first financial statement is coca cola and the second is pepsi. the question is the last image. thank you !!

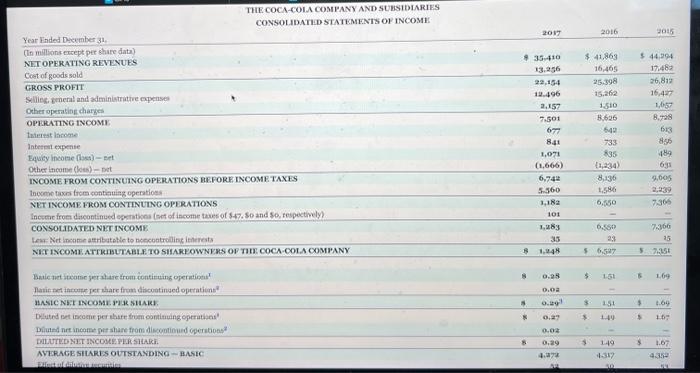

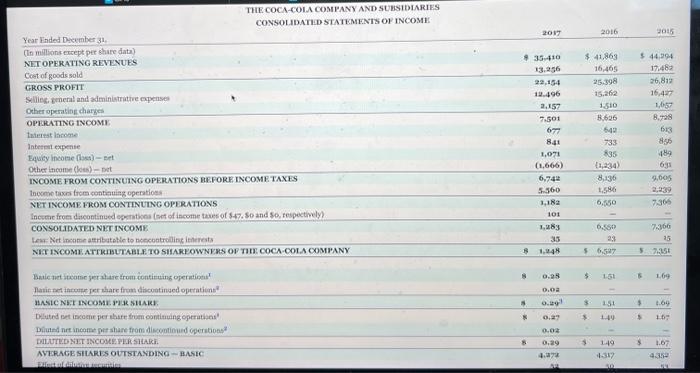

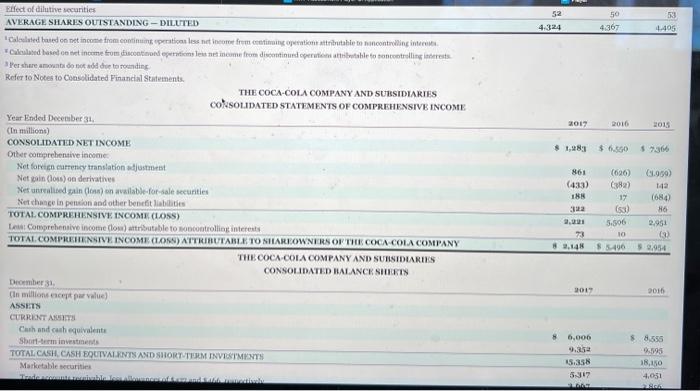

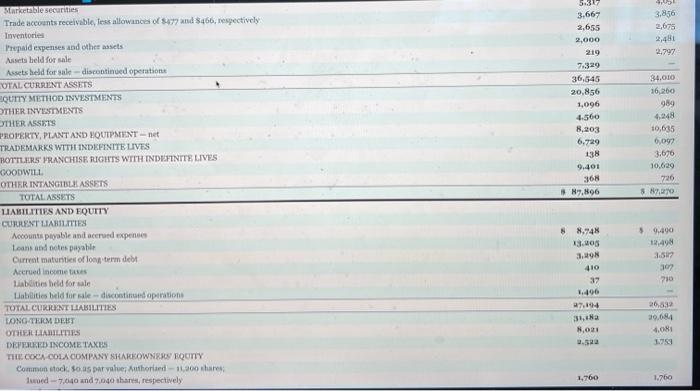

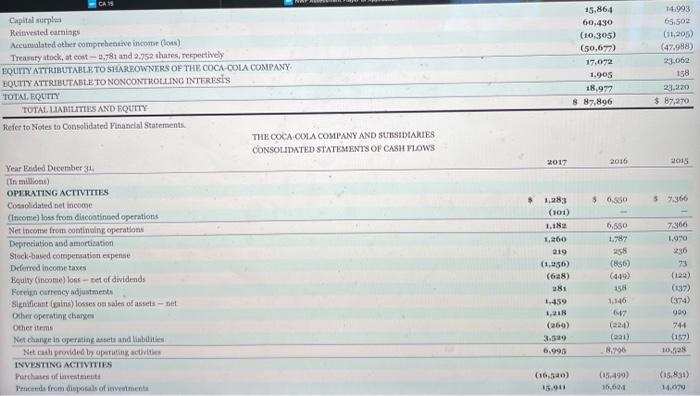

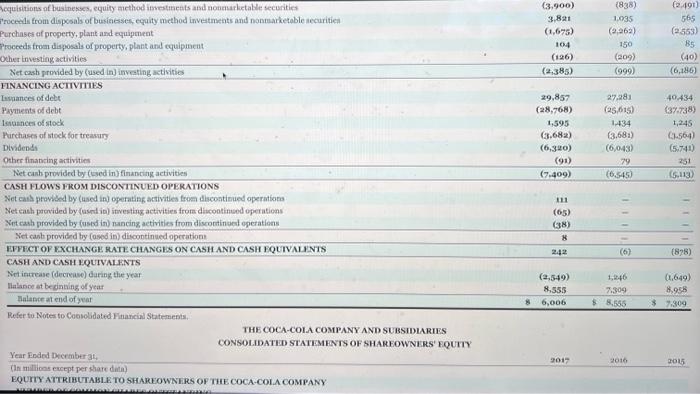

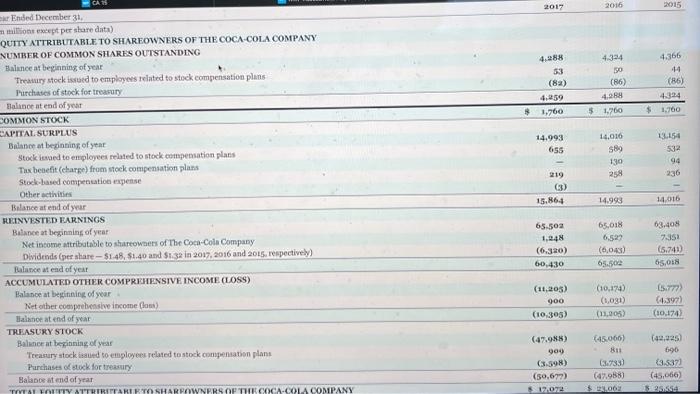

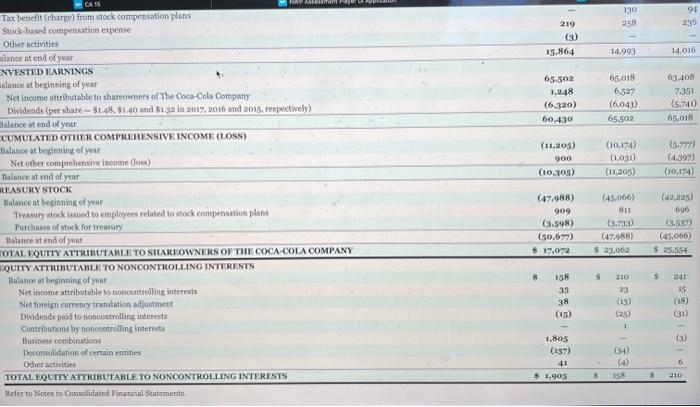

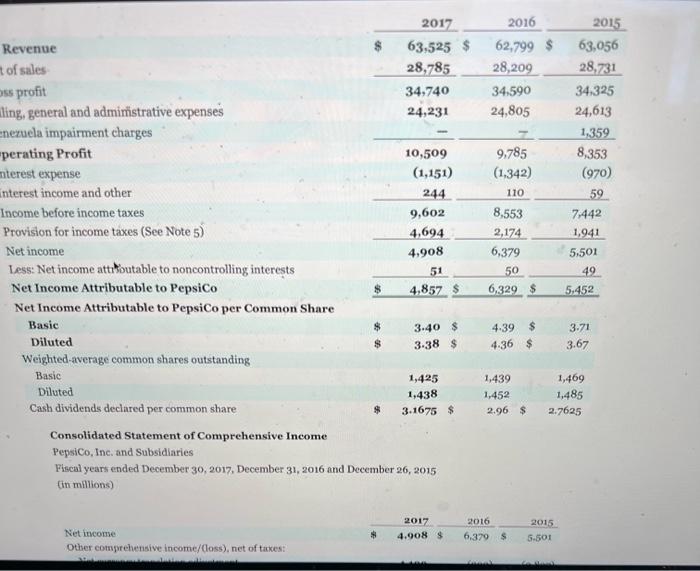

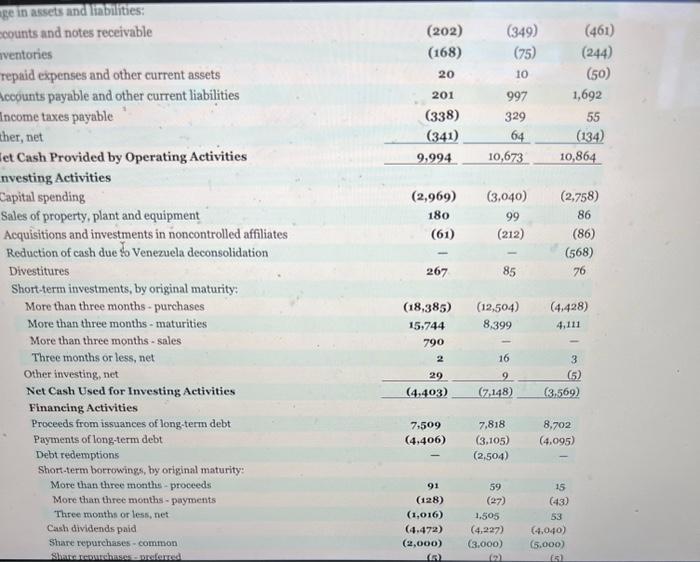

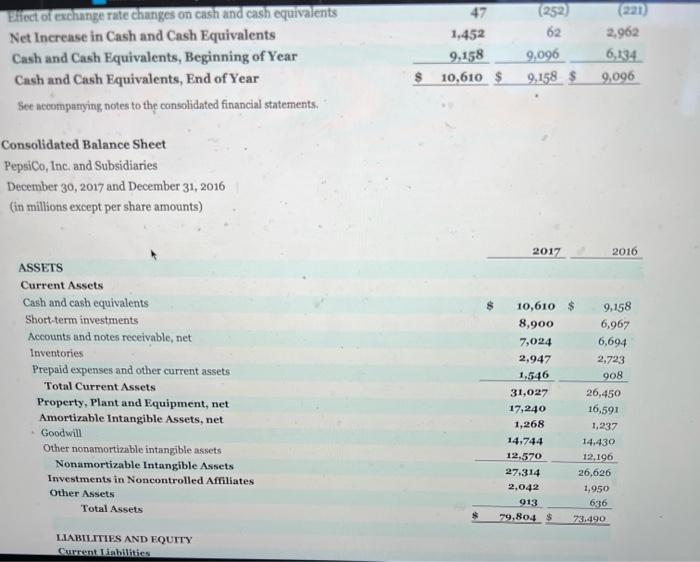

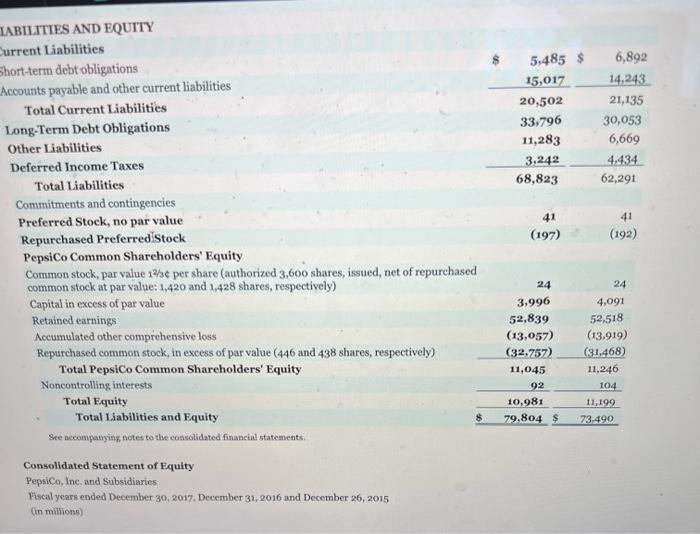

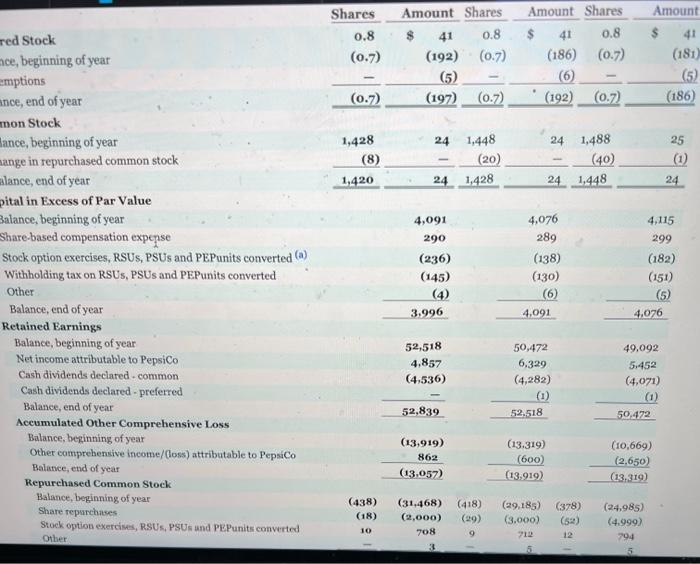

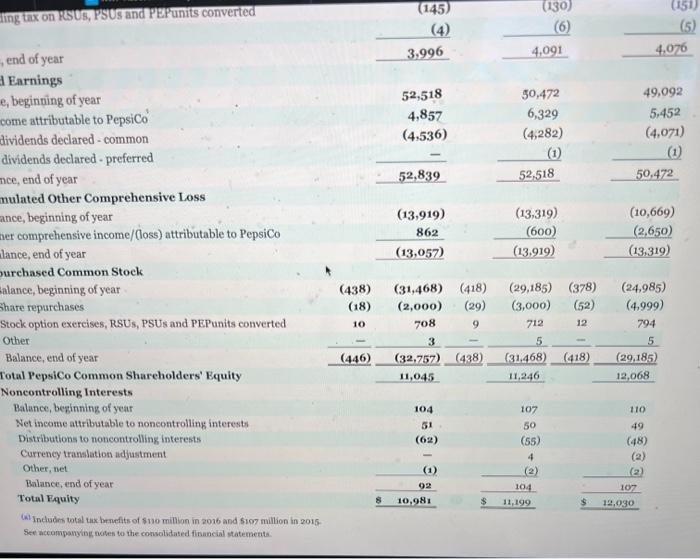

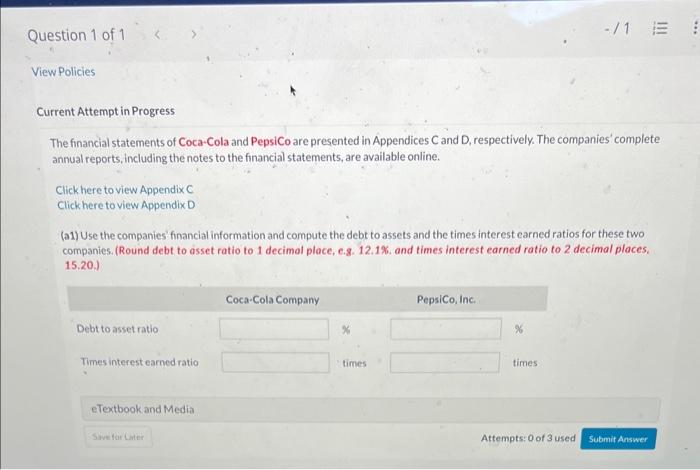

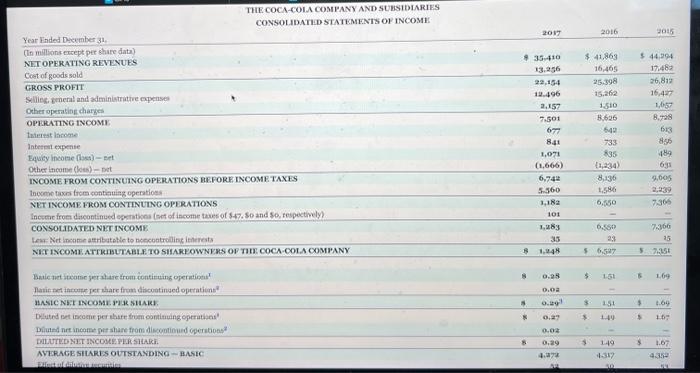

THE COCA-COIA COSHRANY AND SERSIDIARIES CONSOLIDATLD STATEMENIS OF INCOMH Year Ended Dicenber 31 , (In millions eesept per shire data) NIT OPEKATING REVENUES Ccet of goods sold GROSS PROFIT Silieg, emeral and administriture expenses Other operating charges OPERATING INCOME taterest lasome Intesel expente Equity incolse (bst) - set Other tncune (less) - set. INCOME FROM CONTINUING OPERATIONS REFORE INCOME TAXES thecmo taxns frem contaniag opentioss NET INCOME FROM CONTINUDE OPERATONS Inesene froen diveontinued eprativas (oet of iscome taves of $47. So and So, tespectively) COSSOLIDATED NET INCOME Lew: Nirt ineame attribatehle to ncecontrolling itherests NIT INCOMI. ATIKDUUTAL. TO SIIAKROWNERS OF TII COCA-COLA COMHANY Balic wet iteatse jer shase from tontituing ojerntiptut T Narieset incume jer hhare frum dibcoutinged operatiens " IASLC NET Ricosa ruk sHuk. Dluted bet isecene