in your retirement account at age 65? In other words, based on

the amount of the annuity from question #4, the total retirement savings account must have an actual

balance of $______________ in the account on the day of retirement at age 65 assuming a rate of 5%

compounded anually. This is a present value of annuity calculation (CPT PV).

(Show all inputs below.)

INPUTS:

N =

I/Y =

FV =

PV =

PMT =

8. Review your answers from questions #4-#7. This is just the off the cuff approach to retirement

planning. How close were you to reality? What are your thoughts or conclusions?

____________________________________________________________________________________

____________________________________________________________________________________

Now lets take a more analytical approach to retirement planning:

9. INPUT INTO TEMPLATE:

I hope to have $___________________ of retirement savings in the bank by age 30.

I hope to earn $___________________ per year when Im 30.

I hope to earn $___________________ per year when Im 40.

I hope to earn $___________________ per year when Im 50.

I hope to earn $___________________ per year when Im 60.

10.

I PROMISE that I WILL SAVE 15% of that salary each year, and I expect to retire at age 65.

11. If my life expectancy is age 85, my retirement years will total ________.

12.

SHOW WORK IN THE TEMPLATE:

Assume I invest 15% of my salary annually based upon the above

salaries at a savings rate of 6.5% compounded annually. At retirement age, my nest egg (including the

retirement funds I had saved by age 30) would total:

$_______________________

(from Excel template)

13.

SHOW WORK IN THE TEMPLATE:

Based on the amount of funds in your retirement account (question

#12), how much can you withdraw each year during retirement? In other words, what is your annual

annuity?

$_______________________

(from Excel template)

14. With a disciplined savings plan I know I can meet my long-term financial goals:

TRUE/FALSE

15.

Please comment on this exercise. What are your thoughts/conclusions?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started