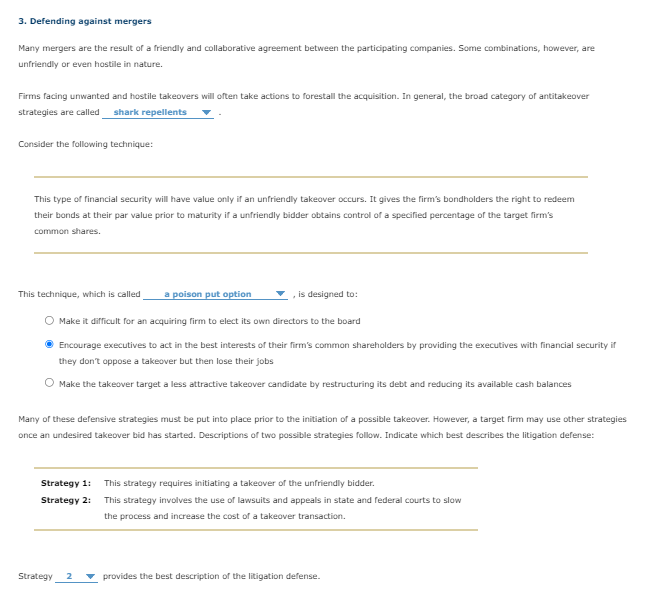

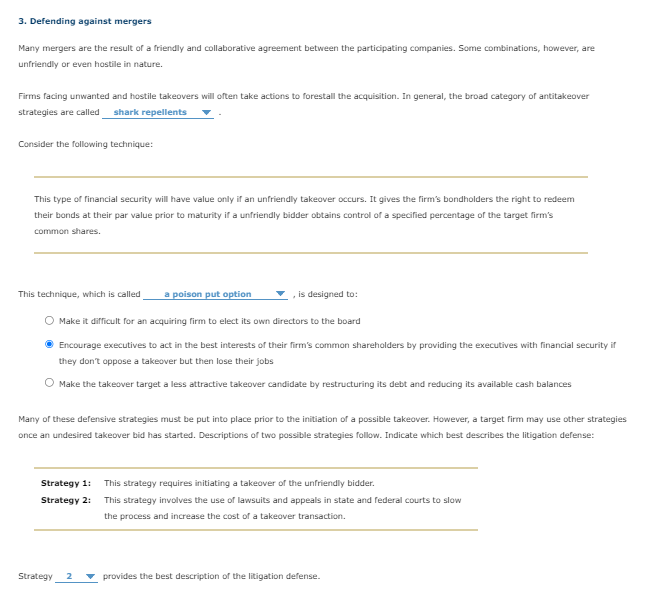

First drop down is poison defenses, baracuda repellents and shark repllents.

Second is a golden parachute contract, a poison put option, a staggered board, supermajority voting rules

3. Defending against mergers Many mergers are the result of a friendly and collaborative agreement between the participating companies. Some combinations, however, are unfriendly or even hostile in nature. Firms facing unwanted and hostile takeovers will often take actions to forestall the acquisition. In general, the broad category of antitakeover strategies are called Consider the following technique: This type of financial security will have value only if an unfriendly takeover occurs. It gives the firm's bondholders the right to redeem their bonds at their par value prior to maturity if a unfriendly bidder obtains control of a specified percentage of the target firm's common shares. This technique, which is called a poison put option is designed to: Make it difficult for an acquiring firm to elect its own directors to the board Encourage executives to act in the best interests of their firms common shareholders by providing the executives with financial security if they don't oppose a takeover but then lose their jobs Make the takeover target a less attractive takeover candidate by restructuring its debt and reducing its available cash balances Many of these defensive strategies must be put into place prior to the initiation of a possible takeover. However, a target firm may use other strategies once an undesired takeover bid has started. Descriptions of two possible strategies follow. Indicate which best describes the litigation defense: Strategy 1: This strategy requires initiating a takeover of the unfriendly bidder. Strategy 2: This strategy involves the use of lawsuits and appeals in state and federal courts to slow the process and increase the cost of a takeover transaction. Strategy provides the best description of the litigation defense. 3. Defending against mergers Many mergers are the result of a friendly and collaborative agreement between the participating companies. Some combinations, however, are unfriendly or even hostile in nature. Firms facing unwanted and hostile takeovers will often take actions to forestall the acquisition. In general, the broad category of antitakeover strategies are called Consider the following technique: This type of financial security will have value only if an unfriendly takeover occurs. It gives the firm's bondholders the right to redeem their bonds at their par value prior to maturity if a unfriendly bidder obtains control of a specified percentage of the target firm's common shares. This technique, which is called a poison put option is designed to: Make it difficult for an acquiring firm to elect its own directors to the board Encourage executives to act in the best interests of their firms common shareholders by providing the executives with financial security if they don't oppose a takeover but then lose their jobs Make the takeover target a less attractive takeover candidate by restructuring its debt and reducing its available cash balances Many of these defensive strategies must be put into place prior to the initiation of a possible takeover. However, a target firm may use other strategies once an undesired takeover bid has started. Descriptions of two possible strategies follow. Indicate which best describes the litigation defense: Strategy 1: This strategy requires initiating a takeover of the unfriendly bidder. Strategy 2: This strategy involves the use of lawsuits and appeals in state and federal courts to slow the process and increase the cost of a takeover transaction. Strategy provides the best description of the litigation defense