per ahare inem contituing operathast Dilutd nre incofmet pet share from diecoptinued cpentions? AVERAGE SHARES OUTSTAYDING - BASEC Ffect of dilutive securities AVIKAGR SHARIS OUTSTANDING - DILUTHD Per shere anownide not aud dive to roendirg. Refer to Notes to Coaselidated Financial Statements. THE COCA-COLA COMPANY AND SUBSIDIARIES COHSSOLIDATED STATEMENTS OF COMPREHENSIVE INCONE Year Ended Decenber 31. (In millions) CONSOLIDATED NET INCOME Otter comprehentive incoene: Not fofien eatrency translation adjustimest Net gain (loss) oe derivathes. Nes unrealised zuin (ioss) on available-for-able securities Netchange in pension and other bencft liabilates TOTAL, COMPRIHENSIVT. INCONM1 (Loss) Leiat Comprehensive incotse (losa) atributible to sabcostrolious intereats IHIOOCA-COIA COMPANY ANI SUHSIDARISS CONSOT.IDATHD IAI ANCE SIIHIX December 31. (In millions cacrit piar value) Asstits CERREINT ASIITI Carh and cahh equivalente Slanil-term investinests Markictalile securitiei Shrketasle securifies Trade accoents receivable, fess allowanca of 8477 and $466, repectively Inventories Irrpaid expenses and othes atsets sisets held for sale Assets held for sale - discontinued operations OTAL CURGIAT ASSRTS: QtTIY METHOD RVESTMENTS OTHHR TNVISTSENTT MHER AESETS PHOHERTY, PLANT ASD YOUTPMSTI - net TRUDEAAKKS WTTH TEDEFINITELVES HOTTLARS FRANCHISE JUGHTS WTH INDEFTNITB LIVES 6000WIL. OTHER INTANCHELA. ASSETS TOTAL ASSEAS: HABIITTBS AND EQUTTY CUREST LABHITTES Acoounts piyable ani acenued expeneis Loans abd netes payable Cirrent maturities of looshterm debt Acerued incrme tases Lablitie beld for aie Lablities beld fur sale - discostinsed oparations LOAO-THEM DEFT