Answered step by step

Verified Expert Solution

Question

1 Approved Answer

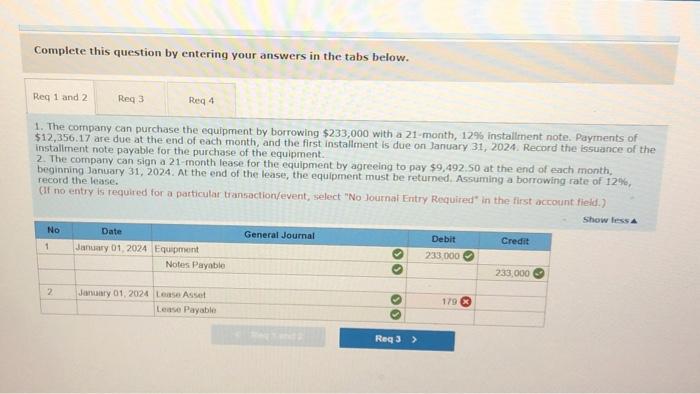

first entry is correct. but second one ... ?! thank you and also show me olease how to apply the formula thank you January 1,

first entry is correct. but second one ... ?! thank you and also show me olease how to apply the formula thank you

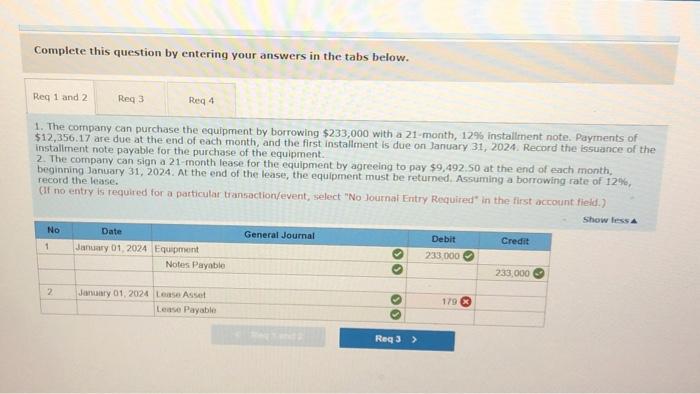

January 1, 2024, Paradise Partners decldes to upgrade recreational equipment at its resorts. The company is contemplating whether to purchase or lease the new equipment. Use PV of \$1 and PVA-ofS1. (Use appropriate factor(s) from the tables provided.) Required: 1. The company can purchase the equipment by borrowing $233,000 with a 21 month, 12% installment note. Payments of $12,35617 are due at the end of each month, and the first instailment is due on January 31, 2024. Record the bsuance of the installment note payable for the purchase of the equipment. 2. The company can sign a 21 -month lease for the equipment by agreeing to pay $9,492.50 at the end of each month, beginning January 31, 2024. At the end of the lease, the equipment must be returned. Assuming a borrowing rate of 12%, record the lease: 3. As of January 1, 2024, does the instaliment note or the lease have a greater effect on increasing the company's amount of reported debt, and by how much? 4. Suppose the equipment has a fotal value of $114,000 at the end of the 21 -month period, which option (purchasing with instaliment note or leasing) would thely be better? Complete this question by enterina your answers in the tabs below. 1. The cornpany can purchase the equipment by borrowng $233,000 with a 21 -inotht, 12% instaliment note, Paycrents of 512,756.17. payable for the purcharse of the equipment. Complete this question by entering your answers in the tabs below. 1. The company can purchase the equipment by borrowing $233,000 with a 21 -month, 12% installment note. Payments of $12,356.17 are due at the end of each month, and the first installment is due on January 31, 2024. Record the issuance of the instaliment note payable for the purchase of the equipment. 2. The compary can sign a 21 - month fease for the equipment by agreeing to pay $9,492. So at the end of each month, beginning January 31, 2024. At the end of the lease, the equipment must be returned. Assuming a borrowing rate of 12%, record the lease. (if no entry is required for a particular transaction/event, select "No Journai Entry Required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started