DE MUEA DSCOME TAXES THE COCA COLA COMPANY SITAREOWNRgS FQUTY Commun atock so as par valve Authoriaed - 11,200 shares: luaed - 7,040 and 7,040 ihares, respectively Hefer to Nofes to Cobselidated Financial Statements. THE COKA COUAA COSHPANY AND SULSHDIAMIES CONSOLDMTED STATEMENTS OF CASH FLOWS Year Feded December 34 201720162015 (tn Eillions) OPIHATTNG ACTTVTTHS Cosaoidated net income. (inconee) loss from discontinued operations Net income from continuing operatlons Drpreciution and amortization Stock babed compensatisn expense Deferred income taxes Beaity (income) loss - ret ef dividends Foreign ourrency adjustraents Significant (eains) losses os sales of assets - net Obher operiting ebaryes Other iterns Net clarye io oferating aisets and lubblitises Net rath provided be operuting activitis IVVESTING ACTTVITES Perthates of innentaneitit Penereds from diejotals of ioveumenta Kcquisitions of businesses, equity aicthod insestinents and nondarketable securities frocemis trom disposals of businesses, ecaity method inveatments and nonnarketable iecuritien Purchases af property, plant and equipment Proceeds froan disposals of property, plant and cquipment Oher tnvesting activities Net cash prowided by (used in) inveting activities FINANCING ACTIVITIES Lapaances of dele Payments of debt tstasnces of stock Purchases of stock for treasury Dividends Orher finabcing artivities Net canh provided by (csed in) financiag activities CASH FLOWS FKOM DISCONTTNUED OHERATIONS Net cand provided by (used in) ogerating activities froa discontinued operntions Net eash pronided by (asnd ib) investing activities from discontinsod operations Xet cath provided by (used in) nancing aetivities from disontinued eperations Set canh provided by (asod in) disontinued operationt EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUTVILNTS CASH AND CASH LQUIVALNTS Net increase (decrease) daring the year Refer tu Notes to Coosoldated Financial Statements, THE COCA-COIA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMFNTS OF SHAREOWNERS' EQUTTY Year finded December 34, (In millions except per share dita) EQUTTY ATTRIBUTABIE TO SHAREOWNIRS OF THE COCA-COLA COMYANY Ended December 31. a millions execpt per stare data) QUTTY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY NUMBER OF COMMON SHARES OUTSTANDING Balence af beginning of year Treasury stoek issued to empioyens related to stock compensation plans Iurchates of sthck for treasury Balinoe at ead of ynat COMMON STOCK EAPTAAT SURYLUS Balaner at beginnins of year Stock iexaed to enployes related to stokk empenation plass. Tux beaefit (charpe) from stoek compensation plass Stock-lased compencation expense Other acthities Belance at end of year MEINVESTED FARNINGS Bitance at beginning of year Net insome attribatable to shartowaes of The Coca-Cols Company Dividends (per ahare 51.48,51.40 and 51.32 in 2017,2016 and 2015 respectively) Balance at ead of year ACCUMULATED OTHER COMPRFHENSIVE INCOME (LOSS) Balanoe at beginining of year Net other comprebmshe incoase (lanu) llakinios at end of year TREASURY STOCK Balmer at beritining of year Trearury stock iasued to engloyees related tostock compenation plans. Purchases of euck for treasury Balasor at end of year Tax benefit (charge) from stock compensation plans Stociabaued compenkation expence Other activitios alance at ebd of year NVHSTED EARNINGS alance at beginning of yoar Net income attrithutable to thareowners of The Coca.Cola Compatiy Diwidends (per share $1.48,$1.40 and $1.32 in 2017,2016 and 2015 , reiyectively) balance it end of year CUMLULATED OTHER COMHRHHENSTVE INCOME (LOSS) Balance at begienieg of year Net otber comprehensive income (lom) lalance at cod of year thAsUMY STOCK flalance at beginning ef year Treasup stock isued to employees related to vock compensatios plans Rurchases of stock for treasury Halance at end of year COTAL EQUTT ATTRIHUTABLETO SHAKEOWNERS ON THE COCA-COLA COMPANY LQUTY ATTREBUTABLE TO NONCONTROL.INO TNTRERSTS Balance at beginning of year Net inome attritatable to nobcentrolling interents Net foreiso currency tranalation adjastment Dividende paid to noncostrolling interest: Contributions by noncontrolling intersity Busibess combinations: Deconsolidation of centain entities Ohher activitien TOTAL EQUTT AITTRIBUYABLETO NONCONTROLING INTERESIS Refer to Nirtes to Consolidated Financinl Statements Revenue tof sales. ling, general and admimistrative expenses enezuela impairment charges perating Profit nterest expense interest income and other Income before income taxes Provision for income taxes (See Note 5) Net income Less: Net income attioutable to noncontrolling interests Net Income Attributable to PepsiCo $63,5252017$62,7992016$63,0562015 Net Income Attributable to PepsiCo per Common Share Basic Diluted 34,74028,78534,59028,20934,32528,731 Weighted-average common shares outstanding \begin{tabular}{rrr} 24,231 & 24,805 & 24,613 \\ & & 1,359 \\ \hline 10,509 & 9,785 & 8,353 \end{tabular} Basic Diluted Cash dividends declared per common share Consolidated Statement of Comprehensive Income PepsiCo, Inc. and Subsidiaries Fiscal years ended December 30, 2017, December 31, 2016 and December 26, 2015 (in millions) Niet income. Other eomprehensive income/(loss), net of takes: ge in assets and Fiabilities: counts and notes receivable \begin{tabular}{rrr} (202) & (349) & (461) \\ (168) & (75) & (244) \\ 20 & 10 & (50) \\ 201 & 997 & 1,692 \\ (338) & 329 & 55 \\ (341) & 64 & (134) \\ 9,994 & 10,673 & 10,864 \\ \hline \end{tabular} nvesting Activities Capital spending Sales of property, plant and equipment (2,969)180(3,040)99(2,758)86 Acquisitions and investments in noncontrolled affiliates (61) (212) (86) Reduction of cash due to Venezuela deconsolidation Divestitures Short-term investments, by original maturity: More than three months - purchases More than three months - maturities More than three months - sales Three months or less, net Other investing, net Net Cash Used for Investing Activities Financing Activities Proceeds from issuances of long-term debt Payments of long-term debt Debt redemptions Short-term borrowings, by original maturity: More than three months - proceeds More than three months - payments Three months or less, net Cash dividends paid Share repurchases - common Share reopucchases - veoflerred \begin{tabular}{rrr} (18,385) & (12,504) & (4,428) \\ 15,744 & 8,399 & 4,111 \\ 790 & & \\ 2 & 16 & 3 \\ 29 & 9 & (5) \\ \hline(4,403) & (7,148) & (3,569) \\ \hline 7,509 & 7,818 & 8,702 \\ (4,406) & (3,105) & (4,095) \\ & (2,504) & \end{tabular} Consolidated Balance Sheet PepsiCo, Inc, and Subsidiaries December 30,2017 and December 31, 2016 (in millions except per share amounts) (in milions) ling tax on RESU, PSUS and PEP units converted , end of year A Earnings e, beginting of year come attributable to PepsiCo dividends declared - common dividends declared - preferred nce, end of year mulated Other Comprehensive Loss ance, beginning of year her comprehensive income/(loss) attributable to PepsiCo lance, end of year (4) ourchased Common Stock alance, beginning of year Share repurchases Stock option exereises, RSUs, PSUs and PEPunits converted Other Balance, end of year Total PepsiCo Common Shareholders' Equity Noncontrolling Interests Balance, beginning of year Net income attributable to noncontrolling interests Distributions to noncontrolling interests \begin{tabular}{rrr} 52,518 & 50,472 & 49,092 \\ 4,857 & 6,329 & 5,452 \\ (4,536) & (4,282) & (4,071) \\ & (1) & (1) \\ \hline 52,839 & 52,518 & 50,472 \\ \hline \end{tabular} Currency translation adjustment Other, net Balance, end of year Total Fquity (4) Indudes votal tux benefits of sno million in 2006 and 5107 million in 2015 - Set accompanyoug, noten to the consolidated financial statemeats. iurrent Attempt in Progress The financial statements of Coca.Cola and PepsiCo are presented in Appendices C and D, respectively. The companies' complete annual reports, including the notes to the financial statements, are available online. Click here to view Appendix C Clickhere to view Appendix D (a1) Use the companies financial information and compute the debt to assets and the times interest earned ratios for these two companies. (Round debt to asset ratio to 1 decimal place, e.g. 12.1\%. and times interest earned ratio to 2 decimal places. 15.20.)